Forex

11 minutes read

Jun 27, 2024

How to Open a Forex Brokerage in 2024?

Opening a Forex brokerage in 2024 requires strategic planning, a comprehensive understanding of regulatory requirements, and a solid technological foundation. New brokers must navigate an increasingly complex landscape as the Forex market evolves. This article provides a detailed roadmap to help you establish a successful Forex brokerage, covering everything from regulatory compliance to choosing the right technological infrastructure.

Understanding Regulatory Requirements

Opening a Forex brokerage necessitates a thorough understanding of the regulatory landscape in your chosen jurisdiction. Forex brokers must adhere to stringent regulations designed to protect investors and maintain market integrity.

Researching Regulatory Bodies

Identify the regulatory bodies governing Forex trading in your target market. Each country or region has its own authority that is responsible for overseeing financial markets and ensuring compliance with local laws. Major regulatory bodies include:

- Financial Conduct Authority (FCA) in the UK: Known for its rigorous standards, the FCA mandates comprehensive transparency and stringent compliance measures to protect market participants.

- Commodity Futures Trading Commission (CFTC) in the US: Along with the National Futures Association (NFA), the CFTC regulates Forex trading in the United States, with rules emphasizing the protection of retail traders.

- Cyprus Securities and Exchange Commission (CySEC) in the EU: Popular for its favorable tax regime and EU membership, CySEC allows for European passporting rights.

- Australian Securities and Investments Commission (ASIC): ASIC is known for its strict regulatory framework, focusing on fair and transparent financial markets.

Each regulatory body has unique rules and requirements, which significantly impact brokerage operations. Thorough research into these regulatory bodies is essential.

Licensing Requirements

Once you’ve identified the relevant regulatory body, familiarize yourself with their licensing requirements. These typically include submitting a comprehensive business plan, demonstrating sufficient capital reserves, and implementing robust AML and KYC policies. Detailed business plans should outline your business model, target market, competitive analysis, marketing strategies, and financial projections (more on this later). Capital requirements ensure brokers can meet financial obligations, such as the FCA’s minimum capital requirement of €125,000 for STP brokers.

Operational infrastructure must include secure IT systems, robust trading platforms, and effective risk management protocols. AML and KYC policies help prevent illegal activities, requiring detailed documentation on client identification, transaction monitoring, and reporting suspicious activities. Some regulatory bodies also require proof of professional competence, including certifications for key personnel.

Engaging with Legal Experts

Navigating the licensing process can be complex and time-consuming. Engaging with legal experts specializing in financial regulations can facilitate this process. These professionals can help you understand specific requirements, prepare and submit necessary documentation, and ensure compliance with all relevant laws. Legal experts also assist in drafting and reviewing contracts, setting up compliance frameworks, and providing ongoing legal support to address any post-licensing issues. Their expertise can help avoid common pitfalls and ensure a smoother, more efficient licensing process.

Preparing for Regulatory Audits

Regulatory compliance doesn’t end once you obtain your license. Ongoing adherence to regulatory standards is essential. Regulatory bodies often conduct periodic audits to ensure continuous compliance, reviewing financial records, client transactions, AML and KYC procedures, and overall business operations. To prepare for these audits, maintain meticulous records and have an effective internal audit system. Regularly review and update compliance procedures to stay ahead of regulatory requirements. Having a dedicated compliance officer or team can be beneficial.

Understanding Regional Differences

Regulations can vary significantly between different regions. For example, Europe’s MiFID II sets comprehensive requirements for investment firms, including Forex brokers, while the regulatory environment in Asia might focus on more stringent leverage requirements. Understanding these regional differences helps tailor your brokerage operations to meet local regulatory standards. Factors such as market potential, regulatory environment, and operational costs will influence your decision on where to establish your brokerage.

Developing a Comprehensive Business Plan

A well-structured business plan is crucial for launching a successful Forex brokerage. This plan serves as a roadmap for your business, detailing your target market, competitive landscape, marketing strategies, and financial projections. Here’s a condensed yet comprehensive guide to developing a robust business plan for your Forex brokerage.

Identifying Your Niche

Begin by clearly identifying your niche within the Forex market. Decide whether you will cater to retail traders, institutional clients, or focus on a specific geographical region. Each segment has distinct needs and preferences, influencing your service offerings and marketing strategies. For retail traders, emphasize user-friendly platforms, educational resources, and competitive pricing. For institutional clients, provide advanced trading tools, high liquidity, and customized services. When focusing on a geographical region, tailor your services to local market conditions and regulatory requirements, including language support and regional marketing campaigns.

Conducting Competitive Analysis

Understanding your competitors’ strengths and weaknesses helps you identify opportunities for differentiation. List major Forex brokers in your target market and analyze their market share, product offerings, pricing strategies, and customer reviews. Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) for each competitor to highlight their competitive advantages and vulnerabilities. Compare your potential offerings against competitors to identify market gaps you can fill, such as superior customer service or lower trading costs.

Developing Financial Projections

Financial projections guide your business decisions and help secure investment or financing. Estimate costs for licensing, technology infrastructure, office setup, legal fees, and initial marketing campaigns. Include ongoing costs such as salaries, rent, marketing, technology maintenance, and regulatory compliance. Project expected revenue from trading commissions, spreads, and additional services like premium accounts or educational resources. Consider different scenarios based on market conditions and client acquisition rates.

Risk Management and Contingency Planning

Incorporate risk management and contingency planning into your business plan. Identify potential risks like regulatory changes, market volatility, or cybersecurity threats and develop strategies to mitigate them. This could include diversifying revenue streams, implementing robust security measures, and maintaining adequate capital reserves.

Operational Framework

Detail your operational framework, including organizational structure, staffing requirements, and operational processes. Define key personnel’s roles and responsibilities and outline processes for account management, transaction processing, and customer service to ensure efficient operations.

Performance Metrics and KPIs

Identify key performance indicators (KPIs) to measure your brokerage’s success, such as client acquisition rates, trading volumes, customer satisfaction scores, and financial performance indicators like profit margins and ROI. Establish benchmarks and regularly review these KPIs to assess your progress and make informed business decisions.

Building the Technological Infrastructure

The technological infrastructure of your Forex brokerage is a critical component of its success. Ensuring you have a robust trading platform, reliable data feeds, and secure payment processing systems is essential for smooth operations and client satisfaction.

Trading Platform

Choosing the right trading platform is paramount. It should be user-friendly, reliable, and capable of handling high volumes of trades. Established platforms like MetaTrader 4 or 5 are popular choices due to their comprehensive features and global acceptance among traders. These platforms offer advanced charting tools, multiple asset class support, and seamless integration with liquidity providers.

For those looking for tailored solutions, custom-built platforms can be designed to meet specific needs. Custom platforms allow unique features and functionalities that differentiate your brokerage from competitors. Whichever platform you choose, ensure it offers high performance, minimal downtime, and a smooth user experience.

Data Feeds

Reliable data feeds are essential for providing your clients accurate and real-time market information. Partner with reputable data providers to ensure data accuracy and reliability. Real-time data is crucial for traders to make informed decisions, so any delays or inaccuracies can significantly impact their trading experience and your brokerage’s reputation.

Payment Processing Systems

Secure payment processing systems are vital for client trust and smooth financial transactions. Implement robust security measures to protect clients’ funds and personal information. This includes using encryption technologies and two-factor authentication to prevent unauthorized access. Efficient payment systems should support various payment methods, including credit cards, bank transfers, and e-wallets, ensuring convenience for clients from different regions.

Integration and Scalability

Ensure that all components of your technological infrastructure—trading platform, data feeds, and payment systems—are well-integrated. Seamless integration minimizes the risk of technical issues and provides a cohesive user experience. Additionally, consider the scalability of your infrastructure. As your brokerage grows, your technology needs will evolve. Investing in scalable solutions from the outset can save time and costs for future upgrades.

Setting Up Operational Frameworks

Once your technological infrastructure is in place, establishing robust operational frameworks is the next step. These frameworks encompass back-office systems, customer support, and risk management processes, all of which are essential for efficient operations and client satisfaction.

Back-Office Systems

Efficient back-office systems are crucial for managing client accounts, processing transactions, and ensuring regulatory compliance. These systems should automate routine tasks, such as account setup, transaction processing, and reporting, to minimize errors and improve efficiency. Implement comprehensive software solutions that streamline operations with your trading platform and payment systems. Regular audits and reviews of back-office processes are necessary to ensure accuracy and compliance with regulatory standards.

Customer Support

Customer support is critical to client retention and overall satisfaction. Provide multiple channels for support, including live chat, email, and phone, to cater to different client preferences. Ensure your support team is knowledgeable and responsive, capable of handling a wide range of client inquiries and issues. Offering multilingual support can significantly enhance your service, especially if you plan to operate in diverse markets. A robust CRM system can also help manage client interactions and track issues to ensure timely and effective resolutions.

Risk Management

Risk management is crucial in Forex trading due to the market’s inherent volatility. Develop comprehensive risk management policies to protect your brokerage and your clients. This includes setting up automated risk management systems that monitor trading activities and enforce margin requirements. These systems should provide real-time alerts and reporting to quickly identify and mitigate potential risks. Regularly review and update your risk management policies to adapt to changing market conditions and regulatory requirements.

Compliance and Regulatory Frameworks

Establishing a compliance framework is essential to ensure your brokerage adheres to all relevant laws and regulations. This includes implementing AML and KYC procedures to prevent fraud and ensure the legitimacy of your clients. Regular staff training on compliance issues and updates on regulatory changes are critical. Maintain thorough records and documentation to demonstrate compliance during audits and inspections by regulatory bodies.

Operational Workflow and Staffing

Define clear operational workflows and staffing requirements to ensure smooth day-to-day operations. Outline the roles and responsibilities of key personnel, including compliance officers, customer support representatives, and IT staff. Develop standard operating procedures (SOPs) for critical tasks to ensure consistency and efficiency. Regular training and development programs can help staff stay updated on best practices and new technologies.

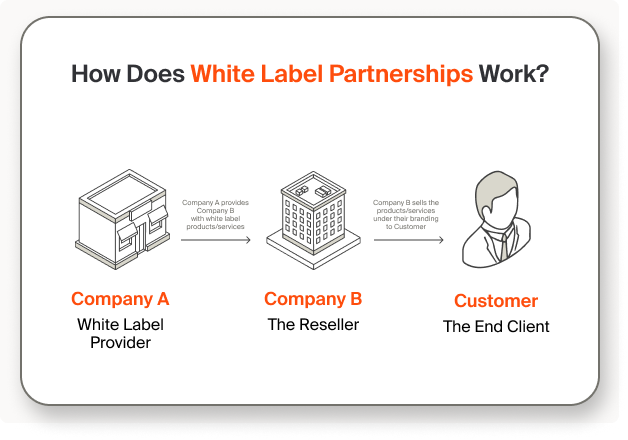

Leveraging White Label Solutions

One of the most efficient ways to establish a Forex brokerage is to leverage white label solutions. These solutions offer a turnkey approach, providing a ready-made trading platform, access to liquidity providers, and comprehensive back-office support. This enables you to concentrate on branding and client acquisition while the provider manages the technical and operational aspects.

Benefits of White Label Solutions

White label solutions significantly reduce the time and cost required to launch a brokerage. Developing a trading platform and securing liquidity providers independently can be both time-consuming and expensive. White label providers offer advanced trading technology and infrastructure, allowing you to avoid these challenges and expedite your market entry.

By partnering with a reputable white label provider, you gain immediate access to a robust and tested trading platform. These platforms have essential features such as advanced charting tools, multiple asset class support, and seamless integration with liquidity providers. This ensures that your clients have a reliable and efficient trading experience from the outset.

Moreover, white label solutions come with comprehensive back-office support, which includes client account management, transaction processing, and regulatory compliance. This support infrastructure ensures smooth operations and adherence to regulatory standards. The provider’s expertise in these areas can help you avoid common pitfalls and ensure that your brokerage operates efficiently.

Focus on Branding and Client Acquisition

The white label provider manages the technical and operational aspects so you can focus on building your brand and acquiring clients. Developing a strong brand identity and a compelling value proposition is essential for differentiating your brokerage in a competitive market. Invest in professional branding and marketing strategies to attract and retain clients.

Your marketing efforts should include digital campaigns, social media engagement, and content marketing to establish your brokerage as a trusted authority in the Forex market. Offering unique features or superior customer service can help you stand out and build a loyal client base.

Quick Market Entry

White label solutions enable quick market entry, which is critical in the fast-paced Forex industry. Launching your brokerage swiftly gives you a competitive edge, allowing you to capitalize on market opportunities without delay. This rapid deployment can be particularly advantageous if you are entering a burgeoning market or targeting a specific niche with high demand.

Ongoing Support and Upgrades

A reputable white label provider will offer ongoing support and regular platform upgrades. This ensures that your brokerage remains up-to-date with the latest technological advancements and market trends. Continuous improvements and technical support help maintain the platform’s reliability and performance, which are crucial for client satisfaction and retention.

Conclusion

Opening a Forex brokerage in 2024 involves navigating a complex regulatory environment, developing a comprehensive business plan, building a robust technological infrastructure, setting up efficient operational frameworks, and implementing effective marketing strategies. Leveraging white label solutions can streamline the process and provide access to advanced trading technology, allowing you to focus on building your brand and acquiring clients. By following these steps, you can establish a successful Forex brokerage and capitalize on the growing opportunities in the Forex market.

FAQ

175

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.