Trading

12 minutes read

Jul 16, 2024

Introduction to Binary Options Trading: Definition and Overview

Introduction

The popularity of binary options has risen tremendously by allowing traders to make speculations on asset prices very easily. This guide will explain the fundamentals for those who want to learn more. Binary options payout a specific amount if predictions about a market going up or down by expiration are correct. While the risks and rewards are quite clear, predictions must be right within a short timeframe.

We will discuss more on this, what binary options are versus regular options, how trades work, like predicting above or below a strike price, and so much more. Factors like regulations depending on location when choosing a platform will also be covered including potential strategies and important risks to know as a new or experienced trader.

Finally, we will look at different strategies that can help traders profit in the long term. Money management and avoiding common mistakes are also addressed. The overall goal is to provide an unbiased overview of the key basics of binary options fundamentals in a simplified manner.

What are Binary Options?

With binary options, traders get to speculate on whether assets will rise or fall using “call” or “put’’ options contracts. These contracts operate with an “all or nothing structure’’ where a fixed payout is paid to you when you are correct or nothing at all. The “call’’ option signifies that a trader is predicting that the price of the asset at the expiration of the determined period will be above the strike price.

The “put” option as you might have guessed is purchased when the trader is predicting that the price of the asset will be below the strike price at expiration. The trader receives a fixed payout when he is correct or loses the entire investment when incorrect.

The risk and reward in binary options are clearly defined upfront. For a standard high or low binary option with an investment of $100, its payout might be $80 for a winning call or put. This amounts to a potential 80% return on investment. However, with a losing trade, the full $100 is forfeited.

This method of determining payout means that if a trader hopes to break even, he will need to correctly predict the market’s movement more often than he gets it incorrect. As the trader progresses, the odds continue to favour the broker with time, which is why it is important to restate that only traders who are comfortable with these risks should engage with binary options.

Each contract has an expiration date and time. After this period, prices are checked to determine if the trade finished “in the money” or not. Expiration periods can range anywhere from 30 seconds up to a week later, allowing both ultra-short-term and longer outlooks to be acted on. Examples of assets you can trade include forex pairs, commodities, economic reports, and stock indexes.

Is Binary Options Trading Safe?

Traders and regulators alike are bound to be concerned about safety in terms of protection from fraudulent activities when trading binary options. This then begs the question “Is binary options trading safe?”

Just as it is seen across different financial markets, there are always entities (in this case brokers operating outside the law) looking to exploit other unsuspecting clients. Due to their largely unregulated nature globally, binary options in particular have faced many issues with dubious providers in recent years.

While binaries are not inherently unsafe when traded properly, many global regulators have expressed strong caution about the space. In the U.S., the SEC and CFTC only permit binaries on approved, regulated exchanges like Nadex due to a history of problems. The ESMA also issued an investor warning for Europeans due to the volume of complaints involving offshore platforms.

Trade Only With Registered Brokers

To mitigate these risks, it is important that traders only deposit money and trade accounts that are properly registered with designated financial authorities, like the FCA or CySEC. Oversight and regulatory standards regarding licensing, degradation, client funds, anti-money laundering protocols, fraud protection and more must also be maintained by the brokers.

Such firms should also have their licensing credentials and jurisdiction boldly displayed on their website. It is NOT safe to trade with overseas platforms promoting “unlimited profits” or making promises of wealth from minimal effort. Sticking to established brands helps protect traders from exposure to such potential scams and frauds.

Properly regulated choice of broker, prudent due diligence on platforms, discipline in trading, and strict personal risk limits can all help ensure binary options are traded safely when used judiciously as a tool for informed speculators. However regulatory oversight of brokers remains the lone true safeguard available for retail client assets and data. Traders’ choices directly impact their level of protection.

Is Trading Binary Options Legal?

The regulatory status of binary options varies greatly depending on the country. The Commodity Futures Trading Commission (CFTC) regulates binary options in the US while the Securities and Exchange Commission (SEC) also plays some oversight functions.

The CFTC allows the listing of binary options as financial instruments known as swaps or commodity options on registered exchanges. The North American Derivatives Exchange (Nadex) and the Cantor Exchange are examples of such exchanges.

These platforms must adhere to stricter oversight standards compared to offshore markets. Elsewhere, many Western jurisdictions similarly allow binaries under licensing or restrict outrightly due to a history of issues.

However, the CFTC has made it clear that offshore platforms not registered in the US are illegal for Americans to trade with. Included in this category are businesses that provide false services classified as “payment processing” to avoid regulatory requirements.

While binaries themselves are legal financial contracts, the unregulated and oftentimes unlicensed nature of dozens of overseas brokers leaves consumers open to potential deception. US citizens who understand the inherent market risks should only consider legal, regulated exchanges when dipping their toes into binary options.

Traders are encouraged to carefully research relevant case law and regulations wherever they reside to ensure activities conform with all applicable standards. Ignorant but good faith use of an otherwise prohibited broker is still legally non-compliant activity. Legality ultimately depends on the residence of each trader.

Can You Really Make Money with Binary Options?

One of the most common questions for new traders is whether consistently profitable binary options trading is realistic or simply a pipe dream.

While the all-or-nothing structure may seem enticing, making money as a retail trader takes diligent effort over time. Various surveys show the overwhelming majority of new speculators lose their initial investment, sometimes quickly, due to a lack of experience or discipline.

It is Not a Get-Rich-Quick Scheme…

It’s imperative not to view binary options as a “get rich quick” gaming mechanism. Rather, binaries should be treated like any speculative market – one requiring education, strategy testing, and skilled execution to achieve an edge over peers and the house.

With high-low options possessing negative expected value owing to the intrinsic payoff disadvantage, even breaking even long-term demands long hours, and more than a touch of luck.

- Demo accounts — are a free way to test ideas, strategies and emotional control against historical and real-time market fluctuations before trust is placed in brokers. Psychologically, learning without risk of loss cultivates better money management habits required for mitigating typical beginner biases.

- For beginners — small position sizes are strongly recommended when paper trading as skills develop. This allows mistakes to be affordable tuition in a live market environment without risking significant funds. Transitioning to real trading also calls for starting conservatively at low stakes and expanding the scope gradually based on demonstrated strategy results.

- No Gambling — Establishing a tested, systematic approach proven through backtesting & verification is key. Relying on random guesses calls the house edge into play and ensures failure on average. Successful traders utilize tools like technical analysis, underlying market education and dynamic risk models to make informed binary choices.

- Stay Disciplined — discipline trumps strategy. Losses will occur, even for experts – but recovery requires strict risk parameters, cutting losses promptly and letting profits run. Emotion has no place in a discipline-dependent game with rules statistically stacked against individual traders. Binary options are challenging but yield consistent, steady improvement over time for admitted students.

Binary Options Trading vs Forex Trading

When venturing into trading as a beginner, binary options versus forex are two popular entry points into the world of financial speculation. Both involve predicting price movements but differ in several key aspects.

- Risk-Reward Ratio: From a risk and reward standpoint, binaries offer clearly defined profit and loss outcomes. Trades are limited to a pre-set payout or the initial outlay. Meanwhile, in forex, risk is uncapped due to leverage amplifying both gains and losses on positions. Careless money management can result in margin calls or catastrophic losses with currencies.

- Product: On the product side, binaries present a straightforward “call” or “put” proposition requiring simply choosing a direction on an asset by expiration. Forex meanwhile features “limit”, “market” and “stop” order types to establish and exit trades at desired price points, along with the flexibility to take partial profits or average into further positions.

- Volatility: This also differs between markets. Forex majors like the EUR/USD can experience violent 100+ pip intraday spikes during breaking news, versus binaries normally having expiration windows ranging from 30 seconds to a week. This subjects spot FX traders to heightened risk demanding near-constant monitoring.

- Position-taking: While binaries entail limited position-taking, forex allows scaling into larger speculative sizes assuming proper capital allotment and risk planning. This scaling capability grants the opportunity for substantially greater risk taken but is accompanied by proportionally larger drawdown threats when trades turn sour.

Overall, binary options offer low barriers to entry through regulatory-compliant brokers with small minimum deposit amounts. However, new traders should carefully weigh their financial goals, preferred involvement level and risk tolerance before committing real funds rather than demo accounts to either market. Both require nuanced strategies for long-term profits.

Developing a Trading Strategy

A key determinant in achieving consistency from binary options is adopting a repeatable set of trading rules based on proven factors within particular assets and timeframes. New traders often err by blindly entering positions without a plan, hoping for success through chance alone.

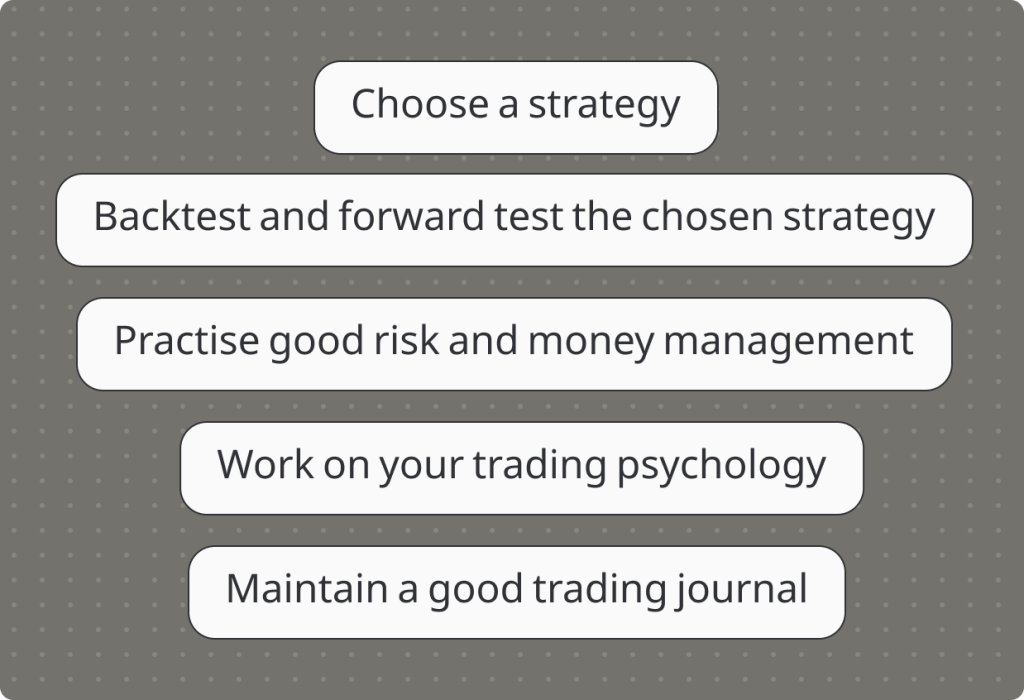

- Choose a strategy: Some examples of strategies include trend trading, range trading, and hedging correlated assets. Trend following looks to enter trades aligned with prevailing price swings. Range strategies set upper and lower price barriers and resistance flips direction. Hedging uses options on related but inverse instruments to offset risk.

- Backtest and forward test the chosen strategy: It is recommended that various strategies be backtested on historical data and tested initially on a demo account or through paper trading. Regardless of approach, strategies must undergo months of backtesting to expose weaknesses under different market conditions. This allows strategies to be tweaked without jeopardizing capital. Concepts shown to add statistical edges based on an asset’s unique nuances can then be refined further with live pilot testing.

- Practise good risk and money management: Even a proven strategy is useless without strict risk management and discipline. Position sizing according to account balance and maximum drawdowns is pivotal. Trailing stops help ensure profits are taken rather than given back in subsequent losses. Diversification helps limit the effects of any one instrument reversing against expectations.

- Work on your trading psychology: Considerations like slippage, commissions and normal errors in execution must be modelled. Outcomes demonstrating statistical significance and alignment with trader psychology add legitimacy. As markets evolve, strategies must also adapt through a review of performance metrics and continuing education on supply/demand factor influences. Successful traders allocate position sizes according to confidence levels, cutting perceived poor setups quickly while letting winners extend.

- Maintain a good trading journal: Maintaining detailed trading journals strengthens the review process. By staying humble and learning from past errors rather than repeating them, traders progressively refine their edge over peers and the house. While strategy forms a necessary framework, consistent discipline and execution ultimately determine the bottom lines.

Risk Management and Money Management

Effective risk and money management is essential to surviving fluctuations in the binary options market long enough to benefit from an edge. Without discipline, even substantially positive expected value trading yields inevitable long-term losses through unavoidable short-term variances and emotional biases.

Traders must avoid over-leveraging positions beyond a sensible percentage of their account. High risk-reward ratio trades may seem enticing but compound inevitable drawdowns. Predefined maximum risk parameters on both position and total portfolio sizes ensure planned losses remain affordable rather than spiralling out of control.

Setting stop-losses that trigger automatic exits is another important risk management tool. These temporary orders lock in reasonable profits that outweigh the defined maximum risk originally accepted on any given trade. Trailing stops adapts to price movement, prevents profitable trades from reversing, yet ensures some gain is taken rather than giving it all back.

After a set losing day or week where planned loss limits are breached, it is wise to refrain from further trading until emotions calm and the opportunity to clear the mind arises. Over-retaliatory trading as losses mount repeatedly wipes accounts. Small losses must be accepted gracefully as an expected cost of entering the market.

Overall portfolio management means smaller position sizes used to keep losers small but let subsequent winners exponentially cover previous mistakes. Strict bankroll management protects capital adequacy needed to weather inevitable drawdown cycles from compounding doomed. Scaling into larger sizes follows sustaining profits over many uncorrelated trades.

Disciplined application of sound risk controls is just as vital as any market strategy for survival as a binary options trader. Even with theoretical or historical edges, variance will occur, and risk management safeguards capital to benefit from repeated opportunities.

Should You Trade Binary Options?

Binary options can offer traders a flexible yet challenging way to speculatively trade markets, but only when certain prerequisites are met. Due to the all-or-nothing payout structure and constant need to correctly predict short-term price behaviour, binary options qualify as a high-risk/high-reward trading vehicle best approached carefully.

When transacted responsibly on regulated exchanges using sound money and risk management practices, binaries need not constitute gambling for informed traders. Some may even find the simplicity and known risk rewards of binaries appeal more than juggling complex positions in forex or stocks.

However, all prospective traders must understand binary options converge probabilities against individual accounts in the long run. Success demands ongoing study, strategy testing, discipline and acknowledging market fluctuations will incur occasional losing periods.

Rather than seeking instant riches, the focus should involve small live accounts to gain real-time experience and avoid emotional attachment to funds. Proper due diligence also verifies brokers’ regulatory compliance before deposits.

Overall, binary options offer opportunities for educated speculators but come accompanied by inherent dangers for the inexperienced or overconfident. Prudence suggests cautious participation and continuous learning on behalf of all traders looking to dabble. With proactive risk controls and realistic expectations, binaries could complement investment portfolios responsibly.

Final Thoughts

Binary options trading presents both risks and rewards for educated speculators. While the all-or-nothing payout structure and short time frames make consistent profits challenging, developing a systematic strategy, practising proper money management, and trading on regulated platforms can help serious traders mitigate risks and benefit from well-researched opportunities over the long run. For most individuals, however, binaries are best approached cautiously with small positions solely of funds dedicated to high-risk speculation.

162

Written by Artem Goryushin

Marketing at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.