Brokerage Business

9 minutes read

Nov 12, 2024

What is a Brokerage Firm and How it Works?

Operating as intermediaries for buyers and sellers in the financial markets, brokerage companies help to trade assets like stocks, bonds, commodities, and currencies. Through market access they provide, financial items that are difficult to sell due to regulatory constraints, market complexity, or the need for professional experience may be purchased and sold via brokerage firms. To properly navigate the complicated terrain of financial markets, one must first understand how brokerage companies operate.

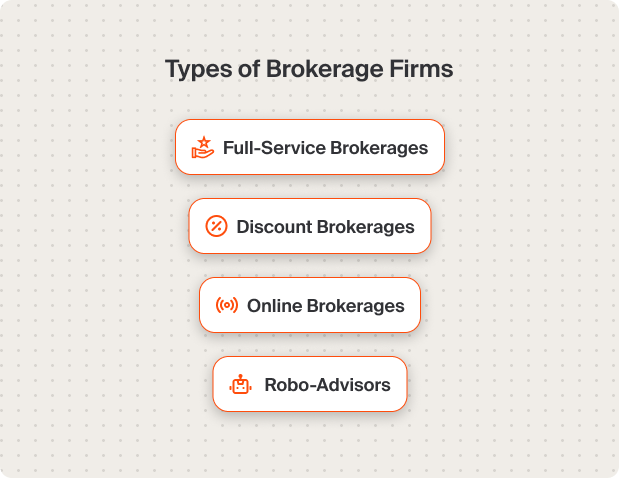

Types of Brokerage Firms

Different customer demands and degrees of service are catered for by many forms of brokerage companies.

Full-Service Brokerages

Among numerous other products, full-service brokerages provide wealth management, retirement planning, investment guidance, and research reports. Usually, they assign customers to certain financial advisers who provide customized advice depending on their investment horizon, risk tolerance, and financial objectives. These firms might be suitable for investors eager to pay extra for thorough services and seeking professional guidance. Full-service brokers may also provide estate planning and tax advice in addition to access to exceptional investment opportunities such initial public offerings (IPOs) and alternative investments as part of their overall approach to wealth management.

Discount Brokerages

Discount brokerages mostly concentrate on completing transactions for customers at lower commission rates. Compared to full-service companies, they provide less auxiliary services and less investment guidance. Self-directed investors that want to make their own investing choices and are seeking affordable methods to trade securities find discount brokerages perfect. Usually providing easy trading systems with necessary tools and resources, these companies let investors effectively manage their portfolios free from the extra expense of tailored advice services.

Online Brokerages

Online brokerages have become ever more common with the development of technology. Often with little or no commission costs, they provide trading systems that let customers conduct transactions online. Online brokerages might provide instructional materials, charting tools, and real-time prices among other things. They serve tech-savvy investors that appreciate control over their trading activity and simplicity. Many online brokerages now provide mobile apps, which let customers trade on-the-road and remain always connected to the markets. The competitive environment has driven these companies to always improve their platforms using cutting-edge technologies and easy-to-use layouts.

Robo-Advisors

Robo-advisors are automated systems that, depending on established investment strategies and risk profiles, manage client portfolios using algorithms. Often at a less cost than conventional advisory services, they provide a hands-off approach to investment. Investors that want a straightforward, technologically driven financial solution free from direct human touch will find robo-advisors appealing. Usually investing in diverse portfolios of low-cost index funds or ETFs, these platforms may include tax-loss harvesting and automated rebalancing to maximize returns and tax efficiency. Robo-advisors provide consumers seeking low-cost professional portfolio management a readily accessible point of access to the financial markets.

How Does a Brokerage Firm Function?

Anyone hoping to start their own brokerage must first understand the underlying dynamics of a brokerage company. Running a brokerage company calls for an extensive infrastructure including regulatory compliance, technological integration, risk management, client acquisition, and income generating techniques.

Regulatory Compliance and Licensing

Legal functioning of a brokerage firm depends on acquiring the necessary licenses from relevant authorities in the jurisdiction of planned business activity. Following anti-money laundering (AML) and know-your-client (KYC) policies, this process satisfies certain capital demands and puts robust compliance procedures into operation. Dealing with legal specialists that concentrate on financial services might help to control the complexity of the licensing procedure and guarantee that all regulatory responsibilities are followed. Compliance is a lifetime commitment to upholding moral standards and following changing policies, not a one-time duty.

Infrastructure and Technology Integration

The success of a brokerage company mostly depends on a strong technical foundation. Since the main interaction between your company and your customers is the trading platform you choose. Among the options are well-known platforms such as MetaTrader, Quadcode, cTrader, Match-Trader, dxTrade, or even creating a bespoke platform catered to your particular customer demand. The platform should provide real-time market data feeds, effective order processing, risk management features, and flawless back-office system integration. Investing in safeguards for cybersecurity is critical for protecting customer data and maintaining the integrity of trading activity.

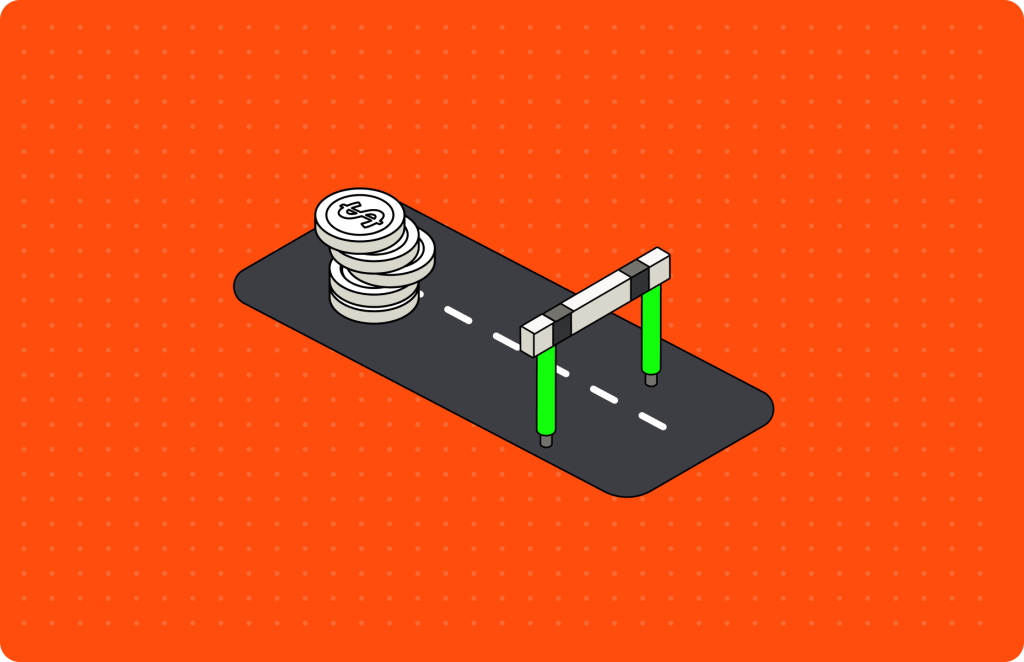

Capitalization and Liquidity Provision

Not only does sufficient capitalization satisfy legal criteria, but it also guarantees that operations are feasible. Unexpected losses and market volatility are cushioned by the capital. Especially if you want to run under the A-Book model or a hybrid approach, building partnerships with credible liquidity providers is very crucial. These ties let your brokerage provide quick execution speeds, narrow spreads, and reasonable pricing, thereby improving the whole trading experience for your customers.

Revenue Generation Models

Your company plan depends on your knowing of how your brokerage will make money. Commission on transactions, spread mark-ups, swap fees, and ancillary services such managed accounts or educational programs are the primary income sources. Your operating model—A-Book, B-Book, or hybrid—will greatly affect the way risks are controlled and these revenues are generated.

In the A-Book model, client orders are passed directly to external liquidity providers. The brokerage earns through commissions or small markups on the spreads. This model aligns your interests with your clients’, as you do not profit from client losses, enhancing transparency and trust. It is practical for attracting clients who prefer ethical practices and may lead to higher trading volumes due to tighter spreads.

The B-Book model involves internalizing client orders, with the brokerage acting as the counterparty. Profits are made when clients lose, which can be lucrative but introduces conflicts of interest and requires sophisticated risk management to hedge exposure. This model can increase profitability but demands robust systems to monitor client activity and market movements effectively.

The Hybrid model combines both approaches, allowing flexibility to route orders based on factors like trade size or client profile. This optimization can enhance profitability while managing risk, but it adds complexity to operations and necessitates clear policies to maintain compliance and client trust.

To make your revenue model practical:

- Align Revenue Streams with Your Operational Model: For the A-Book model, focus on generating income through commissions and offering competitive spreads to attract high-volume traders. In the B-Book model, carefully manage spreads and swap fees to maximize profits without deterring clients.

- Invest in Technology and Risk Management: Especially crucial for B-Book and Hybrid models, implement advanced systems to monitor trading activities and manage exposures in real-time.

- Ensure Transparency and Compliance: Clearly communicate your fee structures, order execution methods, and any potential conflicts of interest to clients. This transparency builds trust and helps you comply with regulatory requirements.

- Diversify Services: Offering ancillary services can create additional revenue streams and enhance client retention by providing more value.

Risk Management

Effective risk management is crucial to safeguard your brokerage’s financial stability and reputation. This includes implementing real-time monitoring systems to track client exposures, market movements, and liquidity levels. Developing comprehensive risk management policies helps in handling exceptional market events and mitigating potential losses. Hedging techniques might be required for B-Book operations to balance risks connected with client trading activity. Also crucial is ensuring compliance with risk management regulations, which include keeping enough capital buffers and conducting frequent stress tests.

Client Acquisition and Marketing

Success of your brokerage depends mostly on attracting and keeping customers. Creating a strong marketing plan means determining your target market segments — retail traders, institutional customers, or certain geographic areas — then customizing your offerings to fit their requirements. Using digital marketing channels, improving your online presence, and interacting with possible customers via content marketing, social media, and industry events will enhance your profile. In a saturated industry, your brokerage may stand out with competitive trading terms, promotional incentives, and top-notch training materials.

Operational Processes and Staffing

Efficient operational processes ensure smooth day-to-day functioning of your brokerage. This covers creating protocols for client onboarding, transaction processing, compliance monitoring, and customer service. For important positions such as compliance officials, IT experts, risk managers, and customer service agents, hiring skilled individuals is quite essential. Client satisfaction and operational effectiveness depend on staff training investments and encouragement of a culture of compliance and excellence.

Customer Support and Client Relations

Providing exceptional customer support distinguishes your brokerage and fosters client loyalty. Providing many channels for support—live chat, email, phone, and social media—along with assuring fast and efficient answers to customer questions improves the client experience. If you work with clients from abroad, you may want to have multilingual help. Implementing a customer relationship management (CRM) system helps in personalizing interactions and maintaining organized client records.

Continuous Adaptation and Innovation

With changing technology, market trends, and legal environments, the financial sector is dynamic. Maintaining competitiveness calls for ongoing adaptability and creativity. This might include improving the functionality of your trading platform, broadening your product offers, or including cutting-edge technology such as artificial intelligence for analytics. Frequent customer feedback and industry insights help your brokerage to be educated and adjustably ready to seize potential customers.

The Role of Regulation and Compliance

Operating in a very controlled environment, brokerage companies guarantee market integrity and investor protection. Regulatory authorities provide guidelines for capital needs, client asset protection, transparency duties, and ethical behavior.

Client Asset Protection

Many times, rules mandate that brokerage companies separate client money from operating accounts of the company, therefore lowering the danger of loss should the company encounter financial problems. By guaranteeing that customer assets remain protected in the case of bankruptcy or insolvency, this segmentation helps to avoid their use in debt settlement for the company. In some jurisdictions, investor protection schemes or compensation funds provide additional safeguards, offering clients a form of insurance to recover their assets if the brokerage fails to meet its obligations.

Disclosure and Transparency

Regarding their services, fees, and possible investment hazards, brokerages must provide truthful and transparent information. This includes disclosing any conflicts of interest, order execution policies, and details about the financial instruments offered. Transparency helps consumers to make educated decisions and builds financial system confidence. Companies also have to notify customers right away about any major changes in terms or conditions to guarantee continuous clarity in the client-broker relationship.

Compliance and Reporting

Following AML and KYC rules can help companies adopt policies meant to find and stop financial crimes. This entails keeping thorough records of every transaction, confirming customer identification, and tracking any unusual activity in transactions. Frequent reporting to regulatory bodies guarantees continuous supervision and compliance including financial statement filing, capital adequacy reports, and notification of any regulatory violations. Ignoring compliance might lead to fines, license cancellation, and legal action among other serious punishments.

Conclusion

Aspiring brokers must first know what a brokerage is and how it runs. Managing a brokerage means negotiating complicated legal constraints, creating strong technology infrastructure, and creating revenue models consistent with A-Book, B-Book, or hybrid operations. Potential brokerage owners may build a company that not only satisfies the demands of today’s investors but also fits the changing dynamics of worldwide financial markets by giving compliance, transparency, and customer satisfaction first priority. Your brokerage may succeed in a very competitive market by adopting creative ideas and using industry best practices, therefore turning challenges into opportunities for profitable expansion.

166

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.