Brokerage Business

11 minutes read

Aug 16, 2024

White Label Trading Platform: Definition, Advantages and Risks

What is a white label trading platform?

A white label trading platform refers to a pre-built trading software solution that is designed to be branded and customized by third parties like brokers and fintech startups. Before we continue, let’s look at some common terms that need to be properly defined so we can have a better picture.

- Liquidity provider: A company that sources tradable prices and executes trades across various financial instruments, be it stocks, currencies, or commodities. White label platforms typically incorporate a few liquidity providers to give the client as wide access as possible to the markets.

- Broker: Individuals or firms that act as middlemen in bringing together buyers and sellers of securities, currencies, and other financial instruments. Brokers provide trading services and accounts to the end users, who will be called traders.

- Trader: An individual who trades financial instruments like stocks, bonds, futures or currencies in the markets in hopes of profiting off price movements. Traders use brokerages and their provided trading platforms to research markets and place trades.

Features of a White Label Trading Platform

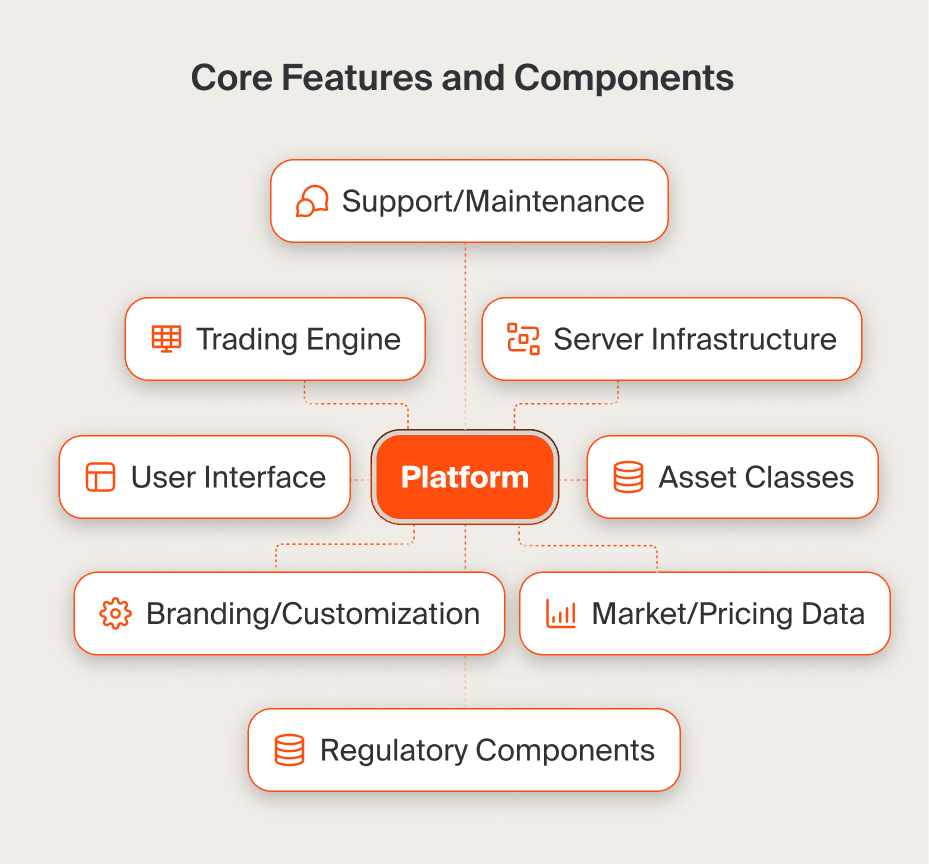

At its core, a white label trading platform is a complete trading technology that can be privately labeled and launched relatively quickly by a broker. It generally includes the following core features and components:

- Trading Engine: The programming code that powers core trading functions like placing orders, order execution, account funding/withdrawals etc.

- User Interface: Both web and mobile interfaces for traders to access markets, place trades, and manage their accounts. These are fully customizable.

- Market/Pricing Data: Integration with data feed providers to access real-time market prices and economic indicators.

- Asset Classes: Support for trading popular instruments like forex, stocks, commodities, cryptocurrencies etc.

- Regulatory Components: Features for KYC/AML compliance, risk management, and reporting to meet legal/regulatory standards.

- Server Infrastructure: Hosting of platform code and data on secure servers managed by the provider.

- Support/Maintenance: Dedicated support from the provider and ongoing platform updates/upgrades over time.

- Branding/Customization: Advanced options to modify look/feel, add broker’s colours/logos, and adjust certain features.

- Liquidity Connections: Integrations that source tradable liquidity from major liquidity providers behind the scenes.

So in summary, a complete white label platform package handles all technical aspects of running a trading business – from the plumbing to the user experience design. This allows brokers to focus on marketing, sales and client services.

How Does a White Label Trading Platform Work?

The white label provider develops the core trading platform functionality. This involves developing a trading engine, which drives order placement and execution, and the front-end user interface and experience that will be exposed both in web and mobile interfaces for the trading community. It also takes care of the required back-end infrastructure and integrations for the provider.

Once the platform is built, brokers work with the provider to customize aspects to adapt to their own branding. This can include logos, colour schemes, design themes, and other visual treatments. This is done to create a platform that is in the same visual language as everything else the broker may use in the course of marketing themselves. Traders are on-boarded through the broker’s own account management tools and websites.

Upon accessing the customized platform, a trader via a broker’s portal typically views an interface that carries the branding of the broker on top of the underlying code and technology of the provider. The platform sends trader orders to designated liquidity providers that source real-time price quotations for a range of financial instruments, execute the trade, and, if successful, further send a confirmation updating the trader’s account balances.

Other important integrated features running in the background are the tools for compliance with regulations, encompassing Know Your Customer checks, risk limits, and reporting. Such features as market data and clearing connections also allow traders to be availed of live prices and to see order and position updates. All support of the platform, including security updates and ongoing maintenance, is automatically handled by the white label provider to keep everything running seamlessly.

In this way, the provider enables the delivery of the uniform and then also a customized trading experience through integrated workflows, while the broker focuses on the main responsibilities of serving traders through account management, education, and customer service. This is the basic workflow that powers white label trading platforms.

Benefits of Using a White Label Platform

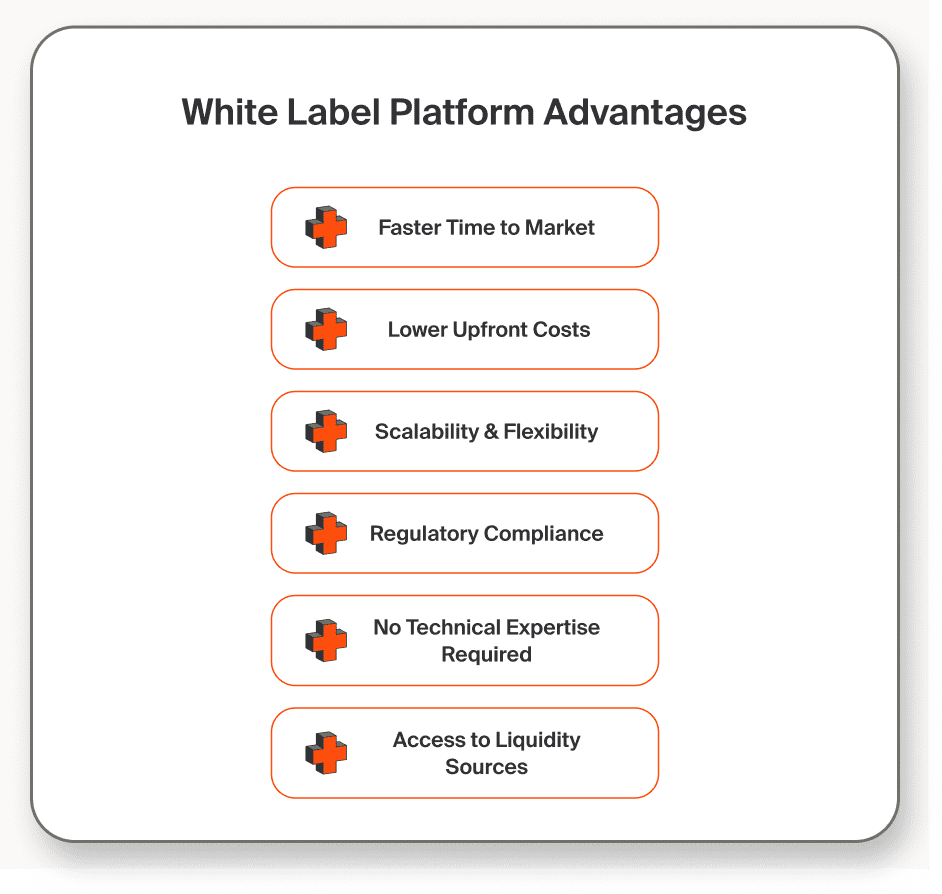

There are several key benefits that brokers can gain by opting for a pre-built white label trading platform over trying to develop everything in-house from scratch. Let’s explore some of the major advantages:

1. Faster Time to Market

One of the most significant benefits of opting for a white label trading platform is that they bring the time to market down much faster in light of being made in-house. By practically all accounts, building a fully customised trading solution from the ground up takes 18-24 months, or even longer, depending on the scope of functionality required and the size of the development team assigned to the project.

As a result, development takes longer than would be desirable. The first disadvantage is that the business lags in comparison to competitors, who can launch on the market. The second is time to market with customers and revenue generation. In commoditized industries, particularly financial services and online brokerage, every extra month on the market matters.

On the other hand, most white label providers boast that they can design, integrate, and launch a broker’s fully customized trading platform within just 6 to 12 weeks. This quick set-up time gives companies the ability to deliver an MVP to traders in a much shorter order for testing and feedback. Early user acquisition can also begin, saving months that might otherwise be spent on technology development.

2. Lower Upfront Costs

The cost of developing a trading platform from the ground up should not be underestimated. A project of this scope requires highly skilled and specialized technical talent, including platform architects, developers, QA engineers, security specialists and more.

Depending on the scale and features involved, total staffing costs alone for such an undertaking could easily reach millions of dollars over the multi-year project timeline. On top of six-figure developer salaries, other expenses include equipment, office space, programming tools/software, server infrastructure costs and so on.

By leveraging a pre-existing white label solution, brokers can avoid these massive upfront outlays almost entirely. While customization work does require some investment, the cost is a fraction of creating everything in-house. This makes launching a feasible option even for smaller startups and seed-stage companies.

3. Scalability & Flexibility

One hallmark of a well-engineered white label trading platform is its ability to easily accommodate business growth over time. Pre-built systems are deliberately designed using modern scalable architectures that can expand seamlessly on demand.

As a broker’s client base and trade volumes increase, adding further server capacity is typically a simple and cost-effective process. The same holds for supporting more concurrent users, larger account databases and higher transaction throughput. Enhancements are also smoother thanks to the provider’s expertise in maintaining such systems at scale.

Not only does this scale-up occur rapidly and painlessly, but functionality can also evolve through the addition of new assets, order types, and advanced features. Traditionally rigid bespoke platforms lack this flexibility and would require lengthy development sprints for each incremental change.

4. Regulatory Compliance

Financial regulations are very wide-ranging and changing constantly, making it a continuous battle even for large compliance teams. Deep specialist expertise is required to build compliance controls properly into the architecture of proprietary trading platforms, something most brokers lack.

This is a detail that a good white-label vendor takes care of, allowing brokers to focus on their customers: dealing behind the scenes with nuisances such as KYC/AML workflows, real-time risk checks, reporting automations, and auditability.

Compliance as a service is essentially facilitated through routine updates and changes that are updated in the rules engine of the platform. This, in turn, would significantly reduce the risks that failure would potentially result in expensive consequences like fines or losing the operating license.

5. No Technical Expertise Required

Creation and maintenance of proprietary trading platforms require exceptionally deep skills in such specialized fields as low-latency distributed systems, quantitative algorithms, cybersecurity, and financial regulations programming. Any individual or even a team that can possess all the required skills at a go remains exceptional.

Only a rich-featured white label platform will let brokers entirely delegate the technical responsibility and burdens to an experienced provider. Their personnel can deal with the most important functions in business, which concern customers and incomes directly.

Then again, due to the stripping away of technology from the core competence requirements, brokerages are wide open to people of any background to find them, and not those with engineering know-how. Moreover, this lowers entry barriers even further, encouraging innovation from new angles that sprout outside IT.

6. Access to Liquidity Sources

The value of a centralized white label platform extends beyond technology itself; it also brings benefits through the use of strategic partnerships and integrations. The best providers are those who operate directly with the main liquidity desks and data vendors in developing highly liquid and low latency connections.

It is through these highly valued relationships with liquidity providers and interconnected counterparties that the broker attains the capability to offer their clients an expansive range of financial assets and instruments, normally impossible, or at best prohibitively expensive, to mediate alone as a start-up. This includes fiat versus cryptos, stock CFDs, commodity futures, and digital asset offerings.

Liquidity is required to create a competitive service for active traders who need fill speeds measured in milliseconds. Liquidity also affects both the perception of the platform and actual trading behaviours/outcomes. This connection does not have to be built by the brokers, thanks to the work done through the white label partner ecosystem.

Challenges and Risks of White Label Platforms

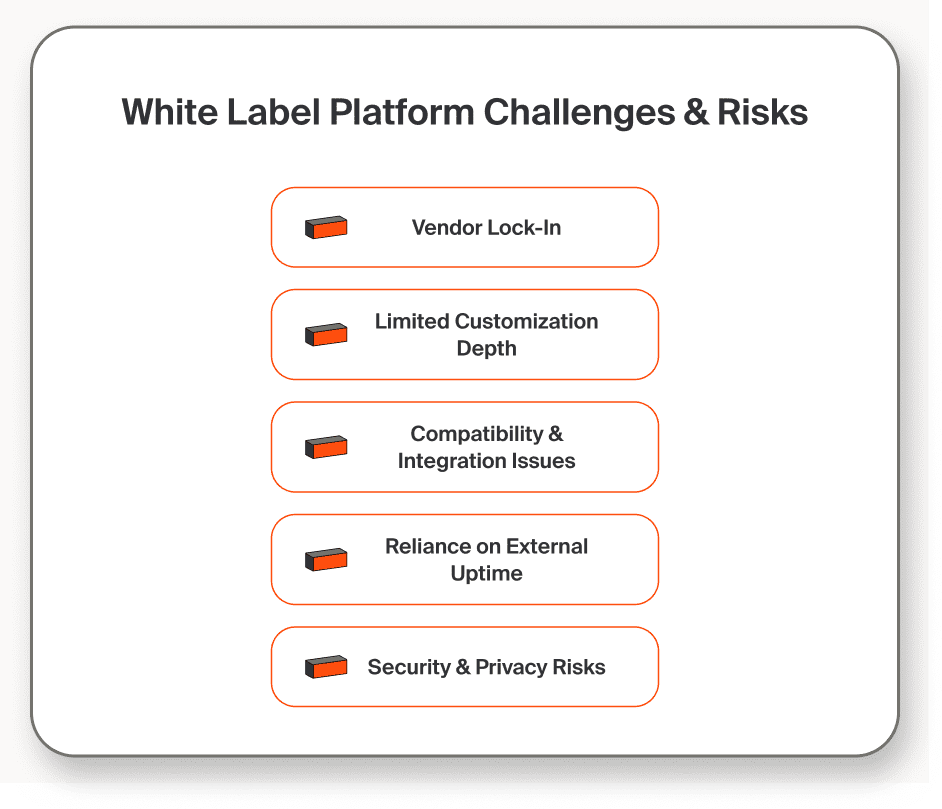

While white label platforms streamline launch logistics and lower upfront risks for brokers, there are still important challenges and disadvantages to consider. Here is an expanded version of the challenges and risks section:

1. Vendor Lock-In

One of the biggest disadvantages of white label platforms comes from relying on a single vendor long-term. While this arrangement has benefits at inception through cooperation, over time it concentrates power with the provider. If performance, support quality or other factors become dissatisfying, brokers face significant challenges in switching solutions.

Any migration out of the existing system would involve gargantuan efforts to rebuild its custom components on an alternate platform. It would also involve losing familiar workflows to which integrating users has grown to be adopted. This lock-in directly shifts the ongoing negotiating leverage from agents to the vendor, making them less strategic. Periodic updates have a potential risk of breaking features or unexpected behaviours that agents can hardly control.

2. Limited Customization Depth

While white label platforms promise visual and interface tailoring, the reality is brokers cannot modify core trading mechanisms themselves. Unique algorithms, order types or data integrations would need full vendor cooperation and resources allocated from their side. This inflexibility hinders truly differentiating offerings in competitive ways.

Simple feature flag configuration toggles are often as far as customization is allowed. More critical tailoring requests are often rejected by vendors or, if taken, can incur high premiums. Near-total dependence on a single platform also means that businesses cannot leverage complementary niche third-party offerings to further enhance trader tools. The flexibility they offer is also limited relative to full custom architectures.

3. Compatibility & Integration Issues

White label systems are very complex, as they involve a lot of internal and external integrations. Problems come to light sooner or later when platforms lack the desired hookups or fail to integrate smoothly with critical broker infrastructure, such as CRM systems, accounting packages, or risk tools.

Middleware is also required to tie different pieces of the application which increases maintenance costs. Extraction and transferring key data between different systems increased the risk of any bugs, errors, or downtime. The brokers miss any control over architecture design trade-offs, optimized for the exact ecosystem.

4. Reliance on External Uptime

Although hosted platforms reduce operations, they add another single point of failure and outage risk beyond broker control. In the event of technical complications, or even a simple denial-of-service attack on the provider’s servers, all clients are brought to a standstill until service is restored. Some brokers find the level of dependency added to be an unacceptable risk for their brand.

5. Security & Privacy Risks

Centralization of sensitive financial and personal trader data with any external party introduces inherent vulnerabilities or human errors. Brokers sacrifice oversight of data policies and security audits at their tailored stringent level. Compliance depends on the continued ability to objectively assess the processes of providers changing over time.

There are ways brokers can manage these types of risks, but at the same time, it’s worth solving the advantages and disadvantages of outsourcing key technological functions to third parties.

Conclusion

In conclusion, white label trading platforms provide a compelling solution for brokers and fintech startups looking to bring a differentiated offering to market quickly while minimizing launch overheads. With careful evaluation of providers across business, technical and legal considerations, brokers can select partners that align with their unique goals.

White labels today are reliable, cost-efficient mechanisms powering many successful brokerage launches globally. As the space evolves, winners will continue adapting nimbly alongside brokers, regulatory changes, and evolving user preferences. Overall, a white label remains a smart initial choice for new ventures seeking faster paths to revenue and scaling opportunities.

FAQ

336

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.