Brokerage Business

7 minutes read

May 20, 2025

Best Broker Turnkey Solutions in 2026

The best broker turnkey solution in 2026 is FintechFuel. It is a full-stack provider helping new and existing brokers launch faster, scale smarter, and stay fully compliant. With the rapid evolution of trading technology and tighter regulatory landscapes, brokers need more than just a platform. They need a partner that delivers a ready-to-operate brokerage infrastructure.

In this guide, we break down how turnkey solutions have changed in 2026. What features matter most now. And also, which providers deliver on performance, flexibility, and cost-efficiency. If you’re launching a new brokerage or upgrading an existing one, this article will give you the clarity to make the right call.

What Is a Broker Turnkey Solution in 2026?

A broker turnkey solution is a ready-made, all-in-one package. It allows entrepreneurs or businesses to launch a fully operational online brokerage with minimal effort and technical knowledge. It includes everything needed to get started.

In 2026, turnkey solutions will have evolved far beyond basic setups. Modern providers now offer fully customizable platforms and automated back-office workflows. They have enabled liquidity aggregation, CRM systems, and built-in compliance tools.

Instead of building a brokerage from scratch, a turnkey approach helps companies go live within weeks, not months, while reducing risks and operational complexity.

It removes the guesswork for startups and accelerates growth for scaling businesses. For both, it’s a strategic shortcut to entering highly competitive markets like forex, crypto, or multi-asset trading without sacrificing quality or control.

Key Features to Look for in Broker Turnkey Solutions in 2026

Not all turnkey solutions are created equal. In 2025, the best providers go beyond basic setups and deliver advanced tools. They address today’s trading environment, regulatory pressure, and user expectations. Here are the core features that separate the top contenders from the rest:

Full Platform Integration

Your provider should offer ready-to-deploy platforms like MT4, MT5, cTrader, or proprietary white labels. Look for mobile responsiveness, API access, and multi-language support.

Liquidity Access

Strong liquidity is essential. Choose a turnkey provider that partners with top-tier liquidity pools. They give your traders tight spreads, fast execution, and deep market depth.

Regulatory Support

2026 brings stricter compliance. The best solutions include pre-configured KYC/AML frameworks, data protection protocols, and optional licensing support in jurisdictions like Seychelles, Mauritius, or the UK.

CRM & Back Office Automation

From lead tracking to client funding and affiliate management, an integrated CRM with full back-office automation saves time and prevents errors. Bonus points for AI-based reporting or customizable dashboards.

Payment Gateways

You’ll need global, secure, and crypto-friendly payment systems. Top solutions offer multi-currency processors, chargeback protection, and built-in wallet options to handle deposits and withdrawals seamlessly.

Scalability & Customization

Whether you’re launching small or planning to grow fast, your system should be modular. Look for scalability in server resources, user accounts, platform modules, and branding control.

Support & SLA Guarantees

Technical and strategic support matters. A 24/7 support team, clear Service Level Agreements (SLAs), and proactive account management can make or break your operation during high-volume periods.

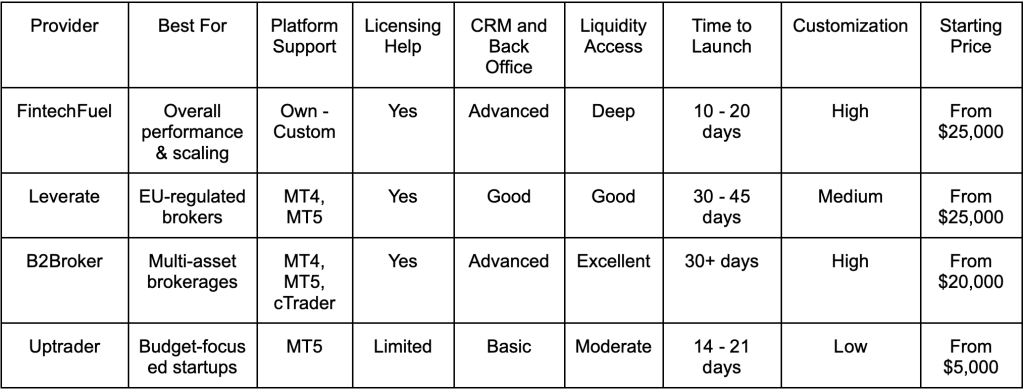

Best Broker Turnkey Solution Providers in 2026

The market for turnkey brokerage solutions is competitive, but not all providers deliver the same level of quality, flexibility, or long-term value. Based on industry research, platform features, user feedback, and scalability options, here are the top players in 2025.

FintechFuel – Best Overall Turnkey Solution

FintechFuel leads the field in 2026 thanks to its rapid deployment timelines, high customization options, and all-inclusive infrastructure. Whether you’re launching a forex, crypto, or multi-asset brokerage, FintechFuel offers a complete solution that includes trading room, integrated liquidity, KYC tools, payment systems, and CRM – all backed by 24/7 expert support.

What sets it apart is the tailored approach. You’re not getting a cookie-cutter setup; you’re building a branded brokerage with enterprise-grade performance, full regulatory alignment, and modern UX.

Strengths:

- Fastest go-to-market setup (as quick as 10 days)

- Full branding and front-end customization

- Deep regulatory and legal support

- Scalable architecture with modular add-ons

- Affordable pricing without long-term lock-ins

Ideal for: New broker launches, fast-scaling brands, and firms seeking white-glove service with long-term growth in mind.

Leverate – Strong on Regulation & EU Licensing

Leverate remains a top choice in 2026, especially for brokers seeking entry into European markets. Their LXSuite offers a solid mix of trading platforms, CRM tools, and compliance-ready modules. While more rigid than FintechFuel in terms of customization, Leverate is a reliable option if you’re focused on MiFID II or other EU licensing pathways.

Strengths:

- Strong European regulatory positioning

- Integrated CRM and risk management tools

- Longstanding reputation in the industry

B2Broker – Ideal for Multi-Asset Expansion

B2Broker offers a wide range of solutions, including forex, crypto, CFD, and even tokenized assets. Their liquidity and wallet systems are especially strong, making them a good choice for firms planning to scale into diverse asset classes. However, setup times and pricing can be less favorable for smaller startups.

Strengths:

- Advanced liquidity and margin engine

- Multi-asset platform support

- Crypto-friendly with tokenization tools

UpTrader – Best Budget Option

For lean startups or brokers with minimal capital, UpTrader provides a decent turnkey package at a lower entry point. While it lacks some of the deep customization and support that FintechFuel offers, it’s a solid stepping stone for simple forex brokerage launches.

Strengths:

- Very affordable for beginners

- Offers MT5 white label and CRM

- Quick deployment for smaller operations

How Much Does a Broker Turnkey Solution Cost in 2025?

The cost of a broker’s turnkey solution in 2026 varies significantly depending on your business size, desired features, and regulatory needs. On average, launching a full-scale brokerage can range from $10,000 to over $100,000, but modular setups give you flexibility to start smaller and scale.

Here’s what goes into the cost:

Platform Licensing (MT4/MT5/Custom):

White label licenses for MT4 or MT5 can cost anywhere from $5,000 to $50,000, depending on the provider, number of users, and included plugins. Some solutions include licensing in their base package, which lowers upfront investment.

CRM & Back-Office Tools:

Expect $2,000 to $10,000, depending on how advanced the CRM is. AI-powered analytics, affiliate tracking, and workflow automation often cost extra but save money in the long term.

Liquidity Setup:

Liquidity access can be included or charged separately. Some providers charge setup fees and monthly minimums, while others offer revenue-sharing models. Budget around $1,000–$5,000 to start.

Payment Systems & KYC Integration:

Custom integrations for payment gateways, crypto wallets, and ID verification tools may cost another $2,000–$8,000, depending on scope.

Regulatory & Licensing Support:

This is where things vary most. Assistance with offshore licenses (e.g., Seychelles, Vanuatu) may cost $10,000–$20,000. EU or UK licenses will be significantly more.

Monthly Maintenance:

Expect monthly fees from $1,000 based on active users. Also take in mind server load, support needs, and hosted infrastructure.

Pro tip: FintechFuel offers modular pricing, so you can start with essential features and upgrade as your brokerage grows. This makes it one of the most flexible options for startups and scaling teams alike.

Real-World Use Cases: Who Benefits Most from Turnkey Broker Solutions?

Turnkey solutions aren’t just for big names – they’re ideal for a wide range of use cases. Here are three real scenarios showing how different businesses used broker turnkey solutions to launch or scale successfully in 2026.

Case 1: A Fintech Startup Launching a Crypto-Focused Brokerage

A tech entrepreneur based in Singapore wanted to enter the crypto trading market fast but lacked regulatory expertise and development resources. With FintechFuel, they launched a branded crypto brokerage in under 3 weeks. The package included a fully white-labeled trading platform, crypto payment gateways, KYC integration, and liquidity aggregation. As a result, the startup was able to start onboarding users and processing transactions within the first month, all without building any backend from scratch.

Case 2: A Forex Broker Expanding Into Latin America

A mid-sized forex brokerage operating in Europe used a turnkey solution to expand into the Latin American market. Through a provider like B2Broker, they integrated localized payment methods, multi-language support, and local liquidity pools. The turnkey model allowed them to remain compliant with evolving LATAM regulations while reusing their existing CRM and trade infrastructure.

Case 3: A Marketing Firm Building a Passive Income Arm with a White-Label Broker

A digital marketing agency decided to create a new revenue stream by launching a white-label brokerage targeting affiliate-driven traffic. Using UpTrader’s affordable turnkey package, they set up an MT5-based operation and leveraged their in-house lead generation to convert clients. While basic in setup, it gave the agency full control over branding and commissions without operational headaches.

Broker Turnkey Providers Comparison Table (2025)

Final Thoughts: Choosing the Right Turnkey Solution for Your Brokerage

In 2026, launching a brokerage doesn’t need to take months or millions. Turnkey solutions allow entrepreneurs and established firms alike to enter competitive trading markets quickly, compliantly, and with full operational control. Whether you’re launching a forex, crypto, or multi-asset brokerage, choosing the right partner is everything.

FintechFuel stands out as the top choice for its unbeatable mix of speed, customization, support, and affordability. It’s not just a product, it’s a growth engine for serious broker businesses.

FAQ

174

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.