Brokerage Business

9 minutes read

Jul 31, 2024

How to Run a Brokerage Company? Comprehensive Guide

According to statistics, an average brokerage company earns from $200,000 per year. Top-notch businesses bring their owners $400,000 – $500,000 annually. Seeing such numbers makes beginner business owners want to enter the niche as soon as possible. Meanwhile, the industry is ready to surprise newcomers with a set of pitfalls. Let’s dive deeper into the steps required to run a successful brokerage company. What are they and why are those steps exceptionally important?

Step 1. Business Planning and Market Research

The path of a successful brokerage business always begins with thorough planning. Never neglect this step as it lays the grounds for a whole company.

Which issues should be raised within this stage?

- Which type of brokerage company are you going to run?

- Who belongs to your target audience?

- Which financial and geographical limits restrict your business?

The thorough market research and detailed answers to the above-mentioned questions help newcomer business owners avoid common mistakes.

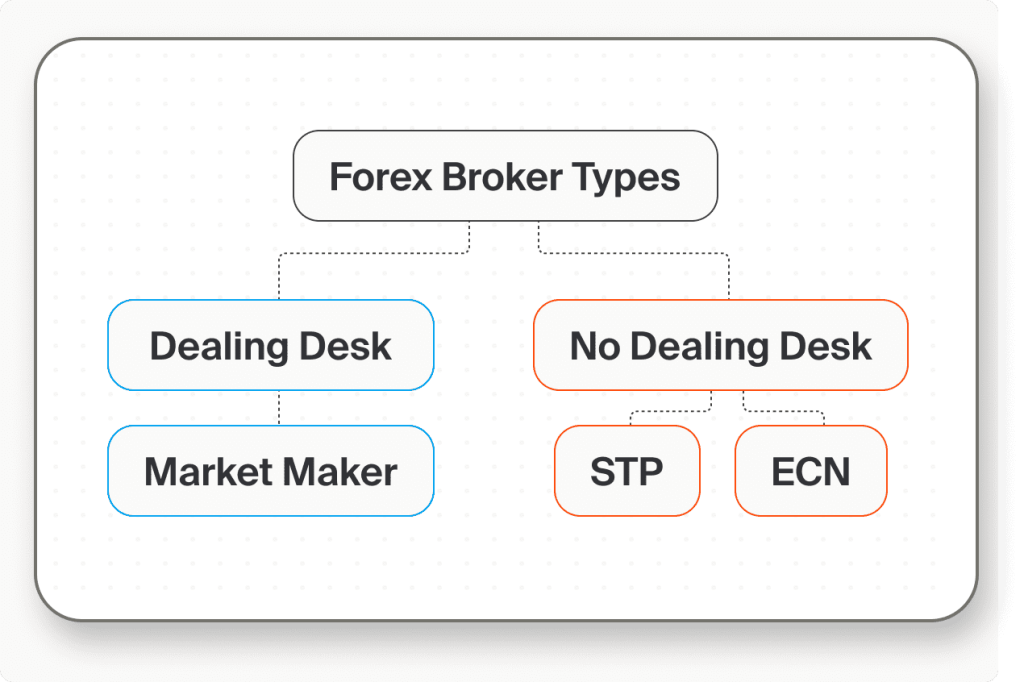

The Differences between STP and ECN Models

When talking about brokerage business models, beginners usually choose between STP (Straight Through Processing) and ECN (Electronic Communication Network) models.

The ECN model connects clients directly to liquidity providers. STP brokers connect traders to liquidity providers through a dealing desk that plays the role of an intermediary.

What are the pros and cons of each model?

Advantages of STP brokers:

- The STP model implies lower fees and spreads.

- Traders access higher leverage multipliers.

- The entry threshold for a client is much lower.

Advantages of ECN brokers:

- Traders get direct access to the interbank market.

- Real-time rates are displayed. There is no interference and manipulations from a broker.

- Clients get the highest level of transparency.

Understanding Your Target Audience

An attempt to run a company that is suitable for all traders is doomed to failure. Clients of different categories have their own demands and expectations; this is why you need to understand your target audience precisely before running a business.

The best way is to proceed from the chosen brokerage model. ECN-driven companies aim to welcome large investors whose deposits will start at $10,000 or higher. Businesses bet on the quality of their clients, not quantity. The STP model invites small traders and newcomers who make the first steps in the industry. The main task of such a broker lies in attracting as many clients as possible and then motivating them to make deals.

Geographical Limits

Most industry-leading brokers commenced their way from a certain region. For instance, your brokerage company is ready to enter the Asian market. It is much easier to understand which legislative norms and standards you should follow.

Running an international company from scratch is not a good idea. A wide range of regulatory restrictions and obligations do not allow business owners to focus on crucial steps. Start from a certain region and then conquer other markets.

Hence, the profound market analysis and precise understanding of how your brokerage company should function are the solid foundation for all further steps.

Step 2. Company Foundation and Regulatory Issues

The next stage requires a business owner to register a company and get all the required licenses to run the business in full correspondence with legislative norms.

Note! The market is full of unlicensed brokerage businesses which are mostly fraudsters. Companies with no legal entity and no license are not credible in the eyes of potential clients.

Requirements for brokerage company registration depend on a certain country. For instance, Belize, one of the most popular offshore jurisdictions, set the following requirements:

- Charter capital. It is not defined but the jurisdiction recommends having at least $50,000.

- Director. At least one director is required (either a private person or a company). Residency doesn’t matter.

- Shareholders. At least one shareholder is mandatory (either a private person or a company). Residency doesn’t matter.

- Secretary. Companies may function with a secretary.

- Register of beneficiaries. Companies are obliged to have a register of beneficiaries and directors, but the information in the register is not subject to disclosure.

- Legal address. A local legal address is required.

Once you have registered a company, the license is the next step. Licensed brokers face no limitations and restrictions from financial regulators and attract many more clients. The licensing process depends on a chosen jurisdiction. Every regulatory body has its own set of requirements and standards.

Newcomer brokerage businesses are recommended to begin with offshore licenses. Those are much easier and cheaper to obtain. Many top-notch companies commenced their ways with a license received from financial regulators of the British Virgin Islands, Saint-Vincent and the Grenadines, Seychelles Islands, Cayman Islands, Vanuatu, etc.

Step 3. Building of a Website and a Trading Platform

Taking into account the high level of competition in the niche, traders are rather demanding. When signing up to a brokerage company they expect to get a functional website that is easy to use for both beginners and professional traders.

The website building process includes two core stages:

- Client area building. Provide your clients with the ultimate set of analytical instruments and tools, profound and detailed statistics, educational materials, and other components that help them effectively manage their portfolios.

- Website design planning. A platform’s design should be simple enough so that traders could intuitively understand what and where to do. Furthermore, design should distinguish your platform from competitors.

As for a trading platform itself, business owners usually choose between two possible options. Brokers may either purchase a trading platform or integrate it through the White Label model.

Most trading terminals are available at a fixed price of $100,000. Furthermore, brokers pay about $20,000 annually for maintenance.

The White Label solution unlocks access to a ready-made platform. This option costs about $5,000; which is why beginner business owners usually prefer to get a WL trading platform and save much money.

Step 4. Partnering Issues

The success of a brokerage business depends much on which service providers you partner with.

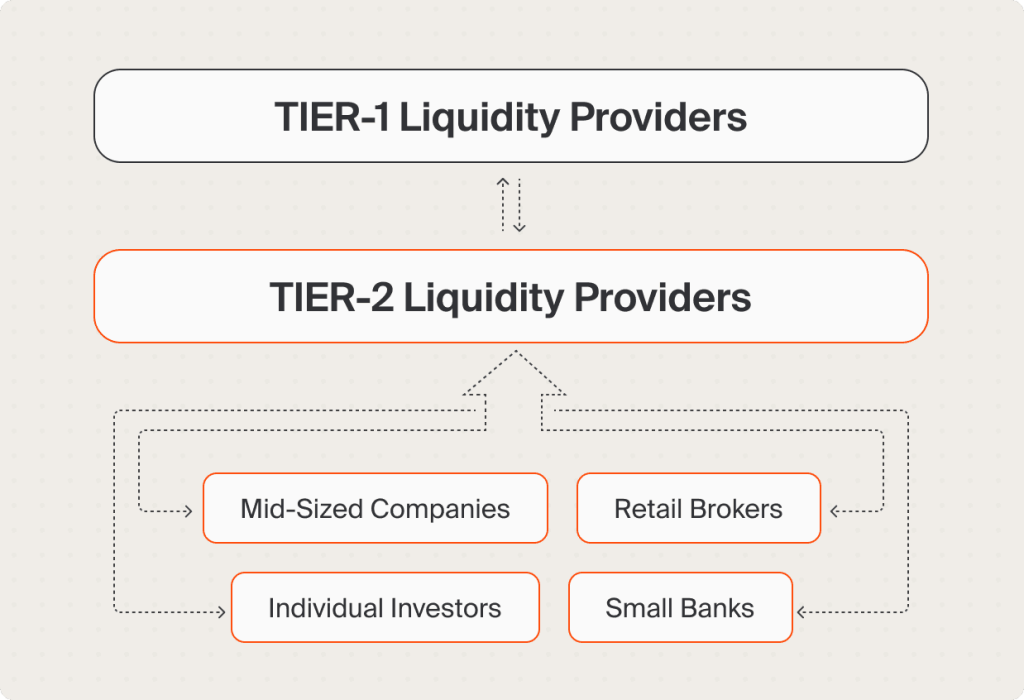

First and foremost, you need to find a reliable liquidity provider. Without partnering with a liquidity provider, brokerage businesses are not able to satisfy all the requests of their traders. You need to decide between PoP providers and the NBLP model.

Prime of Prime liquidity providers connect your traders to Tier 1 liquidity providers which are major banks, hedge funds, etc. The NBLP (non-banking liquidity provider) model includes software that collects the best prices geared together from several liquidity providers.

Top-rated brokers provide their clients with fast and secure deposit and withdrawal methods which means you need to partner with industry-leading payment gateways. When selecting a payment gateway, take into account the following aspects:

- The more payment methods are available, the better. Traders expect to access different payment options, including wire transfers, debit/credit cards, e-wallets, and cryptocurrencies.

- The processing speed is of much account. Partner with payment gateways that guarantee the highest transaction processing speed.

- Providers of payment services may charge fees from 1.5% to 6%. Select gateways that charge the lowest commissions.

Step 5. Promotion and Marketing Campaigns

When the technical and regulatory side is over, business owners have done just half of the whole work. A well-designed website and a functional platform will bring you nothing without high-end promotion. In the scope of the fast-growing competition, you need to pay enough attention to marketing.

Business owners need a complex marketing strategy that makes your platform attractive to traders and investors. This task consists of the following stages:

- Unique corporate style. Foremost, a brokerage company needs a corporate style that distinguishes it from competitors. It includes a unique logo, color scheme, and messages that disclose your company’s goals and value.

- Social media management. Effective promotion of a brokerage company includes tools available in social networks that are a business page creation, qualitative content, interaction with clients, advertising, etc.

- Digital and traditional marketing methods. Digital marketing brings targeted traffic to your website; this is why business owners need to focus on pay-per-click campaigns and paid search advertising is effective enough.

- Content marketing. Content marketing helps brokers increase brand awareness through expert advice on how to trade and get profit from diverse instruments. Useful posts, educational videos, podcasts, webinars, and other materials gain the trust of your target audience.

Step 6. After-the-launch Stages

Your company entered the market, everything functions properly, and the marketing strategy turned out to be effective enough. Is the task over? High-class brokerage businesses introduce measures that retain traders. What are those measures?

- Qualitative and professional technical support. Your clients need to find answers to all their questions within the shortest terms.

- Educational materials and useful information. Fill your website with expert materials that are useful for both beginners and experienced traders.

- Bonuses. Promote rewards to newcomers and active traders. Use promo codes and other options.

- Updates. Industry-leading businesses always develop themselves, add some new features and instruments, and keep up with the times.

After-the-launch stages are exceptionally important as those measures help a company stay competitive.

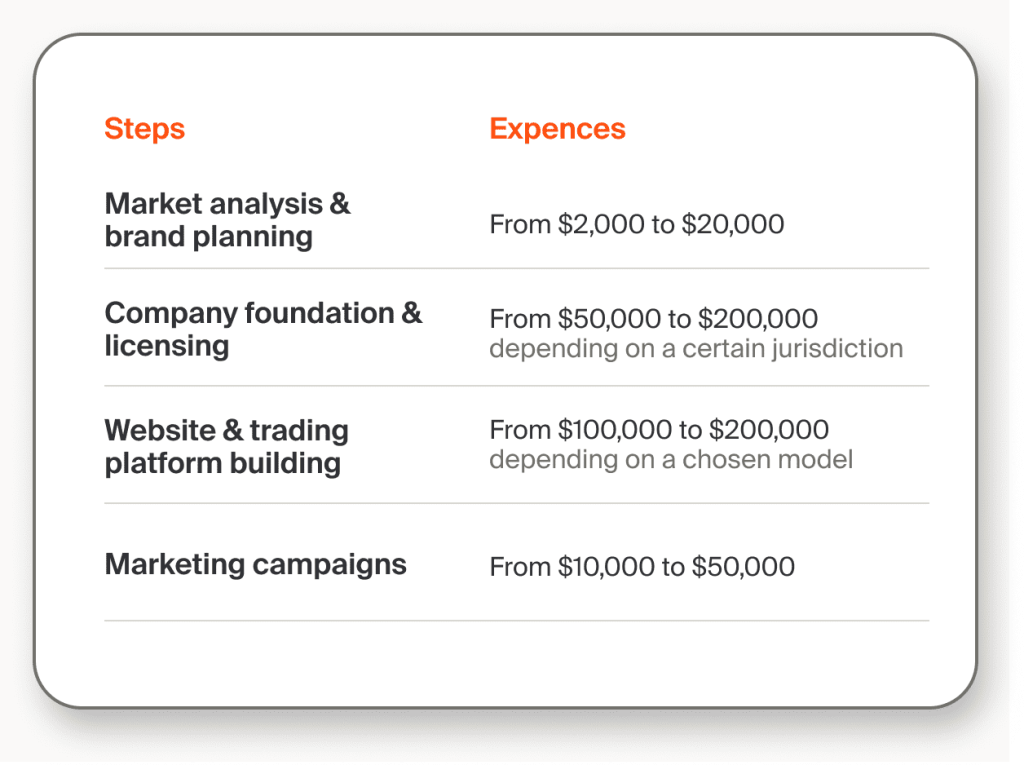

Expenses Required to Run a Brokerage Company

Budget is one of the crucial factors for a beginner business owner. How much does it cost to run a brokerage company?

As such, you need to spend from $162,000 to $470,000 to run your own brokerage business. The White Label model may cut your expenses. What are the key differences between running a company from scratch and getting a White Label solution?

White Label Vs Private Label. What are the Differences?

White Label platforms help business owners to enter the market quickly and effortlessly. Those platforms are ready to be customized to your brand and corporate style.

The main pros of WL solutions:

- The White Label model comprises a ready-made business that has been already launched. You don’t need to undergo all the mentioned steps.

- When selecting a WL solution, you may focus on the marketing stage to give your company a headstart in the niche.

- Providers of WL solutions make all the required settings and guarantee qualitative maintenance.

As for the cons, the only disadvantage lies in the fact that a business owner cannot change something without agreeing with a platform provider.

Note! Many industry-leading brokerage businesses with multi-million audiences entered the market through WL solutions as this option seems to be the best one for beginners.

FAQ

128

Written by Artem Goryushin

Marketing at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.