Trading

10 minutes read

Apr 14, 2025

What is PAMM or MAM and How Does it Work?

What are Managed Forex Accounts?

Managed forex accounts allow investors to delegate trading authority to professional money managers while maintaining ownership of their capital. Unlike mutual funds, they typically offer greater transparency with real-time monitoring capabilities. The relationship is formalized through a Limited Power of Attorney (LPOA).

Key benefits compared to self-trading include expertise utilization, time efficiency, emotional detachment from trading decisions, and diversification opportunities across multiple strategies and managers. Common misconceptions include guaranteed profits, complete safety, unlimited liquidity, and “set-and-forget” investing. However, experienced traders know that successful investing still requires monitoring performance and manager selection.

What are PAMM Accounts?

A PAMM account represents a structured system where multiple investors pool capital into a single trading account managed by a professional trader. Profits and losses are distributed proportionally based on each investor’s percentage share of total equity.

The system operates through a master trading account where client funds are aggregated. When a trade is executed, the platform automatically calculates each investor’s share of the position size based on their equity percentage. For example, if an investor contributes 10% of the total equity and the manager opens a 1-lot position, the investor effectively takes a 0.1-lot position.

Money managers typically earn compensation through performance fees (commonly 20-30% of profits), management fees (1-2% of assets), or additional trading commissions. The high-water mark principle ensures that performance fees apply only to new profits, preventing managers from earning multiple fees on the same performance.

Technical Mechanics

The PAMM system functions through several key components:

- Master Account: The central trading account where all trading activities occur

- Offer: A public proposal by the money manager outlining trading strategy, minimum investment, fee structure, and terms

- Investment Periods: Defined timeframes that determine when investors can deposit or withdraw funds

- Rollover Process: Regular recalculation periods where profits/losses are distributed and fees collected

- Trading Terminal: The platform where the money manager executes trades

When a trade is executed on the master account, the platform automatically calculates each investor’s share of the position size based on their equity percentage.

Pooled Investment Structure

The pooled nature of PAMM accounts offers several advantages:

- Trading efficiency: Managers execute single trades rather than replicating orders across multiple accounts

- Equal treatment: All investors receive the same entry and exit prices proportional to their investment

- Administrative simplicity: Automated calculations eliminate manual position sizing

- Capital aggregation: Smaller investors gain access to strategies that might otherwise require larger minimum investments

However, this structure also creates certain constraints, particularly regarding liquidity. Since all funds exist within a single account, withdrawals typically occur during designated periods to prevent disruption to open positions.

Role of the Money Manager

Money managers in PAMM systems bear complete responsibility for trading decisions while having no direct access to withdraw client funds. Their primary functions include:

- Developing and implementing trading strategies

- Managing risk across the entire account

- Monitoring market conditions and adjusting positions

- Communicating performance and strategy information to investors

Managers typically invest their capital alongside investors, creating an alignment of interests. This “skin in the game” approach reduces moral hazard and demonstrates the manager’s confidence in their strategy.

Capital Allocation and Distribution

The proportional allocation model represents the core mechanism of PAMM accounts. Each investor’s share of profits and losses directly corresponds to their percentage of the total equity. This calculation occurs dynamically, adjusting as account values fluctuate and as investors enter or exit the PAMM account.

For example:

- Investor A contributes $10,000 to a PAMM with a total equity of $100,000 (10% share)

- The account generates a $5,000 profit through trading

- Investor A receives $500 (10% of $5,000) before performance fees

This proportional approach applies equally to losses, ensuring equitable distribution of both positive and negative outcomes.

PAMM Account Lifecycle

The typical PAMM account lifecycle includes:

- Offer Creation: The manager establishes investment terms and strategy description

- Initial Investment Period: The manager and initial investors fund the account

- Active Trading Phase: The manager trades with established capital

- Regular Rollovers: Periodic recalculations distribute profits/losses and collect fees

- Investment Fluctuations: New investors join and existing investors adjust their allocations

- Account Maturity: Long-term performance establishes the PAMM’s track record

Some PAMM accounts operate indefinitely, while others function for predetermined periods before returning capital to investors.

Rollover Periods and Their Significance

Rollovers represent critical operational intervals in PAMM systems, typically occurring daily, weekly, or monthly depending on the broker and manager preferences. During rollovers:

- Profits and losses are formally calculated and distributed

- Performance fees are collected

- New investments are processed

- Withdrawal requests are fulfilled

- Open positions are rebalanced to reflect the updated equity distribution

Rollovers provide structural points for liquidity management and account administration. This periodic approach helps prevent continuous disruption to trading activities while providing predictable opportunities for investors to adjust their participation.

What are MAM Accounts?

A MAM (Multi-Account Manager) system represents an alternative approach to managed forex trading where, unlike PAMM accounts, each investor maintains a separate sub-account while still benefiting from centralized management. The defining characteristic of MAM systems is their flexibility in trade allocation methods, allowing customization at both individual and group levels.

This architecture enables money managers to execute trades once through a master terminal, with trades automatically replicated across all connected client accounts according to predefined allocation methods. The preservation of distinct sub-accounts creates greater flexibility in how trades are allocated and how investors can interact with their investments.

Technical Mechanics of MAM Operation

The MAM system operates through specialized broker infrastructure that links a master management terminal to multiple client accounts. When the money manager executes a trade, the MAM software processes this instruction according to predefined rules and replicates it across all connected accounts, adjusting position sizes based on the selected allocation method.

This architecture typically requires:

- Master Management Terminal: The interface through which the money manager places trades

- Client Sub-Accounts: Individual trading accounts connected to the master terminal

- Allocation Engine: Software that determines position sizing across accounts

- Monitoring System: Interfaces for both managers and investors to track performance

- Permission Structure: Defined authorities regarding who can execute trades and modify settings

Unlike PAMM systems, MAM platforms often allow for two-way communication between the master terminal and sub-accounts, enabling greater customization and control.

Trade Allocation Methods

MAM systems typically offer multiple allocation methods, providing flexibility that represents one of their key advantages:

- Percentage Allocation: Positions sized according to account equity percentages

- Lot Allocation: Fixed lot sizes assigned to each account regardless of equity

- Equity Percent Allocation: Positions sized as a percentage of each account’s equity

- Balance Percent Allocation: Positions sized according to account balance rather than equity

- Risk Percent Allocation: Position sizing based on predefined risk parameters for each account

For example, using percentage allocation, an investor with twice the equity of another would receive positions twice as large, while under lot allocation, both investors might receive identically sized positions regardless of account size.

Lot Allocation Options and Customization

The ability to customize lot allocation represents a significant MAM advantage. Money managers can:

- Assign different multipliers to specific accounts

- Create account groups with distinct allocation settings

- Apply minimum and maximum position sizes regardless of the allocation method

- Exclude certain accounts from specific trades

- Implement risk-control parameters at the account level

This customization allows for tailoring trading approaches to individual investor risk tolerances, account sizes, and investment objectives—flexibility impossible within standard PAMM structures.

Performance Tracking and Reporting

MAM systems typically offer enhanced reporting capabilities compared to PAMM accounts. Since each investor maintains a separate sub-account, performance tracking occurs at the individual level rather than being calculated from a share of the master account.

Standard reporting features include:

- Individual account performance metrics

- Comparison against benchmark accounts

- Trading history with entry/exit points

- Drawdown analysis

- Risk-adjusted return calculations

- Fee breakdown and historical charges

These capabilities allow investors to analyze their specific results rather than relying on pooled performance figures that may not perfectly reflect their experience.

Control Mechanisms for Investors

MAM accounts typically grant investors several control options unavailable in PAMM systems:

- Emergency Trade Closure: Ability to close positions independently in certain circumstances

- Allocation Adjustments: Options to modify how trades are allocated to their account

- Risk Parameters: Setting maximum drawdown levels or position sizes

- Strategy Selection: In multi-strategy environments, choosing which strategies apply

- Account Funding Flexibility: Adding or withdrawing funds without waiting for rollover periods

These control features make MAM accounts particularly suitable for more sophisticated investors who want professional management while maintaining intervention capabilities.

Fee Structures and Transparency

MAM accounts typically offer greater fee structure flexibility compared to PAMM systems. Common arrangements include:

- Performance-Based Fees: Calculated on individual account performance rather than pooled results

- Tiered Fee Structures: Rates that adjust based on account size or performance

- Customized Arrangements: Negotiated terms for larger investors

- Subscription Models: Fixed monthly fees regardless of performance

The individual account structure of MAM systems enables more transparent fee calculation since each investor can clearly see exactly what they’re paying and the specific performance that generated those fees, without the averaging effect that can occur in pooled accounts.

How to Choose the Right System for Your Needs

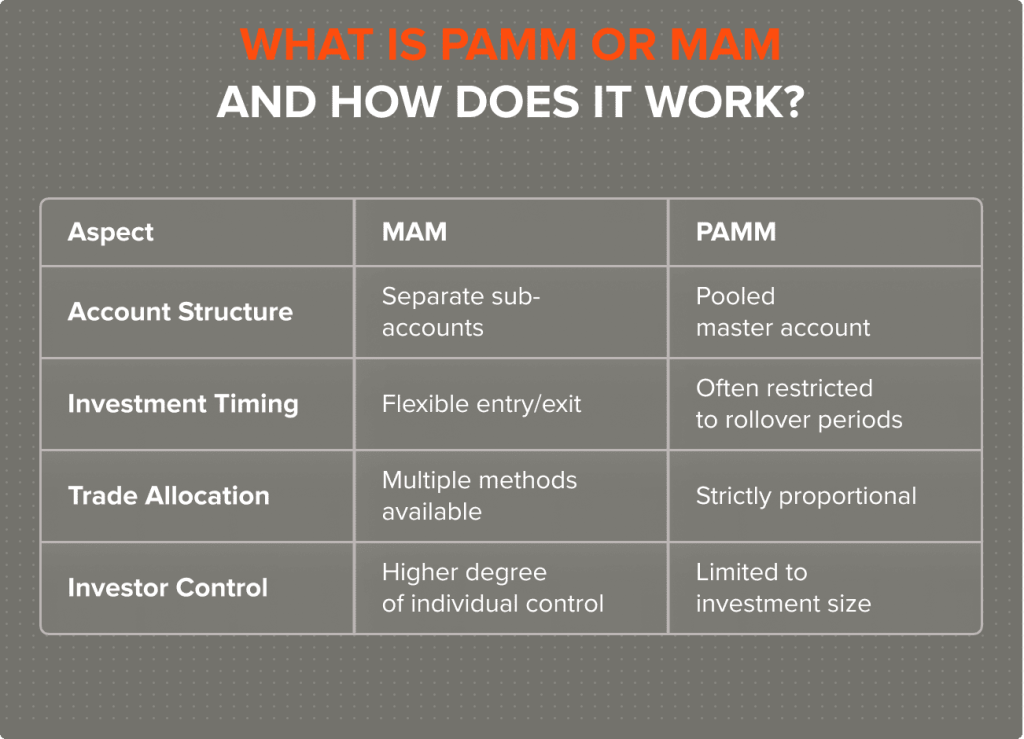

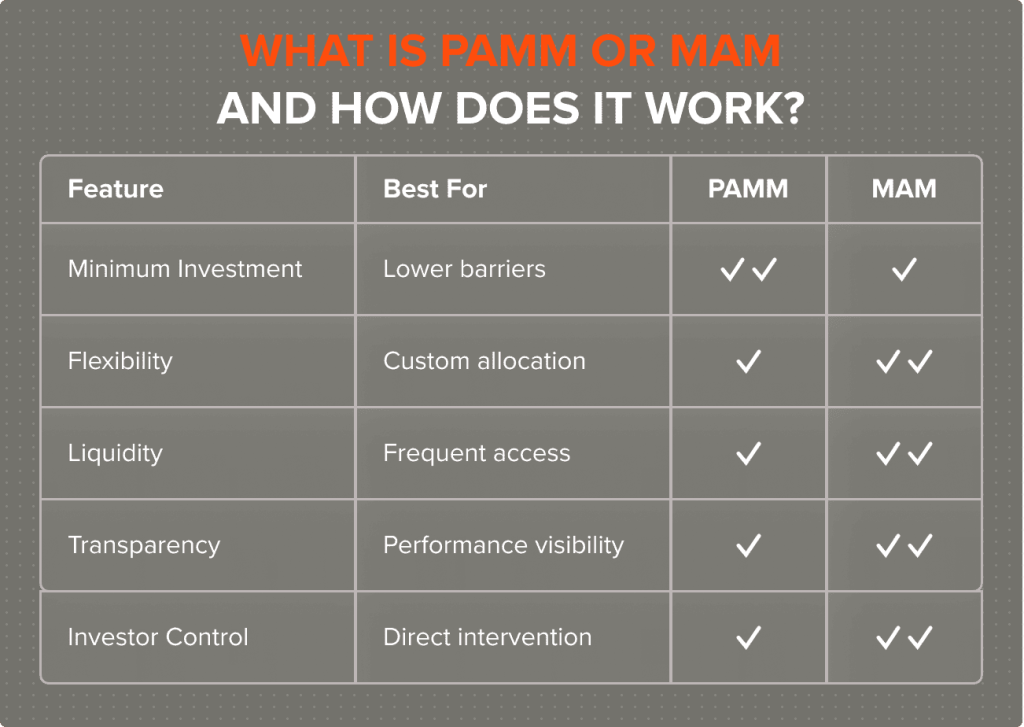

Core differences between MAM and PAMM include:

Your optimal choice depends on which features matter most to your investment approach:

Investment Strategies with PAMM and MAM

Successful managed account investing often involves diversification across multiple dimensions:

- Manager Diversification: Allocate across 3-5 money managers with complementary strategies

- Strategy Diversification: Include both trend-following and mean-reversion approaches across different timeframes

- Instrument Diversification: Allocate to managers trading different currency pairs and potentially other markets

When assessing money managers, focus on risk-adjusted returns (Sharpe/Sortino ratios), maximum drawdown, recovery period, consistency, correlation with other investments, longevity, and equity curve shape.

Different trading approaches create distinct risk/reward profiles:

- Conservative: 5-15% annual returns, <10% maximum drawdown, lower leverage

- Moderate: 15-30% annual returns, 10-20% maximum drawdown, medium leverage

- Aggressive: 30%+ annual returns, 20%+ maximum drawdown, higher leverage

Timing your participation significantly impacts results:

- Entry Strategies: Consider dollar-cost averaging, performance-based entry, drawdown entry

- Exit Strategies: Establish maximum drawdown triggers, watch for performance deterioration or strategy drift

Your time horizon significantly impacts system selection: short-term horizons (0-6 months) favor MAM systems with greater liquidity, while long-term horizons (2+ years) may benefit from PAMM structures through compounding effects.

For Money Managers: How to Build a Successful PAMM/MAM Offering

Building a Track Record

To establish yourself as a successful money manager, you’ll need:

- Verifiable track record (minimum 6-12 months)

- Consistent trading methodology and risk management framework

- Compliance with local financial regulations

- Communication skills for investor relations

Before managing others’ capital, establish credibility through documented performance with third-party verification, real-money results across full market cycles, and proven ability to recover from drawdowns.

Apply Risk Management Strategies

Effective risk management includes:

- Position-level controls: Maximum position sizes (1-3% of equity), automatic stop-losses

- Account-level controls: Maximum drawdown thresholds, daily/weekly loss limits

- Business-level controls: Contingency plans for extreme market events, communication protocols

Marketing Your PAMM/MAM Service

Marketing your service requires standardized performance reporting, a clear explanation of strategy and methodology, and educational content demonstrating expertise. Focus on illustrating risk management discipline rather than emphasizing maximum returns.

Competitive fee structures typically include:

- Performance fees: 20-30% of profits with high-water mark provisions

- Management fees: 1-2% annually, potentially tiered based on investment size

- Alternative structures: Minimum performance thresholds, sliding scales

Technology and Platform Considerations

The most widely used platforms include:

- MetaTrader 4/5: Industry standard with widespread adoption and extensive ecosystem

- cTrader: Growing popularity with built-in copy trading and a modern interface

- Proprietary Platforms: Custom-built solutions by specific brokers

Key infrastructure requirements include:

- Real-time allocation engine with minimal latency

- Secure investor portal with performance reporting

- Automated fee calculation and collection

- Customizable position sizing algorithms

- Comprehensive risk management tools

Common Challenges and Solutions

Technical challenges include:

- Slippage Variation: Different execution prices across accounts Solution: Higher-quality liquidity providers and broker infrastructure

- Scaling Issues: Performance degradation with increased accounts Solution: Capacity planning and infrastructure optimization

- Trade Allocation Fairness: Ensuring equitable treatment Solution: Transparent allocation algorithms and regular auditing

Operational challenges include managing underperforming periods, investor communication during drawdowns, and maintaining strategic discipline despite investor pressure.

Conclusion

PAMM and MAM systems provide valuable structures connecting investors with skilled forex traders. PAMM accounts offer simplicity and accessibility with pooled funds and proportional allocation, making them suitable for hands-off investors seeking simplicity. MAM accounts provide flexibility and control with separate sub-accounts and customizable allocation methods, appealing to more engaged investors.

FAQ

110

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.