Forex

10 minutes read

Jul 26, 2024

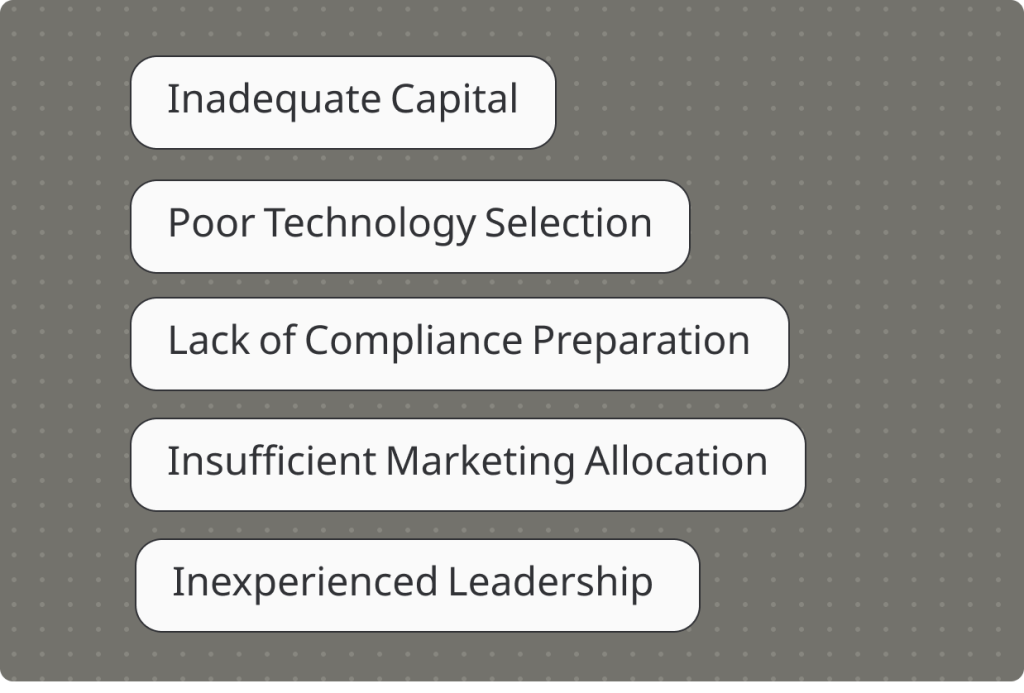

5 Mistakes to Avoid When Starting Your Own Forex Brokerage

By venturing into Forex brokerage, you’re embarking on an immensely rewarding but challenging journey. As with any new business, early missteps can seriously jeopardize long-term viability. However, by proactively sidestepping common pitfalls recognized brokers face, your risks decrease substantially.

This guide outlines the five most critical errors to avoid through prudent planning from inception. With diligence in learning from others’ experiences, you’ll establish sound operational foundations setting your brokerage up for sustainable success. Let’s explore these critical factors to consider during formation.

Inadequate Capital

Beginning a forex brokerage demands significant funding across compliance, technology, partnerships and marketing. Underestimating costs is a common mistake. Experts recommend a minimum of $500,000 in equity before licensing.

Capital allows smoothly handling unexpected expenses without compromising operations or regulations. Requirements like staff, platforms and compliance consume money quickly. Undercapitalization risks viability due to regulatory challenges or inability to scale properly.

Some minimize upfront, but adequate funding establishes a sturdier foundation. Prioritize initial stability before expanding by proving core operations independent first. Prudent capitalization enables sustainable long-term growth.

Poor Technology Selection

Choosing a trading platform is one of the most important decisions for a new forex broker. Inadequate technology will negatively impact the user experience and cripple business operations. Yet some brokers fall into the trap of underestimating their technological needs in the rush to launch.

It’s vital to thoroughly vet any potential vendor solutions. Request live demos and stress tests to ensure platforms can handle high volumes without performance issues. Also, research third-party reviews to assess reliability. Consider not just upfront costs, but long-term support quality as technical problems seriously damage trust.

While savings seem appealing, costs will balloon through extra development, add-ons or replacements later needed with subpar technology. Superior platforms also allow the offering of advanced tools to attract sophisticated traders. The proper evaluation here establishes a foundation for hassle-free, profitable operations long term. Taking the time to get the technology right pays off immensely in the end.

Lack of Compliance Preparation

Forex brokers must adhere to strict compliance standards due handling client funds and transactions. Yet compliance is sometimes overlooked in the early stages. This proves short-sighted, as issues can attract unwanted regulatory scrutiny. Key areas like customer due diligence, transaction monitoring, know-your-customer procedures, and capital reserve reporting require preparation. Engage regulatory counsel experienced in your jurisdiction from the start to ensure all applications and policies follow the rules.

Maintain up-to-date policy manuals adhering strictly to regulations through continuous review. Manual backups support automated systems. Internal training keeps employees focused on protecting clients. Appoint a compliance officer to oversee protocols. While costly, penalties and reputational damage from violations far exceed initial investments. Taking compliance seriously from the beginning demonstrates forethought that regulators respect. It also spares defensive measures required if issues emerge later. Overall, proactive guidance establishes a robust compliance culture.

Insufficient Marketing Allocation

Attracting initial customers poses a huge challenge for new forex brokers. Without dedicated promotion, it’s difficult to distinguish oneself in a crowded market. However, some underestimate marketing’s importance. They assume quality alone drives growth, but competition makes standing out hard without active support. Brokers that underfund promotions often struggle to build a client base.

Experts recommend allocating a minimum of 10% of capital exclusively to lead generation testing. Hire specialists rather than managing campaigns in-house. Consistency over time builds a reputation better than one-offs. Proper testing provides intelligence on effective channels. Ongoing analysis helps refine targeting as the business evolves. Early promotional investment establishes steady customer flow and momentum for long-term sustainable growth through word-of-mouth. Strategic marketing pays dividends initially and beyond.

Inexperienced Leadership

Success demands seasoned executives across functions to maintain operational cohesion. Yet leadership backgrounds covering brokerage compliance, trading platforms and global business administration rarely align serendipitously.

Mitigate weaknesses through appointing advisors counsel across specialties or partnering closely managed services supplying expertise gaps temporarily. Outsourcing non-core roles prevents distractions from strategic imperatives too until a self-sufficient scale emerges.

Additional Considerations

Other typical pitfalls involve feature/platform feature creep before stabilizing, geographical expansion prematurely, under-capitalizing infrastructure or unexpected regulatory changes unexpectedly. Conducting comprehensive feasibility studies mitigates surprises addressing such risks proactively. Additionally, nurture a learning culture continually refining even minor processes delivering disproportionate benefits collectively. Proactive steps avoiding recognized issues others are faced with ultimately prove far less costly than reactionary fixes after preventable problems materialize.

By staying vigilant of these common mistakes, prudent planning and diligent risk management, you’ve equipped your brokerage superbly to navigate inevitable hurdles.

Overall, two critical issues demand special attention when starting a Forex brokerage: selecting the ideal jurisdiction and establishing a secure trading environment. Let’s delve into these important aspects.

Choosing the Ideal Jurisdiction for Your Forex Brokerage

As you prepare to set up your new Forex brokerage business, selecting the optimal jurisdiction is one of your most crucial decisions. The regulatory environment, costs, infrastructure support, and other location factors will strongly influence your long-term success. With so many interconnecting considerations, how do you evaluate and compare your options?

Regulatory Environment

As a brokerage, operating within a regulated framework is non-negotiable. Leading choices meeting high standards include the UK, US, EU, Australia, and Singapore. The UK Financial Conduct Authority (FCA) regulates over 50,000 firms. You can apply for authorisation by submitting a comprehensive business plan outlining activities, systems, and controls. Compliance is rigorous but the FCA has a respected international reputation instilling client trust.

In the US, you should consider obtaining a National Futures Association (NFA) membership. Regulations are stringent but provide access to US clients. Submit detailed applications proving Net Capital requirements are met and systems comply with Anti-Money Laundering (AML) rules. European nations under MiFID regulations offer a single EU-wide “passport” allowing cross-border services. Choose jurisdictions like Ireland with a supportive financial authority like the Central Bank of Ireland. Opt for an English-speaking country to ease expansions.

Other reputable choices include the Australian Securities and Investments Commission (ASIC) and the Monetary Authority of Singapore (MAS). Research licensing categories, application procedures, documentation requirements and timeframes for your targeted business model in each location.

Compliance Costs

Evaluate location-specific obligations from record-keeping software to periodic independence audits. Outsourcing certain functions offsets expenditures versus smaller economies with disproportionate demands.

Compliance expenses form a major long-term consideration. The FCA charges an application fee of £5,000-£10,000 and annual fees from £1,000-£150,000 based on revenues. In addition, budget £30,000-£100,000 in external compliance and legal costs to submit applications. Tally the initial costs of regulator registration or broker-dealer licenses alongside continual annual fees carefully. Ensure you factor in capital reserves mandates which comprise operational expenses substantially.

NFA membership costs $5,000 annually while state licensing through the CFTC demands $6,000 upfront. Hire experienced brokers familiar with obligations like SEC Rule 15c3-1 requiring minimum net capital ratios. Failure to comply risks severe penalties.

EU states differ in fees. For example, annual Irish Financial Service Centre regulatory fees levy €500-€5,000 depending on headcount. Budget €50,000-€200,000 for comprehensive onboarding processes.

Technological Resources

Carefully evaluate the networking infrastructure, data centre capabilities, and developer workforce available in each location. Key considerations include reliable high-speed connectivity through robust cloud networks as well as secure, redundant data centres housing servers capable of powering high-frequency trading systems.

Places like the United Kingdom, Singapore, and the Netherlands offer world-class exchange points and undersea cable systems for low-latency access globally. Additionally, technology hubs in London, Dublin, and Estonia provide deep pools of specialized programming talent experienced in FinTech and compliance solutions. Nearshore centres also emerge as cost-effective options.

Business Sustainability

Political stability, rule of law, and economic resilience are vital long-term indicators of a supportive operating environment that protects clients and sustains business continuity through changing conditions. Locations with a track record of navigating downturns without punitive regulations instil confidence.

Emerging and volatile markets increase disruption risks, so target well-established financial centres consistently ranked as highly competitive like the UK, Switzerland, Canada, and EU states. Their demonstrated commitment to the services sector maintains regulatory standards without compromising growth.

Taxation Structure

Beyond nominal corporate income tax rates which can be optimized through various deductions or incentives, closely examine personal taxation levels affecting talent compensation packages. Consider incentives that directly reduce costs like Cypriot dividends exemptions enhancing scaled international expansion profitability.

Other factors comprise withholding tax rates on foreign earnings repatriation as well as double taxation treaty networks which prevent corporate cash from being taxed by multiple jurisdictions that can impede global operations. Comprehensive tax planning plays a defining long-term role.

Time Zone Coverage

Maintenance of round-the-clock client support demands evaluating time zone alignments to major economic zones from potential operational hubs. A distributed structure balancing locations like London, Dublin and Singapore interacts optimally with European, African, Asian, Australian and neighbouring markets respectively.

With these factors systematically assessed, shortlist viable options by consulting specialized legal counsel. Thorough due diligence reveals the ideal compliant foundation base to concentrate efforts on core functions from—accelerating your success in competitive global Forex markets.

Setting Up a Secure Forex Trading Environment

As a forex broker, securing sensitive client and financial data is paramount. Any breach could compromise funds, destroy trust in your brand and incur hefty fines. Implementing a layered security strategy protects your interests and customers.

How To Set Up A Secure Forex Trading Environment

Server Security

The security of servers hosting your trading platform, databases and applications form the backbone of your environment. Carefully vet potential hosting providers for certifications like ISO 27001 demonstrating rigorous controls.

Ensure servers run up-to-date operating systems and install antivirus, firewalls and intrusion prevention systems. Configure automatic updates and monitoring to promptly address emerging threats. Enable whole disk encryption and multi-factor authentication for access. Properly segment servers housing different functions.

Network Security

To protect internal company networks as well as remote user connections, implement a segregated design. Install virtual private networks (VPNs) governing all external access and carefully restrict internal routes. Monitor traffic flowing in and out using logging tools.

Keep network devices like switches, routers and wireless access points physically secure and password-protected with unique credentials. Consider utilizing next-gen firewalls integrated with other security controls for comprehensive protection. Maintain an air gap between external facing websites and internal resources if possible.

User Access Security

Establish strong yet manageable password policies enforcing complexity, rotation and blacklist screens. Leverage centralized multifactor authentication solutions verifying users through mobile apps or security keys. Grant minimum access permissions based on job roles.

Monitor privileged accounts, administrative actions and login locations/times for anomalies indicating compromised credentials. Restrict email attachments, web access and removable media from confidential systems. Conduct audits and reviews of access rights periodically.

Website Security

Configure encryption using TLS and ensure websites, APIs and trading platforms exist on subdomains isolated from your core network. Regularly scan public assets through vulnerability assessments and penetration tests.

Deploy web application firewalls detecting attacks in real time. Consider a content delivery network and DDOS mitigation service absorbing large traffic spikes. Enforce CAPTCHA on sensitive web forms and educate staff about phishing risks when accessing work emails or browsing externally.

Data Security

Safeguard sensitive information in motion and at rest through encryption techniques. Limit access permissions only to authorized personnel needing data for their job responsibilities. Tokenize sensitive fields like credit cards where possible.

Establish rigorous processes around personally identifiable information handling in compliance with regulations. Conduct regular backups at scheduled intervals and validate the restoration of critical assets. Physically or digitally redact erased data ensuring it cannot be reconstructed. Test incident response plans through exercises involving broad scenarios.

System Maintenance

Stay protected by promptly applying all operating system, software and firmware updates as they are released. Configure automatic updating where feasible. Centrally manage to patch across all devices through vulnerability management systems prioritizing by risk level.

Restrict physical access to production systems using badges, biometric scans or security personnel oversight. Educate all employees on ransomware, phishing threats and secure work habits promoting vigilance as society’s first line of defense. Periodic pen testing reveals flaws before criminals test your defenses.

Incident Response

Though thorough precautions create layered protections, unforeseen incidents may still occur. It is imperative to have an incident response plan in place to minimize damage from a security breach. Within this plan, clearly define communication protocols and the roles and responsibilities of a dedicated response team.

In the unfortunate event of a suspected breach, the incident response team should promptly investigate the issue and work to isolate any impacted systems, networks or data. This containment process helps prevent further spreading of the threat while the investigation is still beginning. Notifying affected internal teams and external parties is also critical if confidential data is believed to have been compromised.

Reporting to regulatory agencies fulfills compliance obligations and keeps the appropriate authorities aware. Close coordination with law enforcement may also be required depending on the scale and evidence of criminal behavior. After the initial containment and investigation process, a thorough review should be conducted to remediate vulnerabilities and bolster existing defenses.

93

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.