Brokerage Business

10 minutes read

Nov 20, 2024

How Do Brokerage Firms Make Money

Considering only the price movements is not the only what you need to consider when placing a trade through. Each brokerage company follows a different strategy for generating revenue, essentially having an impact on your profits.

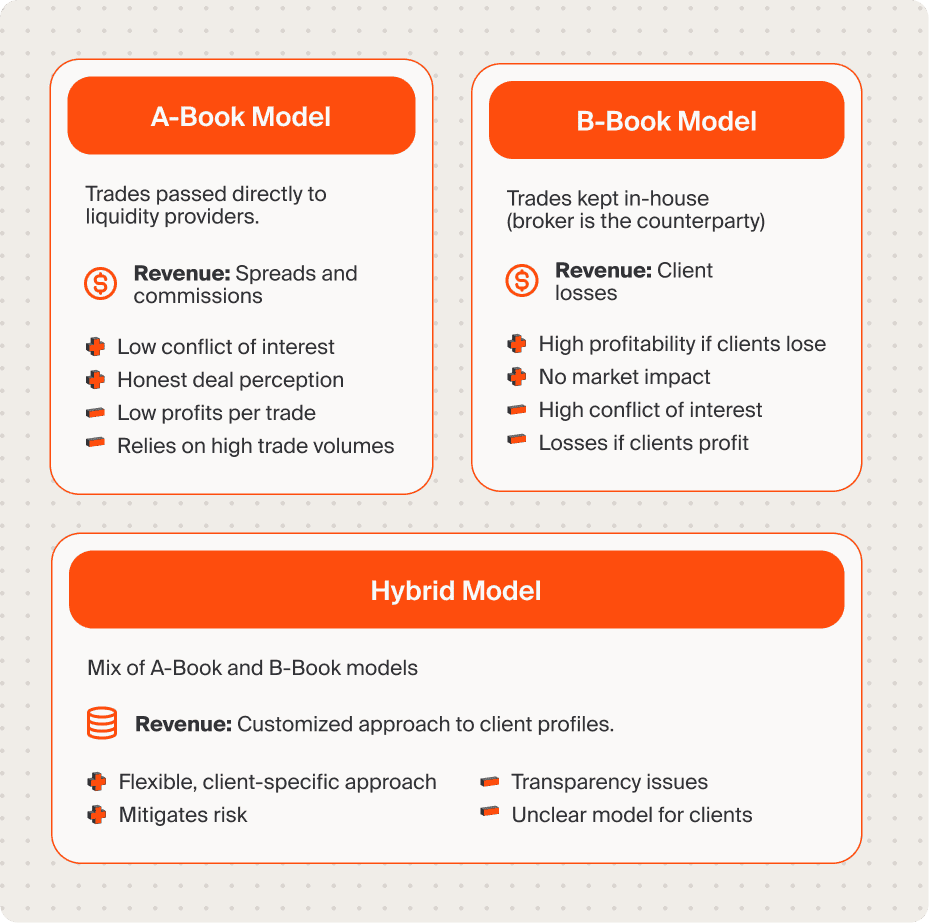

Among the recognized models brokerage companies use are A-Book B-Book and hybrid models. Understanding how these models affect your trading experience is crucial for picking the best broker. The goal of this guide would be to break down these models and how they generate profits.

Different Brokerage Models Explained

Brokerage companies have various ways of generating profits. The strategy they use is related to how they execute trades. The primary trade executing models they use are A-Book, B-Book, and Hybrid. Each model comes with different strategies for brokers’ profit-earning potential.

1. A-Book Brokerage Model

The A-Book model is referred to as Straight-Through Processing (STP). Brokers who follow this model act as intermediaries. They pass client trades directly to liquidity providers, without internally holding the trade.

How A-Book Brokers Make Money

- Spreads – A-Book brokers generate revenue mainly with spreads. Aside from that, they may also charge a small fee on the spread they get from liquidity providers.

- Commissions – Some A-Book brokers charge a commission per trade, especially in highly competitive markets like forex.

Advantages of the A-Book Model

A-Book brokers don’t profit from client results, so there’s less conflict between the broker and the client. Also, as A-Book brokers work on spread and volume, clients may feel they’re getting a more honest deal.

Drawbacks of the A-Book Model

The A-Book model is dependent on Trade Volume, so brokers make less on each trade and heavily rely on high trading volumes.

2. B-Book Brokerage Model

The B-Book model can be presented as a mediator. Companies operating under the B-Book model act as a counterparty for clients’ trades. Keeping them in-house, rather than sending them to external liquidity providers. If a client makes a profit, the brokerage incurs a loss. However, if the client loses, the brokerage makes money.

How B-Book Brokers Make Money

- Client Results – B-Book brokers earn, based on client results. So, if the client wins his trade, the broker loses money.

Advantages of the B-Book Model

B-Book Brokers can make significant profits if clients consistently lose on their trades. By keeping trades in-house, those brokers don’t affect market pricing or liquidity.

Drawbacks of the B-Book Model

B-Book brokers benefit from client results, so there’s a potential conflict of interest. If clients get the broker’s advice or platform influences losses. If clients are consistently profitable, B-Book brokers can face significant losses.

3. Hybrid Brokerage Model

The third model, brokers use is Hybrid. This model is a mixture of the A-Book and B-Book models, from where its name comes. Hybrid brokerages have the flexibility to adjust their strategy. Adjusting can vary depending on the client’s profile, trading preferences, and risk level.

How Hybrid Brokers Make Money

- Customized Approach – Hybrid brokers can keep certain clients on the B-Book model. Typically those less experienced or low-volume traders. The more profitable accounts are transferred to the A-Book.

- Reduced Risk – By splitting clients based on their trading behavior, Hybrid brokers can maximize profits while limiting the risks of client profitability.

Advantages of the Hybrid Model

Hybrid brokers can adjust their approach based on individual client needs and profitability. By balancing A-Book and B-Book strategies, Hybrid brokers can mitigate losses and manage risk effectively.

Drawbacks of the Hybrid Model

The issue with the hybrid model brokers is that Clients may not always know which model they’re being placed in. This usually leads to concerns about fairness and transparency.

Key Revenue Streams for Brokerage Firms

Each brokerage firms use different strategy to generate revenue. These revenue models are invented to adjust the needs of different trading platforms and client profiles. You need to understand how those revenue models work to make the most out of your trading experience.

1. Commissions and Spreads

Commissions

The first and probably the most common way for brokers to generate income is by charging commissions. Types of brokerages and asset classes usually have different commission rates.

- Full-Service Brokers – Full-service brokers’ commissions are higher. They are often based on the trade size. But also on the overall value of managed assets.

- Discount Brokers – They charge lower commissions and have a focus on self-directed investors. They rely on high trade volumes.

Let’s use stock trading as an example. Commissions can either be a fixed fee or a percentage of the total value of the trade, showing a range of possibilities.

Spreads

The difference between the buy and sell price is called spread. Particularly in forex and CFD markets, the spread is a main source of revenue.

- Fixed Spreads – Some brokers set a constant spread. This ensures predictable client costs.

- Variable Spreads – Market conditions, liquidity, and volatility may influence the variable spreads. Brokers often widen spreads during periods of low liquidity to have risk protection.

Let’s take a common Forex broker as an example. If the broker quotes a EUR/USD pair at 1.0530/1.0535. The spread is 0.0005 (5 pips), generating a small revenue with each trade.

2. Account Fees

Account fees contain various charges that clients pay for maintaining an account or accessing additional services. These fees may include.

- Maintenance Fees – Regular charges for keeping an account open, particularly with full-service brokers.

- Inactivity Fees – Brokers may set penalties if clients don’t place trades for a specified period. This motivates trading activity while compensating the costs of inactive accounts.

- Premium Features – Some brokers charge extra for advanced tools, analytics, or premium account tiers.

Robo-Advisors and Lower Fees

Automated investing platforms, known as robo-advisors charge minimal fees. The usually range from 0.25% – 0.50% annually. This affordability makes them attractive to smaller investors while providing brokers with a steady income stream.

3. Interest on Cash Balances and Margin Accounts

You must know one thing about your uninvested cash, it is not idle for brokerages. Here’s what brokerages do with unused cash.

- Interest on Uninvested Cash – Brokerages have many ways to monetize uninvested cash. The most popular one is safe investing in unused balance.

- Margin Lending – When clients trade on margin, brokers charge interest on the borrowed amount. This can range from a few percentage points to double digits.

If a trader has $10,000 equity but applies for $20,000 more, the overall position would reach $30,000. The fees different brokerage charges for this loan may vary, but will usually stay around 7%. This comes to a steady annual revenue for the brokerage, which may not seem like a lot for the trade in the first place.

4. Payment for Order Flow (PFOF)

PFOF refers to brokers directing client trade orders to specific market makers or exchanges for compensation.

How It Works

Market makers execute trades and pay brokers a small fee for sending client orders their way. This model is particularly prevailing among zero-commission brokers.

Pros and Cons

PFOF allows brokers to offer commission-free trading. This happens to be very appealing to retail investors.

On the other hand, critics argue that PFOF prioritizes broker profits. In return, the best execution price for clients is left in the background. There are several regions, in which regulatory checks were performed regarding this issue.

5. Asset Management and Advisory Fees

For brokers offering wealth management or advisory services, fees are often based on the client’s assets under management (AUM).

Fee Structures

- Traditional Advisors – Charge between 1%–3% of AUM annually. Investment strategies, financial planning, and portfolio management are what these fees cover.

- Robo-Advisors – Robo-advisors charge quite less. The reason is they focus on automation. Their fees range between 0.25% to 0.50% of AUM.

The Long-Term Advantage

Advisory fees provide a predictable and recurring income stream for brokers. This is valid as AUM grows with client investments and market performance.

6. Proprietary Trading and Investment Products

Certain brokerage firms provide their own trading services or exclusive investment products. Some of them include mutual funds or ETFs.

- Proprietary Trading – Trade using own funds, profiting from market movements.

- In-House Products – By managing mutual funds or ETFs, brokerage companies collect management fees. They can potentially benefit from performance fees.

7. Data and Subscription Services

Brokers can also sell access to market data, analytics tools, or premium research reports. These additional offerings create another revenue stream while enhancing the user experience.

8. Trading Platform Fees

Some brokers charge clients to access advanced trading platforms or algorithmic trading tools. These fees can be either subscription-based or a one-time purchase.

As an example, a broker might offer a basic platform for free. However, it may charge $50/month for advanced charting features, real-time analytics, or even custom trading strategies.

9. Exchange Rebates and Membership Fees

Brokers executing high trading volumes may receive rebates from stock exchanges. Additionally, brokers charge membership fees for premium services like direct market access (DMA) or VIP accounts.

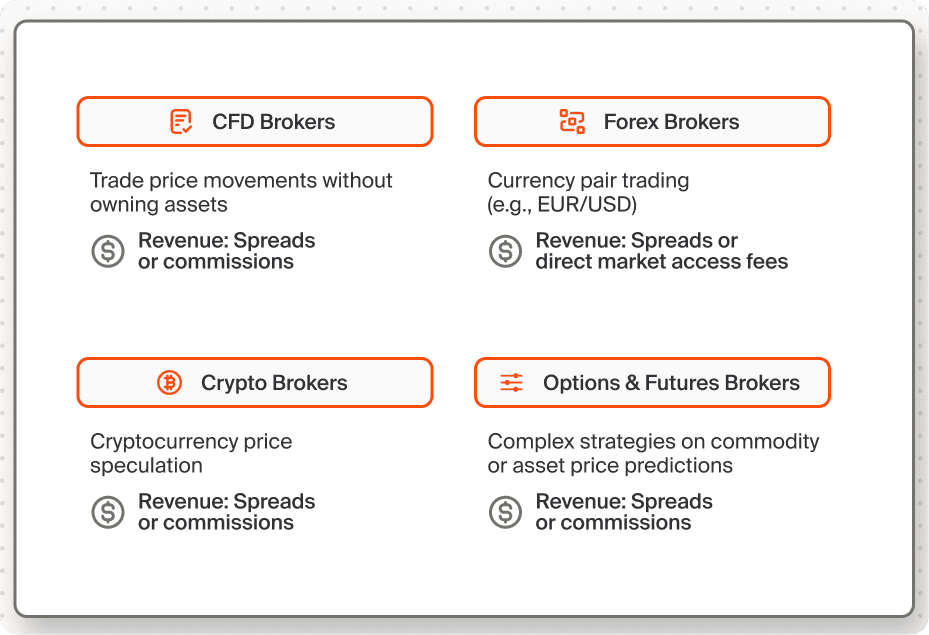

Types of Brokerage Firms by Asset Class

Brokerages also differ in terms of the types of assets they offer. Here’s a look at popular asset classes. They are the key to how brokerages that specialize in each generate revenue.

CFD Brokers

Contract for Difference (CFD) brokers allow clients to trade on price movements. This happens without owning the underlying asset itself. CFDs can cover forex, stocks, commodities, and indices.

- CFD Market Makers – These brokers often follow the B-Book model. They offer contracts for traders to speculate on asset price movements without owning the assets.

- Direct Market Access (DMA) CFD Brokers – DMA brokers follow the A-Book model. They earn revenue from commissions and offer tighter spreads. This can help to avoid the potential conflicts of interest seen in the B-Book model.

Crypto Brokers

The recent boom in cryptocurrency trading has provoked plenty of new crypto brokers to appear. Understanding how they function before starting trading is essential.

- Crypto Exchanges – Crypto exchanges are simply about the purchasing, selling, and or the holding of. Their major revenue is from commissions or spreads.

- Crypto CFD Brokers – Even these brokers are conceptually similar to any conventional CFD broker who offers a price change on the trade of cryptocurrency, they allow clients to trade cryptocurrency price fluctuations. Generally, these companies also offer leveraged trading options while placing their bets on spreads or trade fees.

Binary Brokers

Binary brokerages have a simple way of operating. They allow clients to predict the direction of an asset price. Clients bet on whether the price of an asset will go up or down.

- Binary Options Providers – Binary Options providers are considered very risky and even restricted in some regions. That’s because they are structured as win-or-lose wagers. So, the main income stream for these brokers is from clients’ negative results.

Forex Brokers

Forex brokers specialize in currency pairs. They allow their clients to trade one currency for another. There are different types of Forex brokers, each following a different income strategy.

- Direct Market Access (DMA) Forex Brokers – DMA brokerage companies follow the A-Book model. This setup allows users to trade in the open market. In this scenario, on each trade, a commission is charged.

- Market Maker Forex Brokers – Using the B-Book model, these brokerages are usually avoided by traders.

- ECN (Electronic Communication Network) Forex Brokers – They create a marketplace for direct trading. They charge a small commission for each trade. They are also known to provide tighter spreads.

Options and Future Brokers

Options brokers play a key role in enabling their clients to trade options contracts. They can opt to buy or sell an asset at a price established in advance.

- Options Brokerages – These companies specialize in products like options and futures. They offer platforms tailored for complex trading strategies.

- Commodity and Futures Brokerages – They focus on commodities like oil and metals. These brokers usually earn their income from commissions.

Conclusion

Brokerage gives the freedom for its customers to trade various assets like crypto or stocks. The various types of traders and assets lead brokers to adopt distinct revenue models. A-Book, B-Book, and hybrid brokerages provide flexibility in how trades are handled. That impacts both investor experiences and broker revenue. With tech advancements, many brokers have adopted lower-fee models, even offering zero-commission trading. Instead of generating revenue from methods like payment for order flow and interest on margin accounts.

For traders, understanding a brokerage’s business model and asset specialization is essential. As an example, full-service brokers offer personalized financial advice. However, discount brokers rely on self-directed investors with lower fees. Meanwhile, CFD and forex brokerages provide high-leverage options, advantageous for experienced traders.

FAQ

297

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.