Brokerage Business

10 minutes read

Jun 25, 2025

What is a Multi-Asset Brokerage? Your Complete Guide to Launching One

A multi-asset brokerage is a trading firm or platform that offers access to multiple asset classes, such as forex, stocks, commodities, indices, cryptocurrencies, and ETFs, through a single account. Clients can trade various markets without switching platforms or opening multiple accounts.

This model gives traders more flexibility. It gives brokers a competitive edge. By offering a broader range of instruments, brokers increase trading volume, improve retention, and appeal to a wider audience, from short-term forex scalpers to long-term equity investors.

In this guide, you’ll learn how multi-asset brokerages work and why demand for them is growing. We’ll also see what it takes to launch one successfully, with CFD infrastructure, technology providers, liquidity access, and compliance frameworks built in from day one.

Why Multi-Asset Brokerages Are in Demand in 2025

Traders no longer want limited access to a single market. In 2025, flexibility and diversification drive user expectations. A growing number of retail and professional traders are seeking platforms where they can trade forex, crypto, indices, and stocks in one place, without managing multiple accounts or disconnected portfolios.

There are three core reasons why multi-asset brokerages are outperforming niche players:

- Market Volatility: Asset rotation has become the norm. Traders follow volatility across markets, from oil spikes to crypto runs. Platforms that offer only one asset class miss this demand shift.

- User Retention: Offering more instruments keeps traders engaged longer. If a client can’t find the trade setup they want on one asset, they’ll look for it on another. Multi-asset platforms reduce churn.

- Global Appeal: International traders have different market preferences. While European clients may focus on DAX or FTSE CFDs, traders in Asia may prioritize USD/JPY or gold. A wide asset list increases geographic relevance.

Institutions, brokers, and white-label providers are quickly adapting by integrating asset classes into unified platforms, not just to expand coverage, but to meet user expectations head-on.

Core Components of a Multi-Asset Brokerage

Launching a multi-asset brokerage requires more than just adding extra instruments to a trading platform. It involves building infrastructure that can support a wide range of markets, execution models, compliance requirements, and user needs, all in one seamless experience.

Here are the key components every multi-asset brokerage must have:

1. Trading Platform with Multi-Market Support

Your platform must support CFDs on forex, stocks, crypto, commodities, indices, and more. MT5, cTrader, and custom platforms offer built-in multi-asset capabilities. The backend must handle different pricing feeds, asset-specific margin requirements, and trading hours.

2. Liquidity Aggregation

Each asset class comes with different liquidity providers. Multi-asset brokers must connect to multiple LPs, forex, crypto, equities, and derivatives, and aggregate them for smooth execution across instruments.

3. Asset Routing & Symbol Mapping

Instruments have different tick sizes, lot structures, and execution venues. A strong symbol management engine is required to route orders correctly and avoid data inconsistencies.

4. Risk & Margin Engine

Risk rules vary across asset classes. A multi-asset risk engine must support dynamic margin calculation, portfolio-level exposure limits, and real-time monitoring for diverse instruments.

5. Compliance Layer

Trading crypto requires different checks than trading equities. Your onboarding, KYC, and transaction monitoring tools must adapt to the compliance needs of each asset class.

6. Unified CRM & Back Office

All asset classes must be tracked, reported, and reconciled in a central system, including trade logs, account history, withdrawals, and commissions. A unified CRM makes this manageable.

These components ensure stability, scalability, and regulatory alignment while delivering a seamless experience to clients across global markets.

Technology Stack for a Multi-Asset Brokerage

The success of a multi-asset brokerage depends heavily on the reliability and flexibility of its technology stack. Unlike single-asset brokers, you need to deliver seamless trading across instruments that behave differently, settle differently, and attract different regulatory expectations. The system must be modular, scalable, and responsive to both market demands and backend complexity.

Here’s a breakdown of the core systems your infrastructure needs:

1. Multi-Asset Trading Platform

The trading platform is the face of your brokerage. It must support various order types, asset-specific trading hours, margin settings, and pricing models. MT5 is a leading choice due to its built-in multi-asset support and large ecosystem. cTrader is strong for forex and CFD brokers focused on transparency and user experience. For brokers targeting flexibility and brand control, a custom-built platform with modular asset support is viable, but requires more capital and ongoing development.

2. Liquidity Bridge and Aggregator

Each asset class requires separate liquidity connections. A reliable liquidity bridge aggregates feeds from different LPs and routes orders based on execution logic like best price, depth, or volume. Top solutions support dynamic markups, A-book/B-book routing, and integration with MT5 or cTrader via APIs. Examples include PrimeXM, oneZero, and FXCubic.

3. Risk Management Engine

Your risk engine must monitor exposure across asset classes in real time. It calculates dynamic margin, flags toxic flow, and protects against price manipulation or excessive leverage. Multi-asset brokers require support for cross-margining, correlated instruments, and portfolio-level limits. Without this, one volatile market can expose the entire book.

4. CRM and Back Office

The CRM must do more than store client data. It needs to track trades, manage KYC documents, calculate partner commissions, and handle deposits across asset-specific wallets. Back-office teams must reconcile positions, fees, and balance sheets from forex, crypto, and equities in one unified interface.

5. Real-Time Market Data Feeds

Accurate and fast data feeds are essential for price transparency and order execution. Forex and crypto use real-time tick data. Equities may require regulated feeds depending on your region. Choose a data provider that can supply all needed asset classes without latency issues or symbol mismatches.

6. Front-End Interfaces

Modern users trade on the go. A web-based terminal and native mobile apps must support all offered instruments. Features like one-click trading, custom watchlists, asset filtering, and multi-language UI increase retention and satisfaction.

A stable and well-integrated tech stack not only powers your brokerage but also protects it. Downtime, slippage, or mismatched data across assets damages trust. With the right infrastructure, brokers can launch confidently, scale efficiently, and deliver a professional-grade experience across every asset they offer.

Best Providers for Launching a Multi-Asset Brokerage in 2025

Choosing the right provider is one of the most important decisions when launching a multi-asset brokerage. Whether you go with a white-label solution or build your own infrastructure, the partner you choose must support multiple asset classes, offer deep liquidity connections, and deliver fast execution with a flexible compliance framework.

Below are some of the most reliable and scalable turnkey providers in 2025:

1. FintechFuel

FintechFuel specializes in multi-asset brokerage infrastructure, offering custom platform integration, deep liquidity across all major asset classes, CRM, back office, and licensing support. It’s designed for brokers who want to scale fast without giving up control. Suitable for startups and established firms.

2. Quadcode

Quadcode delivers an all-in-one platform tailored for multi-asset trading. It includes a customizable front end, built-in risk management and CRM. It also supports various asset classes, including forex, stocks, cryptocurrencies and commodities. The platform powers several major global brokers and offers a strong balance of performance and branding flexibility.

3. Leverate

Leverate offers a comprehensive brokerage package that includes CRM, risk tools, marketing automation, and platform integration. While more focused on forex, it supports multiple CFD asset classes and works well for brokers seeking a plug-and-play model.

4. Tools for Brokers (TFB)

TFB focuses on modular technology for MT4/MT5 brokers. Their liquidity bridge and risk management suite work well for firms that want to connect to multiple LPs and build custom execution strategies across assets.

5. Brokeree Solutions

Known for plugin development and infrastructure tools, Brokeree allows brokers to expand multi-asset functionality on MT5. Their Social Trading and PAMM modules are well-suited for firms targeting managed accounts or investment communities.

When choosing a provider, evaluate the following:

- Which asset classes are supported natively?

- Can the platform be scaled or customized?

- How strong is the liquidity network?

- Is the system built for multi-jurisdiction compliance?

Launching a multi-asset brokerage isn’t just about listing more instruments. It’s about choosing a provider that delivers depth, stability, and the technology stack needed to scale securely.

Monetization and Revenue Models for Multi-Asset Brokers

Multi-asset brokers generate revenue through several streams, each tied to how trades are executed, how the platform is structured, and what types of traders are being served. Offering multiple asset classes increases both trading activity and monetization potential, but only when the business model supports it.

Below are the most common revenue drivers in a multi-asset brokerage:

- Spread Markups – Most brokers operate with dynamic or fixed spreads added to the base price from liquidity providers. Multi-asset setups allow different markup strategies by asset class. For example, tighter spreads on forex and wider spreads on less liquid crypto or stock CFDs.

- Commission per Trade – Some brokers apply a commission per lot or per notional value traded. This model is often used for indices, commodities, and equities. It works well for active traders and high-volume clients.

- Overnight Swap Fees – Also known as rollover or financing fees, these apply to leveraged positions held overnight. Multi-asset brokers often earn additional margin here, especially in volatile markets like commodities or exotic forex pairs.

- Crypto Conversion Fees – When offering crypto deposits or wallets, brokers can charge conversion or withdrawal fees. These can be flat-rate or percentage-based, depending on the platform design.

- White Label Services -Brokers with strong infrastructure may monetize their platform by offering white-label solutions to smaller firms. This turns operational systems into a B2B product.

- Copy Trading and Account Management – Through modules like PAMM, MAM, or copy trading platforms, brokers can charge management fees, performance fees, or volume-based commissions on managed accounts.

- Payment Gateway Fees – Integrated payment solutions often include markup on deposits and withdrawals, especially for regions or methods with higher processing costs.

The more asset classes you offer, the more pricing flexibility you gain. A strong monetization strategy aligns each asset with a specific pricing model, balancing trader satisfaction with long-term profitability.

Challenges and Mistakes to Avoid When Launching a Multi-Asset Brokerage

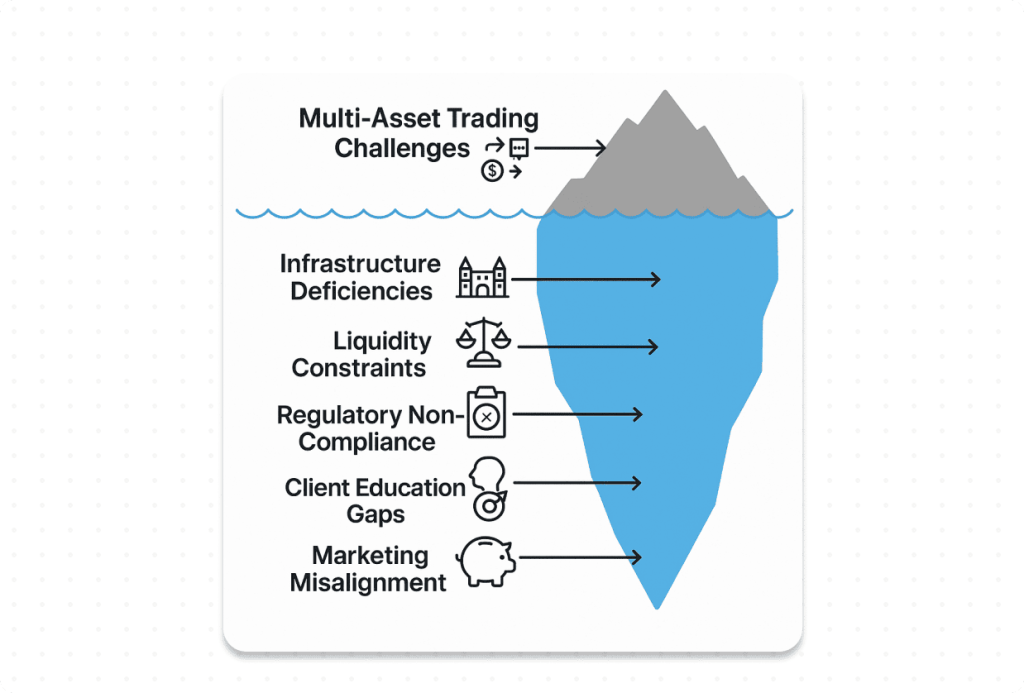

Launching a multi-asset brokerage opens the door to growth, but it also adds operational complexity. Many brokers underestimate the demands of offering multiple markets and end up facing issues with execution, compliance, and retention. Avoiding common pitfalls early can prevent major financial and reputational setbacks later.

Here are the most critical challenges and how to avoid them:

- Underestimating Infrastructure Needs – Running a forex-only brokerage is not the same as handling crypto, stocks, and commodities together. Each asset has different execution, settlement, and pricing requirements. Using a platform or tech provider that can’t support all assets natively leads to execution delays and client complaints.

- Insufficient Liquidity Depth – Some brokers list 200 instruments but provide weak liquidity on half of them. This results in high slippage, re-quotes, and poor fill rates. Only offer what you can support with reliable LPs and stable spreads.

- Poor Risk Management Setup – Offering multiple asset classes without a unified risk engine is a common mistake. Margin mismatches, over-leveraged clients, or asset-specific volatility can expose the entire book if not managed properly.

- Regulatory Blind Spots – Offering crypto in a jurisdiction that restricts it, or marketing equity CFDs to unqualified retail clients, can trigger fines or license issues. Always map your asset offering to your license scope and marketing region.

- Weak Client Education – Traders coming from forex may not understand how stocks or ETFs behave. Without proper onboarding, education tools, or trade examples, clients are more likely to make poor decisions and churn early.

- One-Size-Fits-All Marketing – Multi-asset trading attracts diverse audiences, retail forex traders, crypto speculators, and equity swing traders have different needs. Segmenting your offer and marketing funnel by asset class improves conversion and retention.

Solving these issues requires a combination of the right technology, compliance structure, and client strategy. Multi-asset success isn’t about listing more instruments, it’s about delivering a consistent, high-quality experience across all of them.

Conclusion and Action Steps

A multi-asset brokerage is no longer a niche concept. It’s the new standard for trading platforms that want to compete globally and retain serious clients. Traders expect access to multiple markets from one account: forex, crypto, stocks, indices, and commodities. They expect seamless execution, fast onboarding, and real-time support across all of them.

To launch a multi-asset brokerage in 2025, you need more than just licenses and a trading platform. You need a scalable tech stack, reliable liquidity, asset-specific compliance workflows, and a monetization strategy that works across instruments. The brokers that succeed are the ones that invest early in infrastructure and align their operations with trader expectations.

Action Steps to Launch:

- Choose a platform that supports all key asset classes natively.

- Partner with a provider that offers integrated CRM, liquidity, and risk tools.

- Ensure your license and compliance setup match your asset coverage.

- Prioritize execution quality and user experience across every instrument.

- Start with a focused offer, then expand based on demand and performance.

With the right setup, launching a multi-asset brokerage is not only possible, it’s a strategic move toward long-term growth, client diversification, and global relevance.

FAQ

203

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.