Brokerage Business

10 minutes read

Aug 21, 2024

How Much Does White Label Brokerage Cost?

Running a company from scratch usually starts at the price of $100,000. The upper limit disappears beyond the horizon. Top-notch brokerage solutions may cost $500,000 or more. As for White Label solutions, prices vary from $25,000 to $50,000 when talking about basic features.

Let’s dive deeper into the process of running a White Label brokerage business to understand which features are must-have ones for beginners.

Setup Cost of a White Label Brokerage Solution

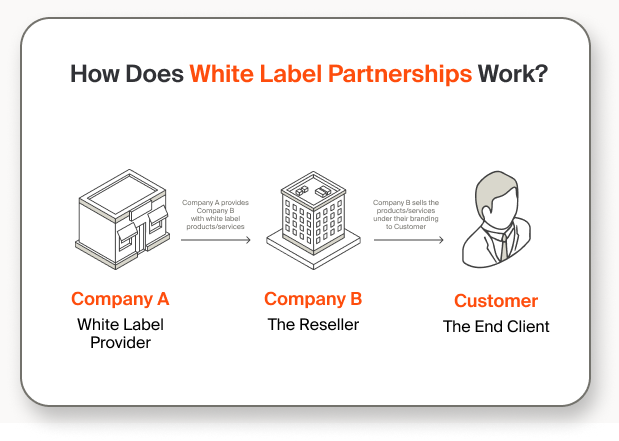

What does a White Label model mean? Business owners get a ready-made solution that helps them enter the niche quickly. What is the setup cost that unlocks access to a trading platform and some extra features?

An average provider of White Label solutions evaluates the setup process at $5,000 – $40,000; meanwhile, you need to understand that such a price only includes access to a trading platform. In most cases extra features require extra costs.

When talking about the setup process, business owners get the following:

- Customization of a trading platform tailored to your brand and to the needs of your target audience;

- Connection of a platform via API so that you could easily access and manage your customized trading platform.

- Setup of the system by a team of qualified experts.

Compliance with Mobile Devices

The setup cost means a business owner gets a traderoom compatible with all the web browsers; meanwhile, it is not enough for up-to-date traders. The number of on-the-go users grows rapidly and mobile applications are more a must-have feature than a competitive advantage. Running your brokerage company without mobile apps means you are going to lose the vast majority of your target audience.

Providers of WL brokerage solutions are ready to launch mobile applications with monthly fees. For instance, you pay $250 per month for an Android-powered application and $500 for an app compatible with iOS.

There is another price model. Business owners may choose a premium bundle and pay a fixed price (about $7,500 for both versions).

Monthly Fees

Qualified experts have completed all the required setup works and mobile applications are available on the official stores. Is everything over? Absolutely not. Since then the most “interesting” part commences. WL providers require monthly fees that vary from $4,000 to $6,500. Why should a business owner pay monthly fees?

Don’t forget that a trading platform is software that requires constant qualified maintenance in order to provide traders with the industry-best solutions. No matter how advanced, functional, and qualified software is, malware may happen. Providers of WL solutions ensure their clients that all the malfunctions and technical problems will be fixed within the shortest terms.

Furthermore, providers are responsible for updates so that a trading platform stays functional and keeps up with the times.

The above-mentioned prices build a skeleton of a White Label brokerage business but do not cover other must-have features. What are they?

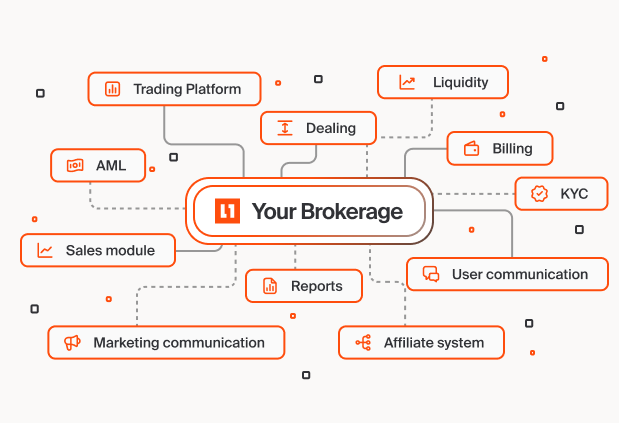

Extra Features WL Brokers Need to Implement

High-End CRM System for Brokerage Business

CRM is a software that enables brokerage companies to manage their businesses in general and relations between a company and its clients in particular. CRMs play an exceptionally important role for a broker because such a system helps organize work with different categories of clients and ensure effective services.

Brokerage companies use CRMs to access the required information related to their clients: order history, trading statistics, current portfolios, preferred assets, and more. Through this information brokers may find the best solutions that meet the clients’ needs.

A high-end CRM system performs the following important roles:

- to enhance the interaction quality with clients;

- to increase the conversion rate;

- to track the client interaction history;

- to organize marketing campaigns.

An average provider requires from $2,000 per month to unlock access to a high-level CRM system that is ready to meet all the needs of business owners.

Leading Multi-Asset Liquidity

Why is liquidity understood as the core factors for brokerage companies? The higher liquidity is, the more chances appear that a trader’s order will be executed instantly at a market price. When a trader faces low liquidity, he needs to set prices that are either higher or lower than market ones. As a result, traders suffer losses. For some trading strategies low liquidity is death-like; therefore, clients will definitely choose another brokerage company that is able to execute their requests instantly.

The cost of the liquidity setup is about $3,000 when talking about industry-leading multi-asset solutions. Providing high liquidity for just one asset category is not a good idea.

Powerful Dealing Desk

Traders do not access financial markets directly and brokerage companies cannot unlock such access on their own. They apply to dealers who are responsible for facilitating trades on behalf of a broker’s clients.

What should a powerful dealing desk include?

- Wide range of available trading instruments. Traders prefer to access Forex, metals, stocks, ETFs, indices, cryptocurrencies, and other asset categories. Top-notch dealing desks gear numerous categories together.

- Diverse order execution models (A-Book, B-Book, and hybrid types).

- Fast processing of traders’ orders and the best possible trading conditions.

- Minimum spreads and commissions.

- Solutions that detect and prevent fraudulent cases.

The cost of a powerful dealing desk is about $16,000 per month.

KYC Verification: Whim or a Requirement of a Financial Regulator?

KYC (Know Your Customer) is a set of measures that traders are obliged to undergo to verify their identity. Brokers introduce KYC for several reasons:

- First and foremost, the KYC procedures are among the requirements of financial regulators. If a broker wants its activity to be compliant with legal requirements, KYC is a must-have.

- Thousands of traders create accounts on a trading platform, and the KYC verification helps brokerage companies understand whether clients meet the “entrance requirements” or not. Such a procedure serves as a security measure that protects users from fraudsters.

Brokerage companies themselves do not handle KYC procedures. They need the assistance of KYC providers who check documents and give their verdicts. The average cost of one KYC check is $2. The price includes the verification of ID, address, and liveness of a trader.

Billing: How to Select a Trustworty Payment Service Provider?

Brokerage businesses deal with giant money flows; which is why traders need to be sure their funds are protected on all levels. Business owners connect payment gateways to provide their clients with fast and secure transaction processing channels. The White Label solution means that a broker gets access to tens of PSPs. Industry-leading solutions help brokerage businesses to connect more than a hundred payment channels to provide their clients with multiple choices. The cost of the PSP integration starts at $1,000.

Affiliate System as a Powerful Promotion Instrument

Some brokers underestimate the meaning of affiliate programs, and that is a huge mistake. Such an instrument becomes a powerful promotion mechanism that is able to attract thousands of active traders. The best providers of WL models offer affiliate modules that support different remuneration models: RevShare, CPA, and hybrid ones. High-class WL providers include the module into premium packages.

Customer Support: The Important Feature that Retains Your Target Audience

Qualitative and professional customer support is among the top-priorities for both beginners and professional traders. Users expect their problems to be solved within minutes. Furthermore, top-notch brokers offer multi-lingual customer support to meet the needs of every client.

WL providers require from $10,000 per month to provide your clients with high-level customer support.

The Best Providers Offer Package Solutions

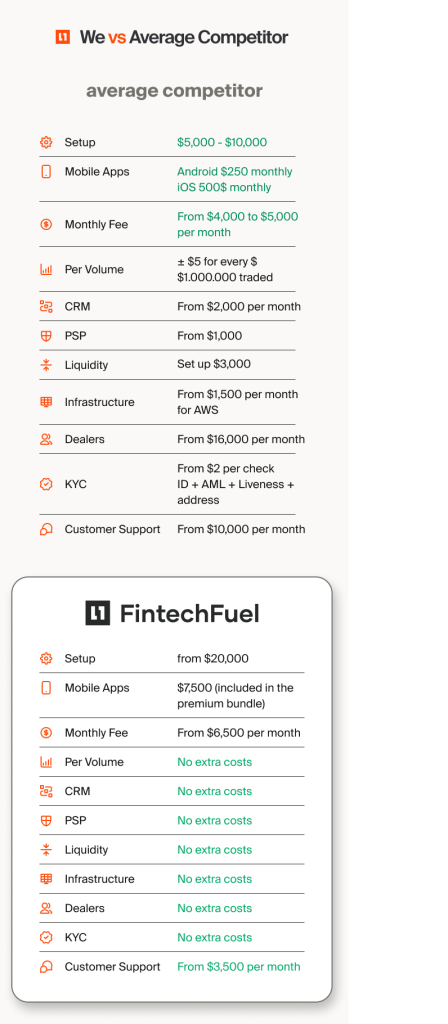

When looking for a White Label brokerage model, newcomer business owners frequently take into account the setup price and monthly fees. Many providers offer attractive prices that work as magnets for businesses who do not know the pitfalls. Then it turns out that you have to pay for every extra feature, and it is a big surprise for a business owner.

For instance, an average provider of White Label solutions that behaves this way, asks a business owner to pay some $5-10,000 for setup and from $4,000 to $5,000 monthly. Prices seem to be exceptionally attractive and beginner brokers take the bait. What do they face further? Monthly expenses rise to $25,000 or even more when talking about “the most coverage.”

Trustworthy providers offer package solutions. A business owner looks through every package to understand what he truly needs and pays for those features he is going to utilize.

White Label Packages Offered by FintechFuel

FintechFuel is among the market leaders offering the fullest scope of White Label brokerage services that combine reasonable prices and ultimate functionality. Business owners are suggested to decide among the three available packages: Light, Advanced, and Full. What do those packages include?

Light Package

The Light Package provides business owners with a high-end CRM system, back office, web traderoom, PWA, and dealing desk. The package’s price is $20,000. No extra expenses for additional features are required. Meanwhile, such a solution is possible for your legal entity only.

Advanced Package

Aside from the features included in the Light package, business owners get access to the KYC verification, antifraud measures, SMS, Emails, and integrated PSPs (170+ ones). When a brokerage company needs a new PSP, the price is $10,000 for each. The price of the Advanced package is $30,000. Furthermore, brokers can select the provider’s legal entity – such an option augments the package’s price to $35,000.

Full Package

Brokers get the fullest scope of features powered by FintechFuel. Together with the features included in the Light and Advanced packages the set offers mobile apps compatible with iOS and Android, sales module, UCC, and affiliate module. The overall price is $38,000 with your legal entity and $46,000 with the provider’s legal entity.

Monthly Fees

When talking about the monthly fees, those depend on a package you select. When your monthly PnL is lower than $100,000 the fee is $7,500 (Light), $8,500 (Advanced), or $10,000 (Full). For monthly PnL that exceeds $100,000 fees are standardized, no matter which package you select:

- PnL over $100,000 – 20%;

- PnL over $250,000 – 17%;

- PnL over $500,000 – 15%;

- PnL over $1,000,000 – 12%.

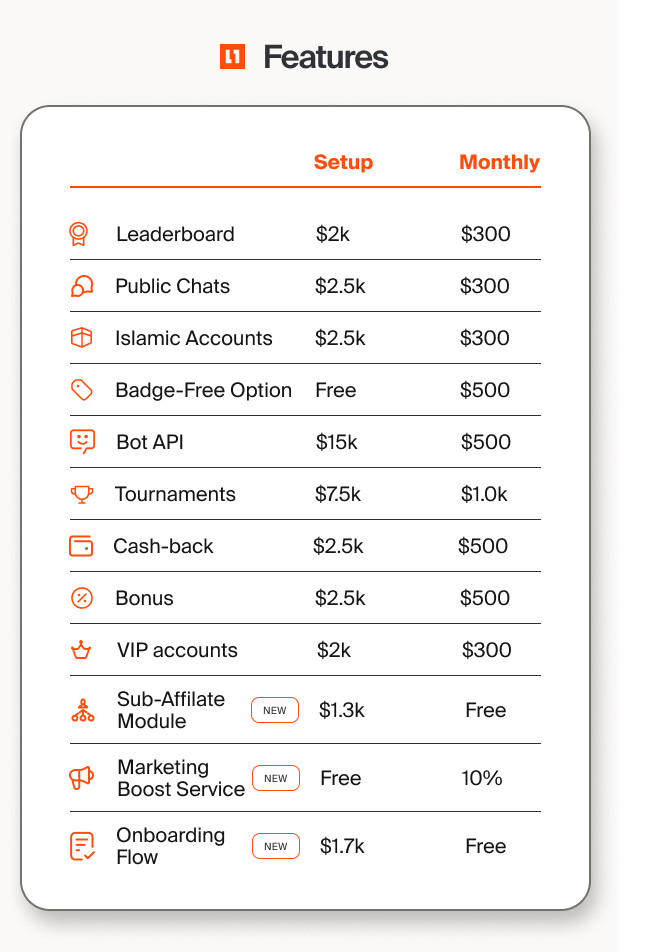

Extra Services

The mentioned packages comprise everything you need to launch your brokerage company. Meanwhile, FintechFuel offers a set of services that are able to highlight your business among the competitors. Here is the list of extra services and their prices:

- Leaderboard. The feature creates the inner competition and motivates your traders to make more deals. The setup cost is $2,000, and the monthly fee is $300.

- Islamic accounts. Such a type is exceptionally important for Muslim countries and allows a business owner to spread his services to a wider audience. The setup cost is $2,200. Brokers pay monthly fees of $350.

- Tournaments. Top-notch brokerage companies offer their clients to participate in different tournaments. On the one hand, a broker enhances its functionality, and on the other hand, a company gets an additional revenue source and increases engagement of its users. Business owners pay $7,500 for setup and $1,000 per month.

- VIP accounts. Distinguish your premium users from the rest of your audience. The setup costs $2,000 and the monthly fee is $300.

- Marketing Boost Service. Brokerage companies enter an exceptionally competitive niche and they need to implement advanced marketing mechanisms to win their places under the sun. The setup is free while the monthly fee is 10%.

Furthermore, business owners may get public charts, badge-free option, bot API, cash-back, and bonus features to make a company one of the most noticeable in the niche.

Bottom Line

When comparing the prices offered by White Label providers, business owners frequently ignore the pitfalls and take into account the setup price and monthly fees only.

FintechFuel unlocks access to Standard, Advanced, and Full packages that cost from $20,000 to $30,000. Monthly fees vary from $7,500 to $10,000. An average provider requires $5,000 – $10,000 for setup and from $4,000 to $5,000 per month. It seems that FintechFuel is losing out to competitors, but wait…

An average provider of White Label solutions doesn’t include extra services in such a price list. It turns out that you need to pay extra $5,000 or even more for setup and up to $30,000 per month for services that are already included in FintechFuel packages.

Don’t let yourself be twisted around a provider’s finger. FintechFuel offers fair prices and no hidden fees – everything is clear from the very beginning. The provider believes that mutual trust is the ground for success.

FAQ

377

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.