Brokerage Business

8 minutes read

Jun 19, 2025

7 Best White Label Brokers for 2026: Your Complete Guide to Choosing the Ideal Partner

White label brokerage solutions equip you with everything you need to launch a professional trading business in the shortest time and with the highest effectiveness. From a thorough examination of circumstances on the market circumstances, we chose seven leading white-label providers that can offer strong technology, precise regulatory assistance, and genuine business partnership.

Whether a startup expanding into financial services or an existing business wanting to diversify its operations, these platforms can help you establish a successful brokerage business.

What Makes a Great White Label Broker?

The difference between excellent white label providers and poor ones is more than just trading software. The best solutions offer end-to-end business systems that improve your development from day one.

Technology Infrastructure Requirements

Your platform must be rock-steady stable, and have the lowest uptime performance. Its multi-asset trading capability must support principal markets like forex, stocks, commodities, and cryptocurrencies. The system must efficiently manage average trading volumes and offer web-based and mobile applications.

Real-time market data feeds remain a requirement of client satisfaction. Traders expect instant price updates and seamless order execution. Minor delays can damage your reputation and drive customers to your competition.

Regulatory Compliance Factors

Regulatory coverage determines the extent of your business and legal standing. Successful white label brokers are licensed in a number of jurisdictions, including major financial regulators like CySEC, FCA, and ASIC. They handle compliance reporting, anti-money laundering processes, and know-your-customer processes without lifting a finger.

Without proper regulatory backing, you’re essentially running an illegal operation. Don’t compromise on this aspect, regardless of cost savings offered elsewhere.

The 7 Best White Label Brokers

FintechFuel

FintechFuel takes the lead with its integrated approach to white label solutions. The platform facilitates brokerage launches within 2 weeks, and its turnkey solution covers over 90% of the operational tasks.

Why FintechFuel Takes First Place

The technology platform offers coverage for approximately 300 financial products on major asset classes, providing adequate coverage for most brokerage businesses. With 200 experienced professionals and ten years of sector background, FintechFuel brings substantial expertise to each partnership.

Their regulatory framework accommodates numerous jurisdictions, allowing you to service clients in different markets from day one. The licensing support eliminates months of individual approval processes, which several others require.

Technology Platform Features

FintechFuel’s web-based platform offers advanced charting capabilities and technical analysis functionality to satisfy experienced traders. The desktop experience is maintained in the mobile application without sacrificing performance or user experience.

Risk management comprises real-time position monitoring, automated margin alerts, and trader-configurable trading limits. Client-configurable settings and portfolio exposure monitoring are applied to all accounts in real time.

Pricing and Support Quality

Fintechfuel offers flexible and competitive pricing depending on features and customization requirements. Moreover, the company ensures smooth operation through dedicated account management, technical support services, and comprehensive training programs for your team.

Quadcode Brokerage Solutions

Quadcode is recognized for its focus on technological advancement and evolving customization solutions. It offers straightforward and cost-effective solutions for opening brokerage companies and is exceptionally proficient in the retail forex and CFD markets.

Platform Capabilities

Quadcode’s white-label SaaS brokerage platform is explicitly designed for the retail CFD and Forex market. It supports high trading volumes and regular execution rates that meet professional-level trading requirements.

Their white label solution includes end-to-end back-office capability, regulatory reporting on autopilot, and built-in payment processing. The platform supports numerous payment methods, including existing ones like cryptocurrencies and e-wallets.

Market Coverage and Integration

Through long-established bank relationships and electronic communication networks, you enjoy deep sources of liquidity. Due to their advanced aggregation technology, spreads are maintained competitively even under conditions of high volatility.

The platform is highly customizable and offers advanced trading features, providing a solid foundation for growth while emphasizing user engagement and retention.

Considerations

While Quadcode excels in technology and user experience, its response times to customers vary during busy trading hours. Nonetheless, its business development support and platform stability generally compensate for minor service delays.

B2Broker

B2Broker provides institutional-grade solutions to the white label market through its B2TRADER and cTrader platforms. Their focus on high-quality liquidity and professional-level trading tools appeals to brokerages selling to professional traders.

Platform Strengths

B2TRADER offers sophisticated order management tools and institutional-quality execution. Integration with various liquidity providers ensures competitive prices under varying market conditions.

Their feature-rich CRM and PAMM (Percentage Allocation Management Module) applications provide sophisticated account management features for complex brokerage operations.

Setup and Implementation

B2Broker’s implementation time is typically days to weeks, depending on the degree of customization required. Their technical support provides enormous integration support for complex operational requirements.

Leverate

Leverate’s Sirix platform has strong multi-asset trading capabilities and integrated social trading capabilities. Its white label product is especially attractive to brokerages serving retail traders who demand diversification in investment options.

Sirix Platform Features

The platform has forex, stock, commodity, and cryptocurrency trading all on one platform. Clients can build diversified portfolios without switching between multiple platforms or accounts.

Social trading functionality lets you replicate successful traders and then automatically replicate their strategy. It significantly increases client activity while reducing the average churn rate.

Options for Customization

Leverate provides complete branding customization, including custom domains, colors, and feature sets. You can create a unique trading environment that accurately reflects your brand identity.

Their mobile-first development approach optimizes performance across all devices, from the screen on a smartphone to the screen on a desktop, without sacrificing any functionality.

Potential Drawbacks

Leverate’s pricing structure can become expensive as your client base grows. Their revenue-sharing model works well for new brokerages but may cut into profits once you achieve significant scale.

MetaQuotes Software

MetaQuotes created the MetaTrader platforms behind millions of trading accounts worldwide. Their white label offering employs this proven base with additional institutional capabilities.

MT4/MT5 Platform Advantages

Traders are already accustomed to the majority of MetaTrader interfaces, which reduces training requirements and support requests. Stability derives from significant real-world testing in mixed market conditions.

Private indicators and professional advisors work well without modification. MetaQuotes provides complete documentation and developer support for technical customization without sacrificing fundamental platform stability.

Global Acceptance

Over 1,000 brokerages worldwide use MetaQuotes’ solutions, with continuous platform improvement and regular security updates that are rolled out automatically without business interruption.

The Reality Check

The MetaTrader platform may seem old-fashioned when compared to modern counterparts designed for mobile-first users. Even if highly functional, it may not satisfy young traders who require a new-generation trading experience.

Soft-FX

The Soft-FX TickTrader platform supports multi-asset trading and has advanced liquidity management features. The white label version includes complete KYC/AML compliance features and sophisticated analytics tools.

TickTrader Platform Features

The system provides broad asset coverage with built-in liquidity connectors, improving the quality of execution. Advanced analytics tools provide full trading patterns and business performance insights.

Their turnkey solution caters to most clients’ operational needs, allowing you to focus on business development and customer acquisition rather than technical administration.

Implementation Schedule

Soft-FX generally completes implementations within weeks, including mandatory compliance configuration and staff training programs.

X Open Hub

X Open Hub completes our lineup with budget-friendly options offering MT4, MT5, and FIX API connectivity. Their regulated method is a draw for budget-minded brokerages that value solid basic features.

Platform Options

X Open Hub offers several types of platforms, allowing for varying client tastes. Their white label offering provides the key back-office solutions along with payment processing integration.

API connectivity options allow connection to multiple third-party services and custom apps as your business expands.

Value Proposition

Their competitive pricing structure keeps professional trading platforms affordable for small operators while maintaining significant regulatory compliance features.

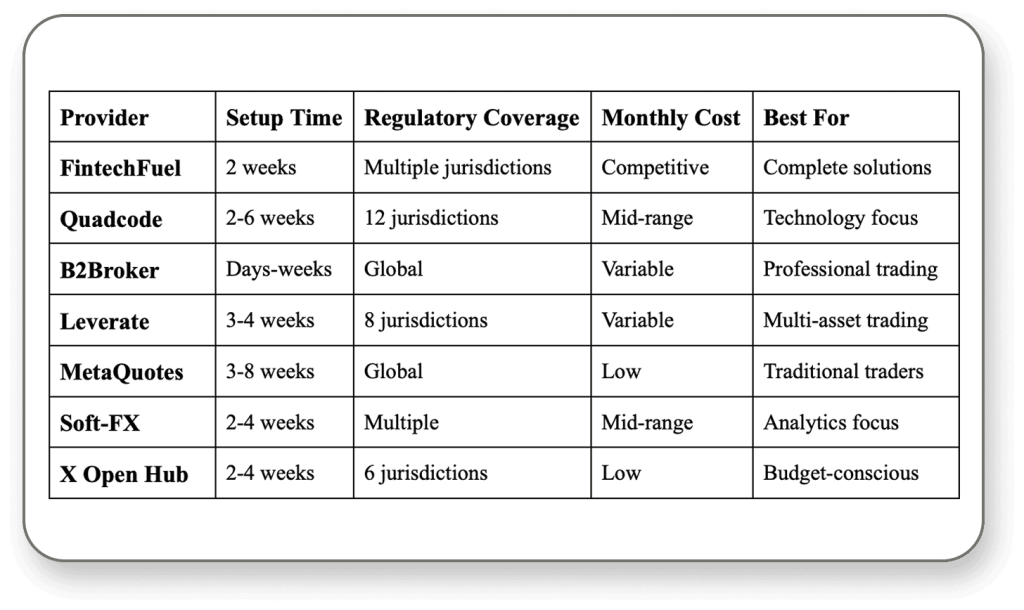

Head-to-Head Comparison Analysis

Avoid providers with unrealistically low opening quotes. Hidden fees generally emerge as transaction fees, data feed fees, and premium support mechanisms. Always request complete price disclosures that include estimated expenses at various client volumes.

For more info, check our post on “How Much Does White Label Brokerage Cost?”

FintechFuel and Quadcode maintain relatively transparent pricing schemes with comprehensive packages, minimizing surprise charges during the growth phase.

How to Choose the Right White Label Broker

Your selection process should start with an honest appraisal of your business objectives, target market, and technical capabilities. Different providers are appropriate for various circumstances.

Assessment Framework

First, firmly pinpoint your target market. Retail traders have platform requirements that are different from those of institutional clients. Geographic concentration determines the regulatory needs and available marketing channels.

Estimate your three-year total cost of ownership, not one-time setup fees. Include licensing fees, transaction fees, support fees, and upgrade fees in your estimate.

Due Diligence Checklist

- Get references from current white label partners

- Test platform performance during high-volatility market periods

- Verify all regulatory claims through third-party research

- Review contract terms for exit terms and data rights

- Determine integration requirements with your existing business systems

Implementation Considerations

Budget 20-30% above quoted figures for unforeseen expenditures. Platform customization, further integrations, and longer support services are usually required in the launch phases.

Regardless of providers’ promises, plan for a 3- 6 month overall roll-out time. Substantial time and expenditures are required for regulatory clearances, staff training, marketing preparation, and technical configuration.

Conclusion

Your white label broker selection will have a critical effect on your brokerage’s future for years to come. Though FintechFuel tops our list with end-to-end solutions and well-established reliability, Quadcode’s technological advancement or MetaQuotes’ tried-and-true platform stability may better suit your particular needs.

The key is to evaluate your target market, technical capability, and growth strategy prior to making this critical business decision. Remember that the lowest-price solution never provides the most significant long-term value. Seek providers with scalable solutions, transparent pricing, and genuine partnership support.

Your white label broker is an extension of your business processes. Therefore, choose a partner who demonstrates a commitment to client success and operational excellence.

FAQ

571

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.