Brokerage Business

20 minutes read

Nov 1, 2024

How to Start Forex Brokerage Business (2024-2025)?

Starting a forex brokerage is no easy feat and involves dealing with difficult legal processes, investing in innovative technology, and building client confidence. Covering basic processes and issues to guarantee a competitive and compliant business in the changing financial environment of today, this guide offers a thorough road map to assist you properly begin your own Forex brokerage.

Steps to Start a Forex Brokerage Business:

- Build a Corporate Structure and Legal Entity.

- Obtain Regulatory Licenses

- Select Your Brokerage Operational Model

- Set Up a Trading Platform

- Implement Risk Management Systems

- Develop a Client Acquisition Strategy

- Establish Customer Support Infrastructure

- Ensure Compliance and Reporting Mechanisms

- Launch Marketing and Branding Initiatives

- Monitor and Adapt to Market Changes

For a complete understanding of how to start a successful Forex brokerage, let’s look at each component immediately.

1. Build a Corporate Structure and Legal Entity

Opening a Forex brokerage starts with establishing a legal company and specifying your business structure. This means selecting a suitable country for registration, which might significantly impact your operational freedom, legal obligations, and tax liabilities. Common jurisdictions include offshore sites as the British Virgin Islands, Seychelles, or Mauritius as well as highly-regulated markets like the United Kingdom and Cyprus.

Consider the regulatory environment of each jurisdiction. Highly regulated markets offer credibility but come with stringent compliance requirements and higher operational costs. Although offshore countries could have less expenses and easier set-up procedures, their seeming loose rules might make it difficult for businesses to foster customer confidence.

To choose the optimal business structure—sole proprietorship, partnership, limited liability company (LLC), or corporation—consult legal specialists with financial services experience. Your brokerage’s governance, taxes, and liability exposure change with this decision. Make sure all of the legal material—including company bylaws, shareholder agreements, and articles of incorporation—is meticulously crafted. Avoiding legal difficulties that can affect your company operations depends on following local laws and international standards.

2. Obtain Regulatory Licenses

Obtaining the required regulatory licenses is a crucial first step that will help your brokerage to be more credible to customers and partners and validate it. Regulatory standards vary greatly across countries, encompassing capital adequacy norms, compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) rules, and strict reporting and auditing practices.

Start by closely researching the license criteria of the jurisdiction you have selected. This might involve proving solid financial health with large capital reserves, establishing strong compliance systems in place, and hiring highly qualified people for important positions such as directors and compliance officers.

Contact the financial regulatory body in your country to begin the licensing procedure. Prepare thorough paperwork covering company strategies, risk management practices, AML/KYC policies, and specifics on your organizational structure. The application procedure could prove to be time-consuming and complicated, so take into account consulting legal and compliance experts with financial services license expertise.

Getting a credible license not only guarantees legal operation but also helps institutional partners, possible customers, and liquidity sources to have confidence in your business. It shows your respect for industry best practices, openness, and security.

3. Select Your Brokerage Operational Model

Choosing the right operational model is a critical step that will shape how your Forex brokerage operates and interacts with clients. The primary models in the industry are the A-Book, B-Book, and Hybrid models, each offering distinct advantages, risks, and operational considerations.

A-Book Model

In the A-Book model, also known as Straight Through Processing (STP) or No Dealing Desk (NDD), your brokerage acts purely as an intermediary. Client orders are passed directly to liquidity providers in the interbank market, and you earn revenue mainly through spreads or commissions without taking the opposite side of clients’ trades. This model is characterized by higher transparency and a reduced conflict of interest since the brokerage does not profit from client losses. Many times, clients find this method ethical and reliable. Because income is confined to spreads or commissions, which might be narrower than other models, the A-Book model may provide smaller profit margins, nevertheless. Additionally, execution quality heavily relies on the performance of your liquidity partners, making your brokerage dependent on their reliability and efficiency.

B-Book Model

The B-Book model involves your brokerage acting as the counterparty to client trades, internally matching orders without sending them to the external market. Essentially, the brokerage profits when clients lose and vice versa. This model offers the potential for higher profits, as you can capture full spreads and potential losses from clients, increasing your revenue. It also provides greater control over pricing and trade execution conditions. However, there is an inherent conflict of interest, as the brokerage benefits from client losses, which can impact trust and raise ethical concerns. Moreover, your brokerage assumes significant market risk, potentially leading to substantial losses if not properly managed. Regulatory scrutiny may also be stricter due to the potential for unfair practices associated with this model.

Hybrid Model

The Hybrid model combines elements of both A-Book and B-Book strategies. Often depending on transaction size, customer history, or profitability, your brokerage may route certain deals to the market and internally match others. This strategy seeks to maximize profit potential and control market exposure thus balancing risk and income. It provides operational flexibility so you may change between A-Book and B-Book operations depending on customer behavior and state of the market. However, implementing a Hybrid model requires sophisticated systems to segment clients and effectively manage different risk profiles, adding complexity to your operations. Transparency concerns may also arise, as clients might question how their trades are being handled, potentially affecting trust if not managed properly.

Making the Right Choice

Selecting the appropriate operational model depends on factors such as your risk tolerance, capital resources, target market, and regulatory environment. If you prefer minimal market risk and aim to build trust through transparency, the A-Book model might be more suitable. If you’re willing to assume greater risk for the possibility of higher profits, the B-Book or Hybrid models could be considered. Keep in mind that B-Book operations may necessitate higher capital reserves to cover potential client winnings, and regulators might require greater capital adequacy. Implementing a Hybrid model demands advanced technology for client segmentation and dynamic order routing, increasing operational complexity.

Ensure your chosen model aligns with the regulations in your jurisdiction, as some authorities have specific rules regarding order execution and client disclosure. It’s crucial to conduct thorough research and consider consulting with industry experts or legal advisors when deciding on your operational model. This choice will significantly impact your brokerage’s profitability, risk exposure, client relationships, and compliance obligations. Making an informed decision at this stage sets the foundation for your brokerage’s long-term success and sustainability.

4. Set Up a Trading Platform

Your brokerage interacts mostly with its clients via the trading platform. Choosing a strong, safe, and user-friendly platform will help to draw in and keep traders. Among the other systems now on the market are cTrader, Match-Trader, dxTrade, and the QuadCode Trading Platform in addition to MetaTrader 4 and MetaTrader 5. Among traders, these systems are well-known for their broad features, dependability, and general acceptance.

When selecting a platform, take technical indicators, complex charting tools, support of several asset classes, and algorithmic trading features into account. To satisfy the different tastes of your customer base, make sure the platform provides interoperability across many platforms, including desktop programs, web-based interfaces, and mobile apps for iOS and Android.

Brand distinction depends on customization. Include the branding components of your brokerage into the client portals and platform interface. To further improve efficiency and simplify processes, also include risk management tools, accounting systems, customer relationship management software, and risk management systems.

Make substantial investments to protect consumer information and transactions. Deploy secure socket layers, encryption techniques, and frequent security audits for protection against cyberattacks. Building customer confidence and loyalty depends on a consistent and safe business environment.

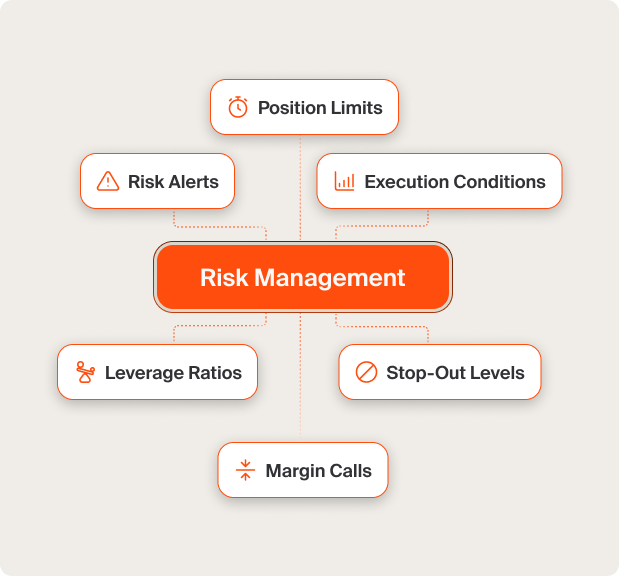

5. Implement Risk Management Systems

Profitability and sustainability of your brokerage depend on good risk control. Create thorough systems that track and manage operational risk, credit risk, market risk, and liquidity risk among others.

Implement real-time monitoring tools that track client exposures, leverage levels, and margin requirements. Automated risk management systems can dynamically adjust trading conditions, such as leverage ratios and margin calls, based on market volatility and individual client behavior.

Establish clear policies and procedures for handling exceptional market events, such as sudden price spikes or economic announcements that could lead to increased volatility. Define protocols for trade execution, order routing, and dealing with potential system failures.

Verify regulatory compliance with regard to risk management. Regular stress testing, keeping appropriate capital buffers, and open risk exposure reporting are just a few of the particular risk reducing policies that regulators may demand from your brokerage.

Equally vital are teaching your employees risk management techniques and encouraging a risk awareness culture within your company. By means of proactive risk management, your brokerage can earn credibility among customers and partners and protect itself from losses in the future.

6. Develop a Client Acquisition Strategy

The foundation of your brokerage’s success is undoubtedly customer attraction and retention. Create a thorough client acquisition plan including your target market segments—that of individual traders, institutional investors, or certain geographical areas.

Research the market to know your potential customers’ wants and preferences. Whether via competitive spreads, varied trading instruments, instructional materials, or creative trading tools, customize your products to fit their demands.

Employ digital methods of marketing to effectively reach your audience. Use content marketing to position your organization as a thought leader in the industry, and optimize your website for search engines (SEO) to get more visibility. Use social media to connect with prospective consumers and form a community.

To promote new sign-ups and customer retention, think about providing promotional incentives as welcome bonuses, referral programs, or loyalty benefits. Additionally appealing to inexperienced traders looking to improve their abilities are trading guides, seminars, and instructional materials.

Enhancing your reputation and reach may be achieved by forming partnerships with affiliate marketers, bringing in trading community influencers and introducing brokers (IBs). Make sure that every marketing action meets regulations to prevent problems.

7. Establish Customer Support Infrastructure

Great customer service sets your brokerage apart in a crowded market and promotes client loyalty and satisfaction. Create a specialized customer care staff ready for technical questions, account problems, and trade help.

Offer live chat, email, phone, and social media channels among other customer service channels. Make sure assistance is accessible throughout trade hours relevant to your customer base, maybe needing 24/5 or even 24/7 availability.

Invest in teaching your support team company procedures, platform features, and Forex trading concepts. Encourage them to quickly and successfully address problems; additionally, put in place a mechanism to monitor and evaluate client inquiries to find areas needing improvement.

Consider offering multilingual support if you plan to serve clients from different regions. Providing assistance in clients’ native languages enhances their comfort and trust in your services.

Using a customer relationship management (CRM) system will enable tracking of interactions, client data organization, and personalizing of communications. The entire client experience and the general standing of your brokerage depend much on an effective customer care system.

8. Ensure Compliance and Reporting Mechanisms

Maintaining regulatory compliance is a continuous responsibility that helps your brokerage to be more credible and shields it from legal consequences. Put in place thorough compliance initiatives covering every facet of your business.

Create and apply strong KYC and AML policies to prevent financial crime. This covers customer identity verification, transaction monitoring for suspicious activity, and reporting of findings to relevant authorities. Update your compliance guidelines often to reflect changes in industry standards and laws.

Utilize compliance management software to automate monitoring and reporting processes. This can help in tracking regulatory changes, managing documentation, and ensuring timely submission of required reports to regulators.

Frequent internal audits and risk analyses help to find possible areas of compliance deficiency. Periodically have outside auditors or compliance specialists impartially evaluate your compliance system.

You really have to educate your personnel about rules and regulations. Every staff member should understand their responsibility for maintaining compliance and for spotting and reporting questionable and suspicious activity.

Good compliance management not only helps to prevent legal issues but also builds trust among clients and partners who value transparency and adherence to legal requirements.

9. Launch Marketing and Branding Initiatives

Differentiating your brokerage in the packed Forex industry depends on building a distinctive brand identity. Create a strong marketing statement that highlights the value proposition of your brokerage—that of exceptional customer service, creative technologies, or competitive trading conditions.

Create a professional and easily navigable website to act as the main center for your internet identity. Make sure it is clear about your services, platform features, and regulatory credentials and is appropriate for mobile devices.

Invest in high-quality marketing materials, including brochures, presentations, and videos, that can be used across various channels. Consistent branding across all touchpoints reinforces your brokerage’s identity and professionalism.

Work on public relations to improve brand recognition. Press releases, writing articles for industry magazines, and podcasts or interviews could all be a part of this effort.

To interact with potential customers, partners, and industry experts, attend trade exhibits, conferences, and industry events. Organizing conferences, workshops, or webinars will also help your brokerage establish itself as an educated and authoritative player in the FX market.

Track the success of your marketing efforts with analytics, then modify your plans in response to performance data. A well-run marketing and branding campaign may greatly improve the profile of your company and consistently attract customers.

10. Monitor and Adapt to Market Changes

Constant changes in economic situations, legal contexts, and technology developments define the very dynamic Forex market. Maintaining competitiveness and compliance depends on constant monitoring of these developments.

Stay apprised on central bank policies, world economic data, and geopolitical developments influencing currency markets. This information helps you to predict changes in the market and modify your approach to risk control.

Stay current with legislative changes in every sector where you do business. Laws or compliance standards may call for changes to your operations, reporting systems, or client onboarding practices.

Incorporate technological developments that may enhance the efficiency and offers of your brokerage. This includes using cutting-edge trading tools, adding artificial intelligence for analytics, or strengthening security protocols.

Regular feedback from consumers helps you to better grasp their expectations and requirements. Such information will help you to hone your offerings, add fresh ideas, or enhance client service.

For your personnel as well as yourself, promote continuous learning and professional growth. Engaging in industry groups, going to seminars, and acquiring certifications can help your brokerage project more knowledge and trustworthiness.

Your brokerage may remain strong and seize new opportunities in the changing Forex scene by continually monitoring and adjusting to changes in the market.

Revenue Streams for a Forex Brokerage

- Commissions on Trades

- Spread Markups

- Fees on Deposit and Withdrawal Transactions via Payment Service Providers and Cryptocurrencies

- Currency Exchange Fees and Commission Markups

- Swap Markups (Overnight Financing Charges)

- Additional Brokerage Services

A Forex brokerage generates revenue through various channels that are integral to its profitability and sustainability. Understanding these revenue streams allows you to optimize your business model and enhance financial performance.

- Commissions on Trades

For Forex brokers, a basic source of income is charging fees on transactions. Usually giving customers narrower spreads in return, this strategy allows the brokerage to charge a set fee per transaction or amount traded. This approach is common in the A-Book model, where trades are passed directly to liquidity providers, and the brokerage earns from commissions without taking the opposite side of client trades. In the B-Book model, while commissions can still be charged, the brokerage may rely more heavily on spreads and potential trading gains from acting as the counterparty, meaning that B-book brokers make money when traders lose their trades. The Hybrid model allows flexibility, enabling the brokerage to apply commissions strategically based on whether trades are routed to the market or handled internally. The Hybrid model also allows the brokerage to make money off of losing trades, just as the B-book model.

- Spread Markups

Spread markups involve widening the difference between the bid and ask prices offered to clients beyond what is received from liquidity providers. This approach helps the brokerage to make money on each transaction the customer completes. Spread markups may be a major source of income under the B-Book model, in which the broker manages transactions internally and serves as the counterparty who has complete control over pricing. Under the A-Book model, transactions are delivered straight to the market, so spreads are usually narrower; yet, small mark-ups may still be used to generate extra income. The Hybrid model provides the opportunity to adjust spread markups depending on how trades are processed, balancing competitiveness with profitability.

- Fees on Deposit and Withdrawal Transactions

Through many payment methods—including payment service providers (PSPs) and cryptocurrencies—brokerages often help customer deposits and withdrawals. Brokerages might create extra income by charging fees or small mark-ups on these exchanges. This essentially results in a margin on every transaction by charging an additional fee somewhat over the cost paid by the payment source.

- Currency Exchange Fees and Commission Markups

When clients deposit or withdraw funds in a currency different from the brokerage’s base currency, currency exchange services are required. Brokerages can charge fees or apply commission markups on these currency conversions, generating additional income. This revenue stream is relevant across all brokerage models, as it involves client fund management rather than trading activities. By providing competitive exchange rates with a modest markup, brokerages can offer valuable services to clients while enhancing profitability. Effective management of currency exchange services can also improve client satisfaction and trust in the brokerage’s financial operations.

- Swap Markups (Overnight Financing Charges)

Swap markups involve adjusting the overnight financing charges applied to positions held open beyond trading hours. These charges result from the interest rate differential between the two currencies in a pair. Brokerages can increase the standard swap rates provided by liquidity providers to earn additional revenue. In the B-Book model, since trades are handled internally, the brokerage has greater flexibility to adjust swap rates, potentially enhancing profitability. In the A-Book model, swap rates are typically passed through from liquidity providers, but slight markups can still be applied. The Hybrid model allows brokerages to optimize swap markups based on how trades are managed, balancing competitiveness with revenue generation. Transparent communication about swap rates is essential to maintain client trust.

- Profits from Losing Trades (B-Book and Hybrid)

When a customer loses their trade and realizes the loss, the brokerage actually earns a profit as it manages the order internally and acts as the counterparty to the client transaction. Conversely, the brokerage loses money when a customer trade is successful. This is a major source of revenue for the brokerage as most traders are not successful over the long run. Hybrid brokerage may also profit from this source of revenue since it combines the elements of A and B-Book brokerages, and can decide which orders to process internally, and which to send to a liquidity provider.

- Additional Brokerage Services

Offering ancillary services can also contribute to revenue. These services may include educational programs, premium market analysis, trading signals, virtual private server (VPS) hosting for algorithmic trading, or managed account services. Clients seeking comprehensive support or advanced trading tools may be willing to pay for these value-added services. This income stream helps set the brokerage apart in a cutthroat industry and fits all types of brokerage structures. Offering premium auxiliary services may improve customer loyalty and provide fresh revenue sources. Constant expansion and improvement of these products helps a brokerage to remain ahead in the market and meet changing customer expectations.

A Forex broker may increase its profitability by spreading income streams and customizing pricing policies, therefore preserving competitive and appealing trading conditions for its customers. Maximizing financial performance requires a knowledge of how every income source interacts with your selected operating model. Managing these income sources carefully will help your brokerage to be sustainable and successful over the long run.

Costs Involved in Starting a Forex Brokerage

- Regulatory and Licensing Fees

- Technology and Platform Expenses

- Operational Costs (Office Space, Utilities, Staff Salaries)

- Marketing and Branding Initiatives

- Customer Support Infrastructure

- Compliance and Reporting Expenses

Launching a Forex brokerage involves significant initial and ongoing expenses that require careful financial planning. Let’s explore each of these costs in detail, considering how they relate to different brokerage models.

- Regulatory and Licensing Fees

Among the most major expenses are licensing and regulatory fees. Getting the required permits comes with significant costs including application fees, legal advice, and minimum capital requirements set by government agencies. The capital reserves needed in highly regulated areas may be significant, which may affect your starting financing obligations. The B-Book model may attract stricter regulatory scrutiny due to the potential for conflicts of interest, potentially increasing compliance costs. In contrast, the A-Book model might have fewer regulatory hurdles related to market-making activities but still requires adherence to strict standards.

- Technology and Platform Expenses

Technology and platform expenses represent another major investment. Buying or leasing a trading platform means license fees, customizing charges, and continuous maintenance costs. Including CRM software, risk management tools, and payment gateways increases the IT expense. The Hybrid model requires more sophisticated technology to manage client segmentation and dynamic order routing between A-Book and B-Book operations, potentially increasing costs. Advanced risk management systems are crucial across all models but are particularly important in the B-Book and Hybrid models due to the increased market risk exposure.

- Operational Costs

Office space, utilities, staff pay, and administrative expenditures all fall under operational costs. Hiring talented candidates for important positions such as marketing experts, customer service representatives, compliance officials, and IT specialists increases current payroll costs. The complexity of your brokerage model can influence staffing needs; for example, the Hybrid model may require additional IT and risk management staff to handle its sophisticated operations. Effective internal processes are essential to maintain efficiency and control costs across all models.

- Marketing and Branding Initiatives

Initiatives in branding and marketing need an individualized budget for tasks like content generation, advertising campaigns, website construction, and industry events attendance. Although customer acquisition depends on these costs, they must be managed carefully to provide a reasonable return on investment. All brokerage models benefit from effective marketing, but the B-Book model may need to invest more in building trust due to inherent conflicts of interest. Transparent communication about your services and operational model can enhance credibility and attract clients.

- Customer Support Infrastructure

Investing in robust customer support infrastructure adds to operational costs. This includes setting up communication systems, training staff, and potentially providing multilingual support to serve a global client base. High-quality customer service is crucial across all models since all have to make sure the customer is happy with the provided services. The A-Book model can leverage superior execution transparency as a selling point, but still requires excellent support to retain clients.

- Compliance and Reporting Expenses

Compliance and reporting obligations incur additional costs, including legal advice, subscriptions to compliance tools, and fees for external audits or regulatory reporting systems. Maintaining compliance is a continuous responsibility, and costs may vary depending on the brokerage model. The B-Book model may face higher compliance costs due to increased regulatory scrutiny. The Hybrid model must navigate the complexities of both models, ensuring compliance across all operational aspects.

Thoroughly evaluating and budgeting for these costs will help you create a feasible financial strategy that guarantees your brokerage has the tools it needs to run economically and efficiently. Knowing how expenses change depending on various operating models enables you to make prudent decisions in accordance with your company plan. Proper financial planning will support the sustainability and growth of your brokerage in the competitive Forex industry.

Advantages of Using a White Label Solution

Using a white label solution offers significant benefits for entrepreneurs looking to enter the Forex brokerage industry with reduced complexity and investment. A white label arrangement allows you to leverage an established broker’s trading platform and infrastructure under your own brand.

One of the primary advantages is cost efficiency. Creating bespoke trading systems and infrastructure calls for significant technical knowledge as well as funding. Including fundamental features like real-time market data, charting tools, and order execution capabilities, a white label solution offers access to a fully working trading platform at a fraction of the cost.

The quick launch capability is another benefit. Since the core technology and systems are already in place, you can focus on branding, customization, and regulatory compliance, accelerating your time to market. This enables you to start operations and begin acquiring clients much sooner than if you were building systems from scratch.

Technical support and maintenance are often included in white label agreements. The provider handles software updates, server management, and technical troubleshooting, reducing the need for in-house IT staff and allowing you to allocate resources to other areas of your business.

Some white label providers offer assistance with regulatory compliance and back-office operations. They may provide guidance on meeting licensing requirements, implementing AML/KYC procedures, and setting up reporting mechanisms, easing the regulatory burden.

Using a white label solution allows you to focus on fundamental company operations like marketing, customer relationship management, and service delivery. This emphasis improves your capacity to create a strong brand, provide first-rate customer service, and create market-based competitive advantages.

Still, it’s important to choose a reputable white label provider that knows your business goals and offers clear terms and conditions. Review agreements carefully to find any obligations or restrictions; then, make sure the collaboration benefits your long-term growth.

Conclusion

Starting a Forex brokerage company calls for great knowledge of the financial markets, meticulous preparation, and large investment. From legal establishment and regulatory compliance to technology setup and client acquisition, you build your brokerage for success in a competitive sector by methodically addressing each phase. Using white label solutions can help you to simplify the procedure while allowing you to concentrate on developing a trustworthy brand and provide your customers with first-rate service. With dedication and smart execution, your Forex brokerage may prosper in the volatile world of global currency trading.

167

Written by Artem Goryushin

Marketing at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.