Brokerage Business

10 minutes read

Nov 4, 2024

Stock Brokerage Firm: How to Start and How it Makes Money.

Starting the road to build a stock brokerage company calls for thorough knowledge of the financial markets, strict compliance with legal rules, and strategic planning to produce a viable company model. From acquiring the required permits to using sophisticated trading systems, every action counts in building a company that not only runs well but also distinguishes itself in a cutthroat sector. The article investigates the fundamental features of launching a stock brokerage company as well as the revenue-generating processes.

Understanding Stock Brokerage Firms

A stock brokerage company serves investors and the securities markets to help trade stocks, bonds, and other financial products. Managing the financial transactions resulting from consumer buy and sell orders as well as ensuring everything is done in line with legal requirements takes front stage.

Choosing Your Broker Type

Choosing the sort of broker you want to become— broker, dealer, or broker-dealer—is the first important step in launching a retail stock brokerage. This decision shapes the regulatory requirements, business operations, and services offered to clients.

Broker

Strictly serving customers, a broker facilitates transactions between buyers and sellers without gaining title to the securities. Order execution on behalf of customers by brokers generates income mostly via commissions and fees. They have fiduciary obligations and must conduct themselves in the best interests of their customers, therefore securing the best conditions for them.

Operating only as a broker implies concentrating on offering first-rate execution services, investment guidance, and client assistance. Registration as a broker with the competent authorities and membership in self-regulating organizations constitutes regulatory compliance.

Dealer

On the other hand, a dealer buys and sells items for their own account, therefore acting as a principal in transactions. Dealers profit on the difference between the purchase and sell rates. Their readiness to buy or sell assets at designated rates helps the markets to remain liquid.

Being a dealer calls for substantial funds to keep inventory and control market risk related to price swings. Dealers must comply with additional regulations including strict risk management systems along with additional capital adequacy criteria.

Broker-Dealer

A broker-dealer combines the roles of dealers and brokers. They trade assets for their own accounts and also on behalf of customers. This dual status brings possible conflicts of interest as the company could give its own trade interests first priority over those of its customers.

Becoming a broker-dealer necessitates comprehensive compliance measures to manage conflicts of interest and ensure transparent operations. Regulatory bodies often impose stricter oversight, requiring detailed disclosures and adherence to best execution obligations.

Making the Choice

Selecting the appropriate broker type depends on your business goals, available capital, risk tolerance, and the services you wish to offer. If your focus is on client services and advisory roles without taking on market risks, operating as a broker may be suitable. If you aim to engage in proprietary trading and market-making activities, becoming a dealer or broker-dealer might align better with your objectives.

To fully grasp the consequences for every choice, one must consult legal and financial advisers. The decision made affects operational complexity, license criteria, income sources, and compliance responsibilities.

Steps to Start a Stock Brokerage Firm

Regulatory Compliance and Licensing

First and most crucially if one wants to open a stock brokerage firm is obtaining the required licenses from regulatory authorities. This process guarantees meeting rigorous criteria set by governing agencies. Companies have to register and become members of self-regulating organizations such the Financial Industry Regulatory Authority (FINRA).

Compliance with rules depends on following ethical conduct, capital adequateness, and reporting standards. Strong KYC and AML systems are needed for businesses to prevent fraud. Lawyers specialized in securities laws might aid with the licensing process and ongoing compliance.

Business Model and Structure

Determining the firm’s business model is essential. Decisions must be made about the kinds of services provided: discount brokerage emphasizing trade execution with reduced costs or full-service brokerage including customized financial advice. The selected model should be backed by a well-defined organizational structure that specifies functions, rules, and procedures for governance and operations.

Whether the company will serve institutional investors, retail customers, or both affects the services provided as well as the legal requirements. Attracting possible investors and directing the company’s growth depend on a comprehensive business plan including market research, target demographics, competitive tactics, and financial predictions.

Capital Requirements

Starting a stock brokerage company requires substantial capital not just to fulfill legal minimums but also to fund running costs until the company turns a profit. Minimum net capital standards imposed by regulatory organizations help companies to fulfill their financial responsibilities and safeguard customer assets. These requirements vary by jurisdiction and the scope of services offered.

Infrastructure projects include trading platforms and technological systems, human expenses, marketing, office establishment require capital. Fulfilling capital requirements mostly depends on providing thorough financial documents and acquiring funding via loans or investors.

Developing Relationships with Exchanges and Clearinghouses

Executing trades and settling transactions requires establishing relationships with stock exchanges and clearinghouses. Membership in exchanges might call for extra costs and following certain rules. Post-trade processing is handled by clearinghouses, therefore guaranteeing the transfer of securities and money between buyers and sellers.

Negotiating agreements with these entities involves demonstrating the firm’s financial stability and compliance readiness. Strong relationships facilitate smoother operations and can provide access to better trading terms or advanced market data services.

Risk Management

Protection of the company from credit risks, operational mistakes, and market volatility depends on good risk management techniques. Using procedures to track and manage exposures—such as counterparty and margin lending risks—safeguards the financial integrity of the company. Compliance experts and business managers should regularly assess any risks and ensure the conformance of all regulatory criteria.

By use of risk management tools and crisis management strategies, investments in these sectors improve the capacity of the company to handle unanticipated situations. Regular audits and stress testing can identify vulnerabilities and strengthen resilience.

Client Acquisition and Marketing

Attracting customers calls for a planned marketing strategy stressing the unique value propositions of the company. In a crowded market, developing a strong brand identity, using digital marketing channels, and providing competitive pricing or creative services may set the company apart. Trust and client loyalty may be developed by means of educational materials, seminars, and tailored customer service.

Knowing the preferences and desires of the target market helps one to provide customized products that satisfy their particular requirements. Maintaining reputation and avoiding legal questions calls for close adherence to advertising guidelines.

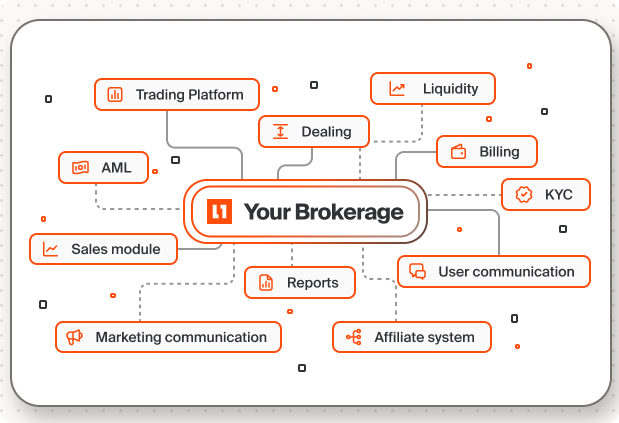

Technology Selection and Integration

Choosing and combining the appropriate technology solutions to support trading operations, guarantee compliance, and improve customer experience can greatly determine the success of a stock brokerage business.

Selecting the Right Trading Platform

Among the most important technical choices is selecting a trading platform. Among the things to consider are security, scalability, user experience, and usability. The platform should include sophisticated charting capabilities, real-time market data, and support of many order types. It has to be easy for customers to use, providing a customized interface fit for both new and seasoned investors.

Integration with Back-Office Systems

Operating efficiency depends on flawless integration between back-office systems and the trading platform. This involves connections with accounting software, tools for monitoring compliance, risk management systems, and CRM platforms. Efficient data flow ensures accurate record-keeping, timely reporting, and enhanced decision-making capabilities.

Cybersecurity Measures

First and foremost is safeguarding transaction data and private customer information. Strong cybersecurity rules include intrusion detection systems, multi-factor authentication, and encryption help one prevent data breaches and cyberattacks. Regular security audits and following GDPR or CCPA demonstrates the company’s commitment to client security and builds trust.

Scalability and Future-Proofing

Technology solutions should be scalable to accommodate growth in client numbers and trading volumes. Modular system designs and cloud-based architecture enable for flexible development free from major overhauls. Keeping updated with developing technologies such artificial intelligence and blockchain will help the company to implement ideas improving operational effectiveness and services.

Enhancing Client Experience through Technology

A superior client experience differentiates your brokerage in a competitive market. Mobile apps let customers to monitor and carry out trades on the move, hence extending accessibility. Customizable dashboards and personalized alerts are among personalizing elements that boost engagement. Integrating educational resources and market analysis within the platform adds value and supports clients in making informed decisions.

Vendor Selection and Partnerships

If choosing external solutions, it is essential to choose reliable, compliant providers with an established track record. Solid partnerships provide access to continuous support, upgrades, and joint opportunities to improve the platform. Extensive due diligence on providers helps to reduce the risks connected to technology outsourcing.

Implementation and Training

Successful technology integration requires careful planning and execution. A phased implementation approach can minimize disruptions. Providing comprehensive training for staff ensures they are proficient in using the systems and can assist clients effectively. Continuous feedback mechanisms allow for ongoing improvements and adaptability to changing needs.

Regulatory Compliance and Reporting

Technology plays a key role in meeting regulatory obligations. Automated compliance tools can monitor transactions for suspicious activities, enforce trading limits, and generate required reports for regulatory authorities. Integrating compliance functions within the technology infrastructure enhances accuracy and efficiency, reducing the risk of violations and penalties.

How a Stock Brokerage Firm Makes Money

- Commissions and Fees

For conventional brokerage companies, commissions received on each transaction carried out on client behalf are their main source of income. These costs help the company to offset its expenses for providing market access and transaction facilitation. While discount brokerages provide reduced fees in order to draw in cost-conscious consumers, full-service brokerages charge more commissions because of the additional value of investing advice and specialized services.

Some companies have switched to zero-commission structures because of other sources of income. Whichever the arrangement, regulatory compliance and client confidence development depend on open fee disclosure.

- Interest on Margin Accounts

Brokerage firms offer margin accounts, allowing clients to borrow funds to purchase securities. The firm charges interest on the borrowed amount, generating significant revenue. This service enables clients to leverage their investments but introduces credit risk to the firm. Proper assessment of clients’ creditworthiness and setting appropriate margin requirements mitigate potential losses from default.

- Payment for Order Flow

Payment for order flow is the process by which market makers or exchanges pay certain brokerage companies to route customer orders to them. This set-up lets companies make money even when they allow customers to pay minimal or zero commissions. While legal in some jurisdictions, it requires careful management to avoid conflicts of interest and ensure compliance with best execution obligations, ensuring clients receive favorable trade prices.

- Securities Lending

Usually for the purpose of short selling, securities lending is the process whereby brokerage firms let other financial institutions borrow assets from their client accounts. The firm earns fees from these lending activities. Proper disclosure and compliance with regulations governing the use of client securities are essential to maintain transparency and client trust.

- Advisory and Management Fees

For firms offering wealth management and advisory services, fees are charged based on a percentage of assets under management (AUM). This model provides a steady revenue stream aligned with the growth of clients’ portfolios. Providing high-quality advice and demonstrating consistent performance are key to retaining clients and attracting new ones.

- Ancillary Services

Additional services such as financial planning, retirement accounts, educational resources, and premium research reports can generate extra income. Fees for these services diversify revenue streams and enhance the firm’s value proposition to clients. Bundling services or offering tiered membership levels can appeal to different client segments.

Conclusion

A brokerage company may effectively enter the market and flourish by negotiating regulatory constraints, developing strong technology infrastructure, and using sensible income-generating policies. Making money from commissions, fees, margin account interest, and auxiliary services demands the company to find a mix between client satisfaction and ethical behavior. Aspiring brokerage entrepreneurs committed to quality and flexibility may build a successful company that satisfies changing expectations of investors in a dynamic financial environment.

FAQ

144

Written by Ivan Bogatyrev

Business Development at FintechFuel

Writing about the exciting worlds of iGaming and the brokerage business, breaking down the latest trends and insights. Making complex topics easy to understand, helping readers stay informed and ahead of the curve.

More by authorRead more

Brokerage Business

10 minutes read

Sep 30, 2025

The brokerage industry in 2026 is entering a new phase shaped by technology, regulation and shifting client demands.